Some recent news on the manufacturing front indicated new orders and production both fell in November, but both were still at high and healthy levels.

According to Timothy Fiore, Chair of the Institute for Supply Management, “Survey committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities and difficulties in returning and hiring workers are causing strains that will likely limit future manufacturing growth potential.”

Fiore went on to add, “Manufacturing performed well for the sixth straight month, with demand, consumption and inputs registering growth, but at slower rates compared to October. Labor market difficulties, both current and anticipated, at panelists’ companies and their suppliers will continue to dampen the manufacturing economy until the coronavirus (COVID-19) crisis ends.”

Find flatbed loads and trucks on the largest on-demand freight market place in North America.

Top 10 Market Watch

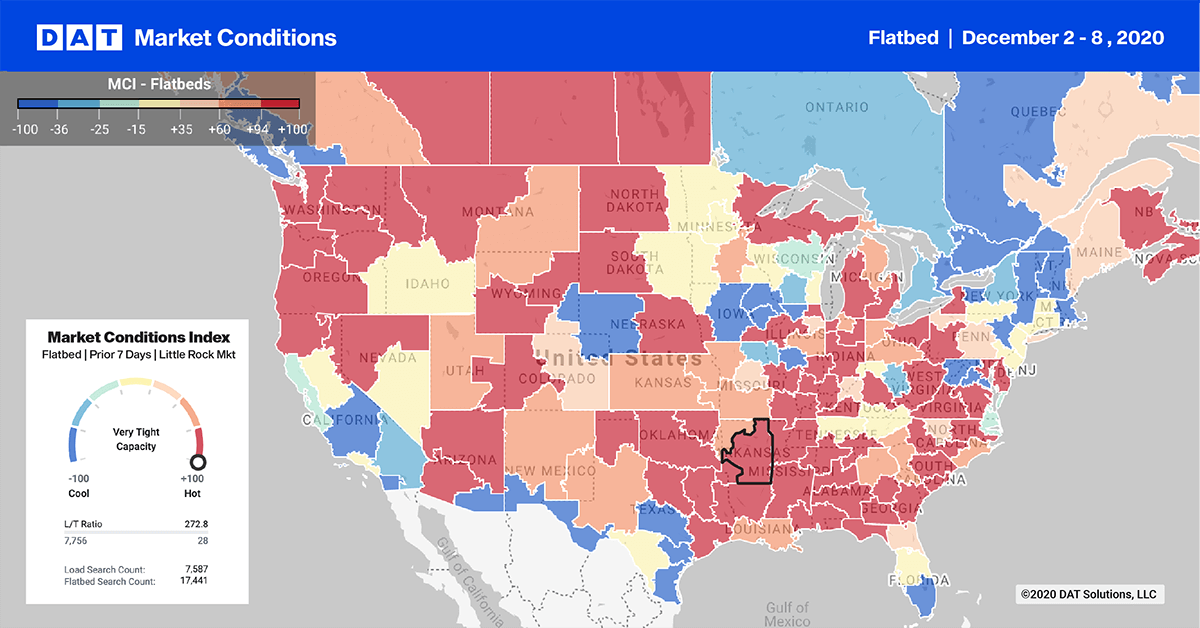

Even though load post volumes in the top 10 markets increased by 62% w/w, most markets recorded significant rate decreases as the flatbed market continues to cool.

The exceptions were in the number one flatbed market in Little Rock, AR, where rates jumped $0.14/mile to $2.67/mile with nearby Memphis recording a rate increase of $0.04/mile to end the week at $2.85/mile.

Notable rate decreases were recorded in the south region – Montgomery, AL, down $0.45/mile to $2.94/mile, Birmingham, AL, down $0.16/mile to $2.67/mile and Shreveport, LA, down $0.65/mile to $2.40/mile.

The flatbed LTR increased to 35.86 last week, which is right around the weekly average for the prior two months. Load and truck post volumes are down 2% and 4% respectively over the same time frame.

Flatbed rates decreased slightly last week by $0.01/mile to $2.19/mile. Compared to the same week in 2019 when flatbed rates were $1.77/mile, rates are still $0.42/mile higher.