Flatbed freight has lagged for much of the year, but demand spiked on the top flatbed lanes last week. A big part of that was due to increased activity from inland Southeast markets shipping into areas impacted by Hurricane Dorian.

Even before this past weekend’s attack on Saudi oil fields, there was more than a 65% surge in activity from Houston, the No. 1 flatbed market and a major supplier to the oil fields near El Paso, TX, and Oklahoma City. The number of wells in operation has been steadily declining, but that could start to reverse. The U.S. is in position to pick up the shortfall in oil production from Saudi Arabia.

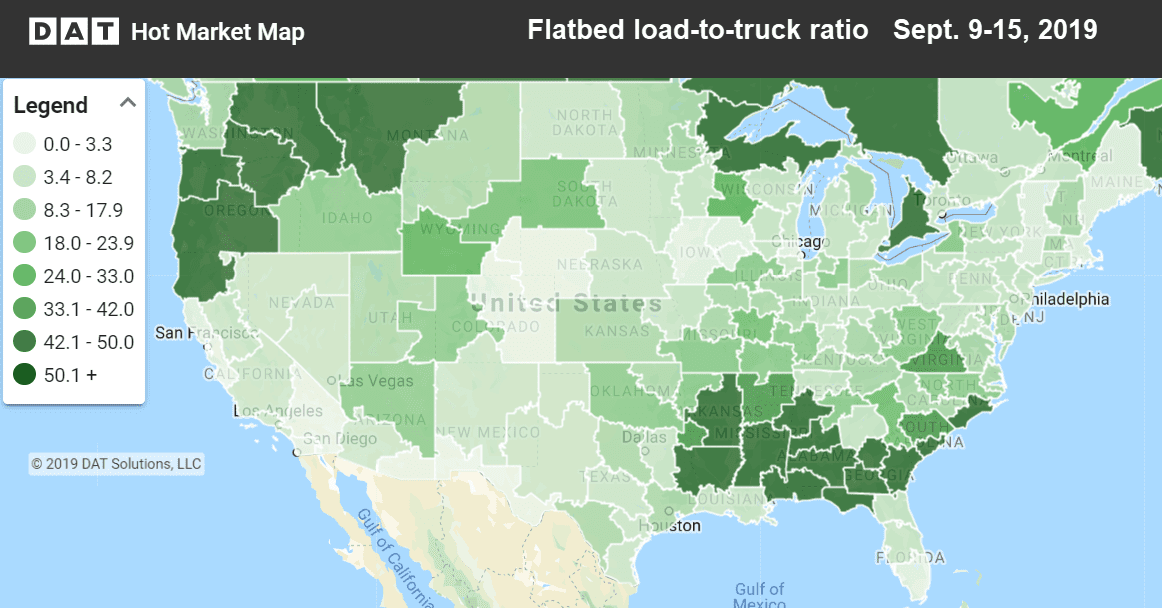

Hot Market Maps in DAT Power and DAT RateView show where trucks are hardest to find. The darker the color, the less competition there is for truckload freight.

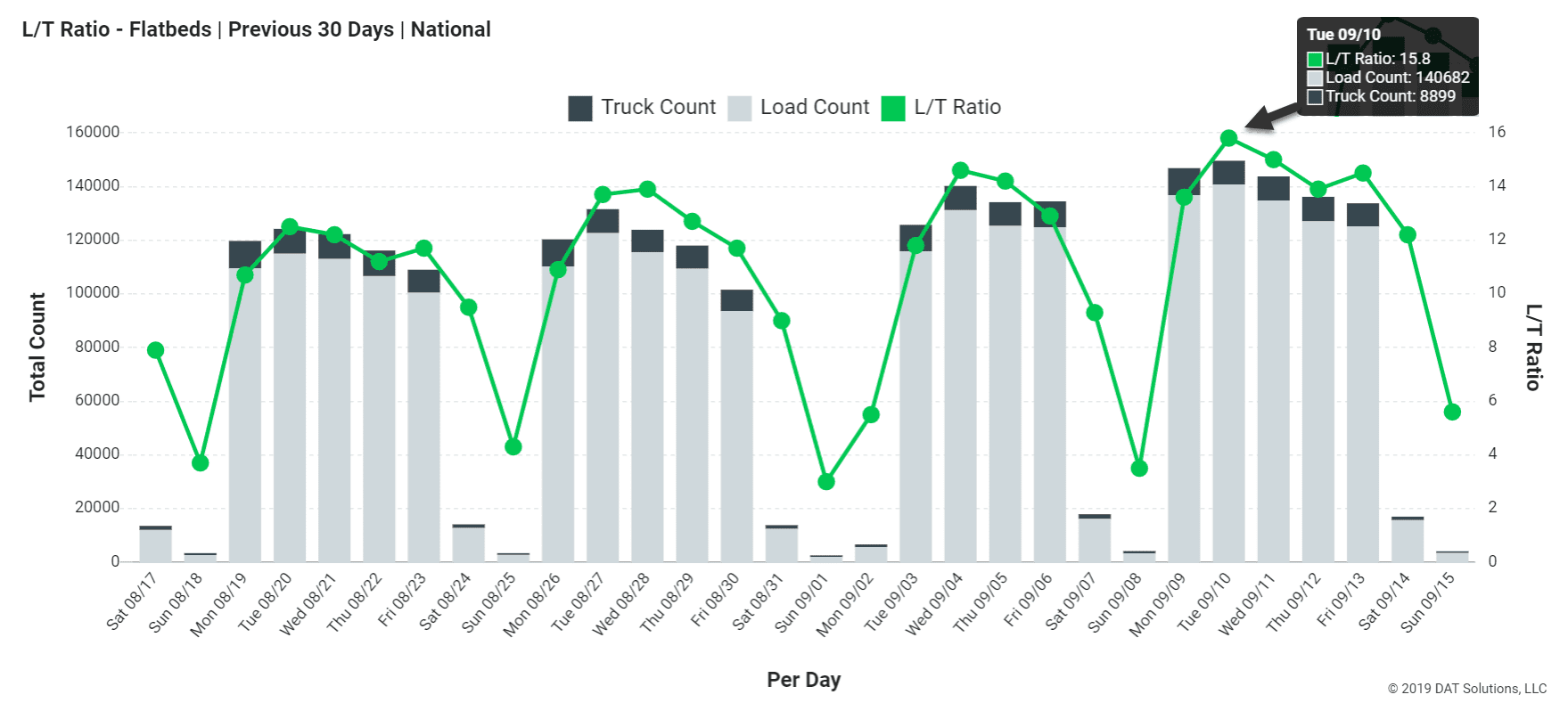

Flatbed load counts and load-to-truck ratios have risen since Hurricane Dorian arrived on the East Coast in early September. (Graph from DAT RateView.).

Rising Markets and Lanes

Last week saw increased flatbed volumes in the wake of Hurricane Dorian. That lifted up several Southeast markets, including Tampa, Birmingham, AL, and Roanoke, VA.

- Raleigh, NC, to Greenville, SC spiked 51¢ to $2.94/mi.

- Atlanta to Raleigh, NC, jumped 32¢ to $2.68/mi.

- Roanoke, VA to Harrisburg, PA rose 46¢ to $2.88/mi.

- Cleveland to Harrisburg, PA added 28¢ to $3.55/mi.

Falling Markets and Lanes

Ample capacity led to lower rates in Pittsburgh, Memphis, Dallas and Ft. Worth, TX, while Houston rates were mostly neutral. Rates were also down in Jacksonville, FL as the harbor was blocked by a capsized vessel. Expect South Central markets to perform better in the coming week. Usually there is a lag between increased activity and higher rates, especially when initial capacity is readily available.

- Baltimore to Springfield, MA dropped 51¢ to $3.44/mi. as rates normalized following Dorian’s threat to New England.

- Jacksonville to New Orleans was down 33¢ to $1.60/mi. Most likely related to port issues.

- Las Vegas to Sacramento feel 41¢ to $2.20/mi.

- Cleveland to Milwaukee came down 40¢ to $2.39/mi.

RELATED: Van demand falls as Hurricane Dorian fades

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.