Van carriers may be glad to see February recede in the rearview, as rates and volume slid lower for the first few weeks of the month in a typical winter slump. As of last week, however, rates seemed to have hit a plateau, and truckload volumes were starting to pick up. But the much-anticipated spring recovery may be delayed or canceled, due to the impact of the COVID-19 coronavirus on supply chains worldwide.

The coronavirus and related quarantines led to extended closures of factories throughout China, well beyond the usual Lunar New Year vacation, so there’s a gap in the volume of container freight that should be arriving at U.S. seaports. Those containers would ordinarily have started landing last week, which could explain why we’re not seeing a big impact yet on over-the-road truckload freight.

We’re keeping an eye on shipping schedules from Asian ports to the U.S., as well as West Coast port traffic and drayage, and we’ll publish regular updates — but spot market trucking has proved resilient so far, as we head into the first week of March.

Outbound van capacity was plentiful last week in most markets on the West Coast, while rising load-to-truck ratios signaled rising rates in the South Central and Southeast regions. Hot Market Maps are included in DAT Power and DAT RateView.

Outbound van capacity was plentiful last week in most markets on the West Coast, while rising load-to-truck ratios signaled rising rates in the South Central and Southeast regions. Hot Market Maps are included in DAT Power and DAT RateView.

First, the not-so-bad news. Rates are actually trending up on some high-traffic lanes. You’ll notice that none of these rising lanes originates in port cities. That’s probably not a coincidence.

- Memphis to Columbus added 12¢ per mile last week, to $1.95, and Columbus to Memphis paid $1.65, down only 2¢. The roundtrip lands squarely on this week’s national average of $1.80 per loaded mile.

- Dallas to Laredo rates rose 6¢ but that lane still pays only $1.25. Laredo to Dallas lost 2¢ to $2.08. Not fabulous, but there’s plenty of freight.

- Chicago to Los Angeles, at $1.47, was up 7¢, and L.A. to Chicago dropped 6¢ to $1.22. That’s a lot of miles for not a lot of money.

- Denver to Albuquerque was up 9¢ to $1.92, which is pretty good for Denver. The return trip from Albuquerque to Denver paid $1.86 last week, down 4¢, and there aren’t a lot of loads.

- Allentown, PA, to Richmond, VA gained 6¢ to $2.35, and Richmond to Allentown held steady at $2.70 per loaded mile. This 600-mile roundtrip could pay well if it works with your schedule.

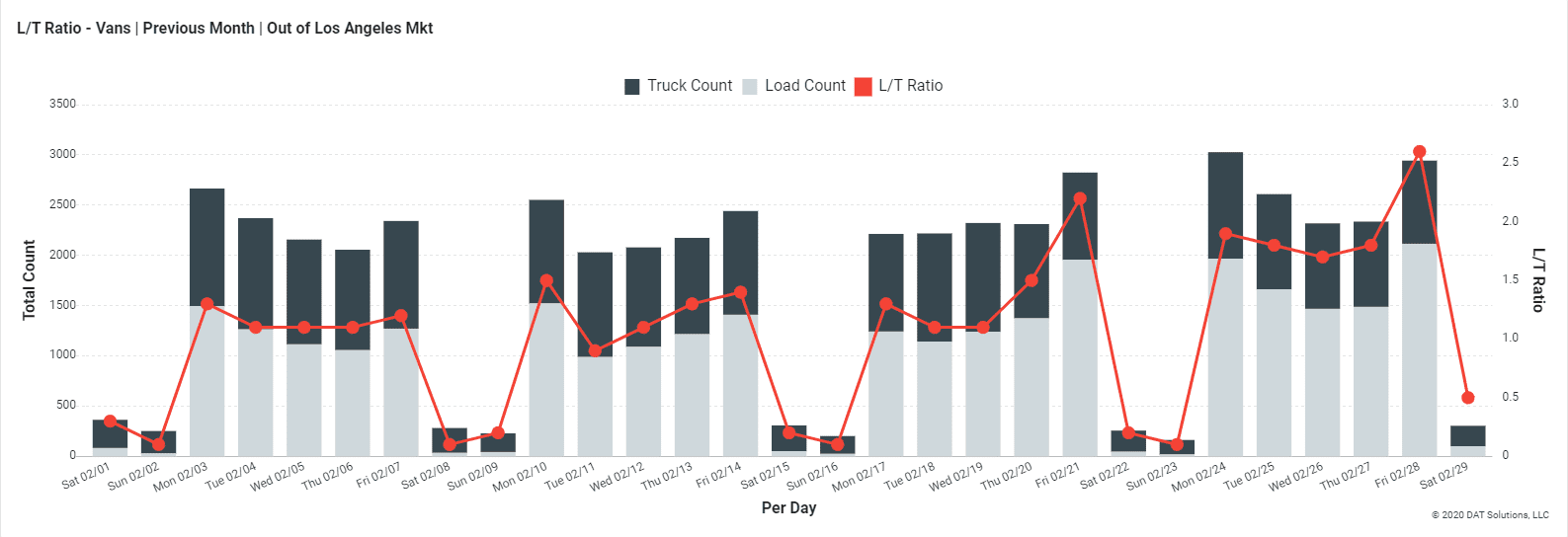

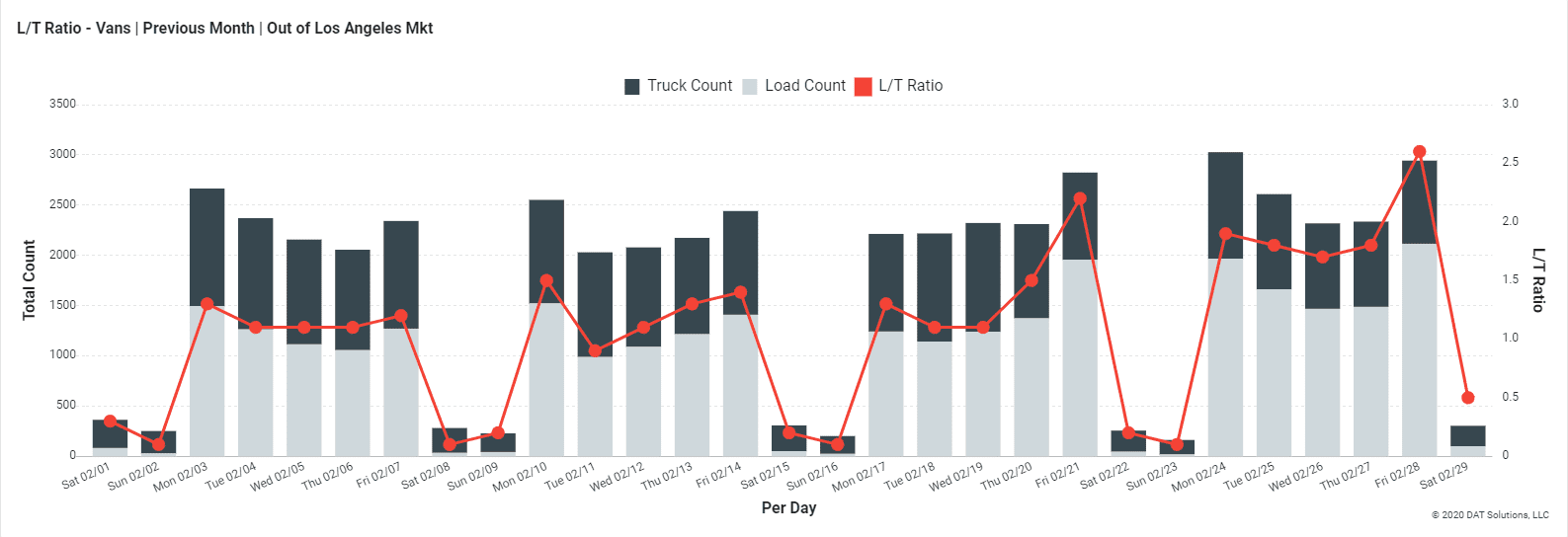

This graph is a feature of the Hot Market Maps in DAT Power and DAT RateView.

Surprisingly, load-to-truck ratios rose out of the Los Angeles market throughout February, to end the month at a high of 2.6 loads per truck for van equipment, as seen in the above graph. Outbound ratios and inconsistent rate trends signal that the coronavirus closures in China have yet to affect over-the-road trucks in the U.S. That could change any day, as ocean cargo shortfalls pose an increasing challenge to U.S. port volumes.

Falling prices

Other rate trends were not so good. Some lanes will improve this week, but probably not in port cities on the West Coast.

- Columbus to Buffalo still paid $2.84 last week, but that was a drop of 18¢ from the previous week. Buffalo to Columbus paid $1.78, which could have been influenced by snowstorms and protests in Canada that held up rail service.Dallas to Chicago rates are low and going lower, down 6¢ last week to $1.15. Chicago to Dallas also declined, losing 2¢ to $1.96 per loaded mile. Pass.

- Denver to L.A. dropped 6¢ to $1.17, and L.A. to Denver lost 4¢ to $2.21. (Look for a TriHaul from Denver to L.A., maybe via Las Vegas.)

- Philadelphia to Charlotte slipped 5¢ to $1.45, and Charlotte to Philly lost 3¢ to $2.19. Charlotte to and from Allentown pays about the same, but you get 100 more loaded miles.

- Stockton to Seattle rates fell 7¢ to $2.19, and Seattle to Stockton lost 4¢ to $1.33, with more loads moving.