Over the past few weeks, freight volumes have been building, but there was enough capacity to keep rates from rising. Last week we saw a turnaround. On the top 100 van lanes, more lanes had rising rates than falling. That’s the first time in four weeks that that has happened.

Holiday retail freight is on the move from west to east, and we’re seeing rates tick up in several of the traditional retail hubs. In addition, the GM strike has ended so we may see some capacity exit the spot market and move back to the contract market, which could push up spot rates. Autos and parts generally move as contract freight, but some of those trucks worked the spot market temporarily to keep their trucks loaded during the strike.

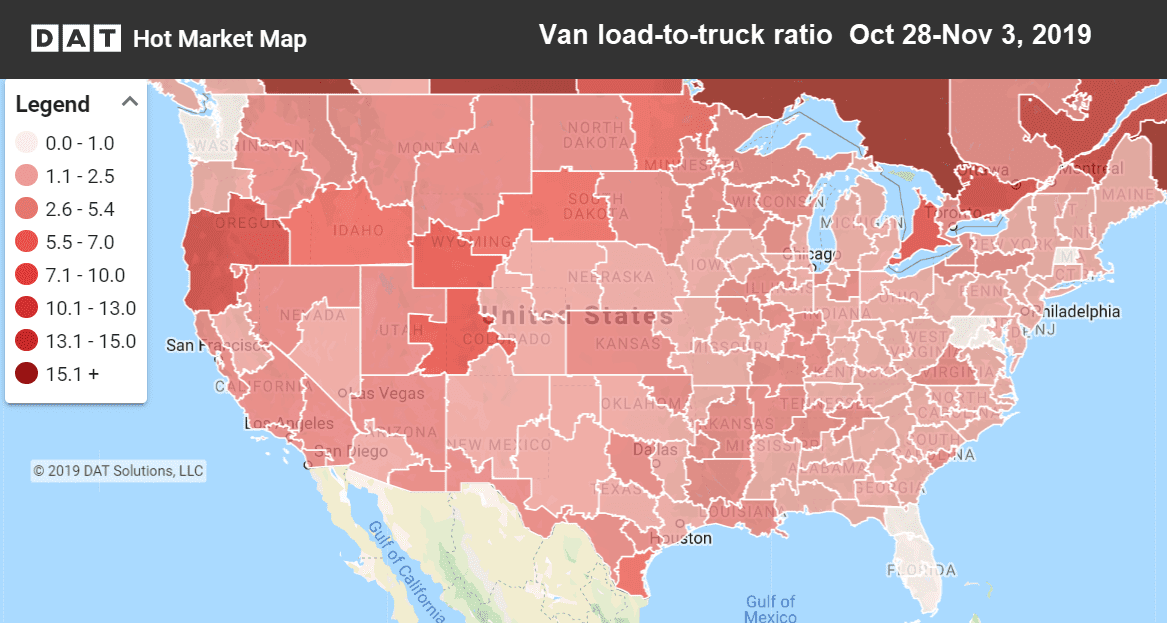

Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Rising markets and lanes

Retail freight is moving into the densely populated Northeast region. We saw price gains coming out retail powerhouses such as Los Angeles, Dallas, Columbus, OH and Buffalo, NY.

- Chicago to Buffalo increased 14¢ to $2.59/mi.

- Charlotte to Buffalo added 10¢ to $2.06/mi.

- Buffalo to Allentown, PA also added 10¢ to $3.05/mi.

- Columbus, OH to Atlanta gained 10¢ to $2.08/mi.

Falling markets and lanes

Seattle lost about 20% of its previous week’s volume, and outbound rates fell. Most lane rate declines were mild, however, and some of the areas where we saw rates fall the most were on shorter, regional lanes.

- Allentown, PA to Richmond, VA dropped 17¢ to $2.31/mi.

- Philadelphia to Buffalo fell 13¢ to $2.12/mi.

- Seattle to Spokane slipped 10¢ to $2.99/mi.