We’re currently in that transitional season between the end of fall harvests and the beginning of the holiday rush. For example, last week the Grand Rapids, MI market had a sharp drop in volumes and prices as the harvesting of tree fruit comes to an end, while the Nogales, AZ market — where produce moves into the U.S. from Mexico — had a big boost in both volumes and rates.

Last week on the top 72 reefer lanes, more lanes had rising rates than falling, which is always a positive sign. And the average reefer rate for November is up 2¢ compared to the October average. The current national average is $2.13/mi. for reefer trailers.

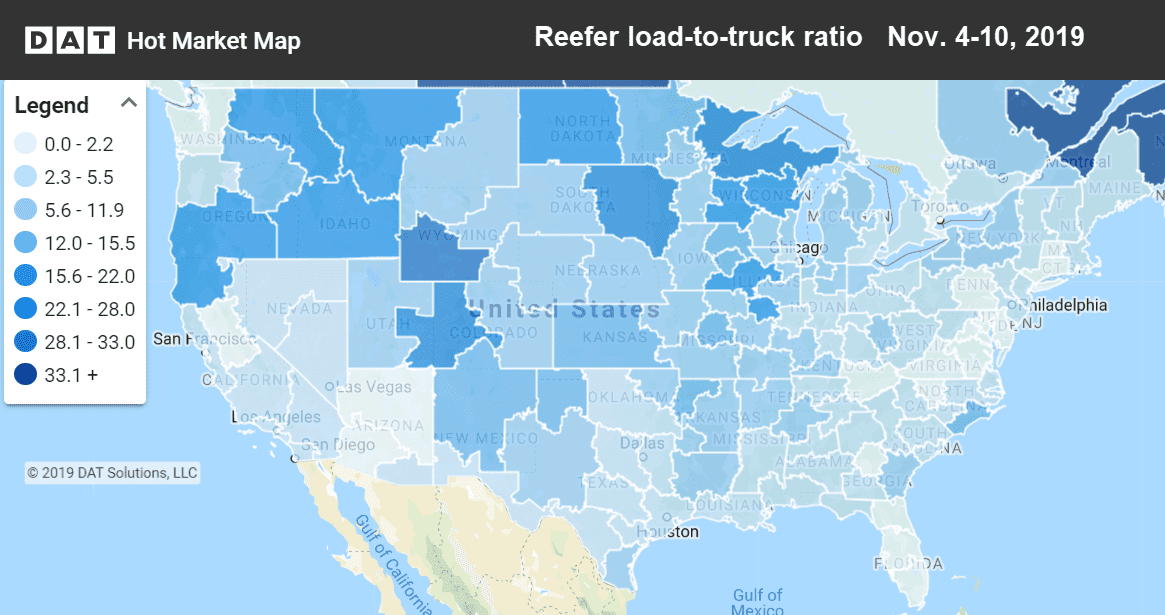

Hot Market Maps, available in the DAT Power load board and DAT RateView, show load-to-truck ratios in 135 freight markets in the U.S.

Rising markets and lanes

Thanksgiving is coming soon and fresh cranberries are on the move. Massachusetts is famous for its cranberries, but they’re also grown in southern Oregon in the Medford market. That may be the reason rates are trending up from Boston to Philadelphia and from Medford to Los Angeles, even though those are typically low-priced backhaul lanes.

All of the high-volume lanes out of Nogales, AZ trended up last week, including the lane to Dallas, Chicago, and Los Angeles. Another border crossing associated with fresh produce, McAllen, TX, had a decline in volume last week but rates rose 2¢ on an average.

- Nogales, AZ to Chicago jumped 19¢ to $1.84/mi.

- Nogales, AZ to Dallas increased 15¢ to $1.83/mi.

- Green Bay to Wilmington, IL added 16¢ to $3.54/mi.

- Chicago to Kansas City, MO gained 14¢ to $2.38/mi.

Falling markets and lanes

Grand Rapids, MI saw the biggest declines last week. Load volumes were down more than 15% and rates averaged 11¢ lower. Rates were also lower in another Midwest market: Green Bay, WI.

- Green Bay to Des Moines, IA collapsed 69¢ to $2.22/mi.

- Green Bay to Minneapolis was down 26¢ to $2.23/mi.

- Grand Rapids to Cleveland plunged 56¢ to $3.49/mi.

- Miami to Boston dropped 39¢ to a mere $1.42/mi.