There is a shift underway right now in the refrigerated freight segment. Two main factors are involved.

More restaurant spending, more contract freight

The first, and perhaps the most important influence, is on the consumer side. As a nation, we are spending more money in restaurants and proportionally less in grocery stores. That has a big impact on the supply chain. Restaurants are far more likely to order from large food service suppliers, rather than the type of distributor — or even a consortium of growers — that might service grocery stores. The big food service outfits have private fleets, or they work with contract carriers, so the restaurant trend “eats away” at the refrigerated freight volume on the spot market.

More imports, less home-grown

Secondly, Americans are importing more produce and consuming less of the home-grown stuff. Poor growing conditions in California and Florida are partly responsible for this change. California went from drought to floods. Be careful what you wish for, right? The heavy rains disrupted the winter planting season, and the Golden State is expected to produce 40% fewer strawberries this year, for one example.

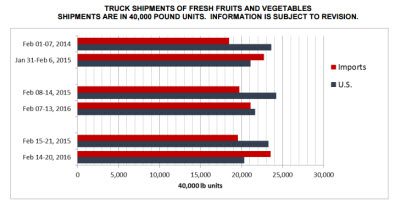

Truckload volume of imported produce (red) surpassed domestic (blue) in two of the past three weeks, according to this weekly report from the USDA.

In Florida, the weather has been bad, too. On top of that, a parasite has been devastating citrus trees for years, causing fruit to fall before it ripens. The citrus “greening” is likely to reduce orange and grapefruit yields by one third, even compared to last year. The U.S. still grows plenty of apples, onions, and potatoes, in Washington, Colorado and Idaho, respectively. Potatoes make up 15% of vegetables consumed in the U.S. They don’t always require refrigerated trailers, however.

As domestic production declines, refrigerated freight activity is increasing at ports in the Southeast, and at border crossings between the U.S. and Mexico. Imported foodstuffs include bananas, avocados, citrus fruit, peppers, tomatoes, and mixed vegetables.

Geographic shift for outbound reefer loads

Nogales, AZ and McAllen, TX have been very active this winter. So have Miami and Savannah, but an ever-larger portion of the reefer freight in those markets originated in Chile and neighboring countries. Other ports that bear foreign fruit include East Coast docks at Philadelphia/Wilmington, and NY/Newark, as well as Los Angeles/Long Beach, the largest port complex in North America.

If you specialize in refrigerated freight on the spot market, you’re going to find more of your loads originating at the borders and ports. That also will have an effect on seasonal rate spikes. The spring rush in Florida won’t be as great, and the typical June boom in reefer rates may be muted, as well.

If you have van freight or trucks, you may be affected, too. Every tractor and every driver that is pulling a reefer is one more unit that is not hauling van freight. That means fewer trucks compete for van loads during peak reefer seasons, and everyone’s rates get a nice bump. This year, the bump might be flatter, and trucks will be tight in Savannah and McAllen instead of Lakeland or Stockton.

To learn about the impact of these and other trends on market-based rates in the lanes you run, sign up for DAT RateView.