Spot market flatbed rates normally peak in Q2, but this year they hit their high mark in early July. Since then, rates have sunk 3.5%. But like with dry van freight, flatbed volume isn’t bad.

Overcapacity in the flatbed segment remains the chief obstacle to pricing power, with trucks readily available in many parts of the country.

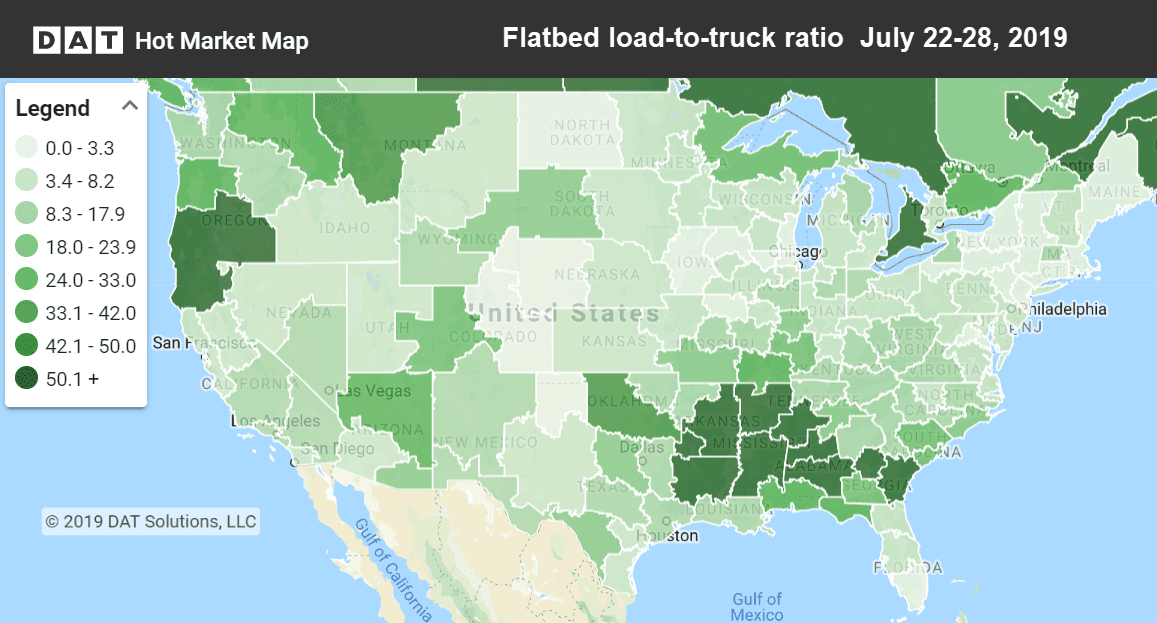

Hot Market Maps in DAT Power and DAT RateView show where trucks are hardest to find. The darker the color, the less competition there is for truckload freight.

Rising Lanes

Jacksonville rates rebounded on 22% higher volumes last week. Atlanta, Savannah, Raleigh and Fort Worth all had significant increases in load counts as well. Las Vegas rose on a shift from north to south California shipping.

- Las Vegas to Los Angeles popped 53¢ to $3.45/mi

- Atlanta to Raleigh, NC, added 44¢ to $2.76/mi

- Savannah to Greer, SC, jumped 39¢ to $3.56/mi

Falling Lanes

Birmingham, AL, volumes and prices plunged last week. Pittsburgh and Cleveland also saw sizeable drops in flatbed load counts.

- Birmingham to Raleigh came down 99¢ to $2.59/mi (seasonal high)

- Las Vegas to Sacramento dipped 64¢ to $2.48/mi

- Rock Island to Indianapolis dropped 40¢ to $2.60/mi

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.