Just as we saw with van freight, reefer rates and load-to-truck ratios cooled down last week after rising sharply the previous week due to the International Roadcheck inspection blitz. On the other hand, reefer freight volumes were up 20% compared to the previous week. Produce season is on, and we saw big volume increases coming out of both California and Texas.

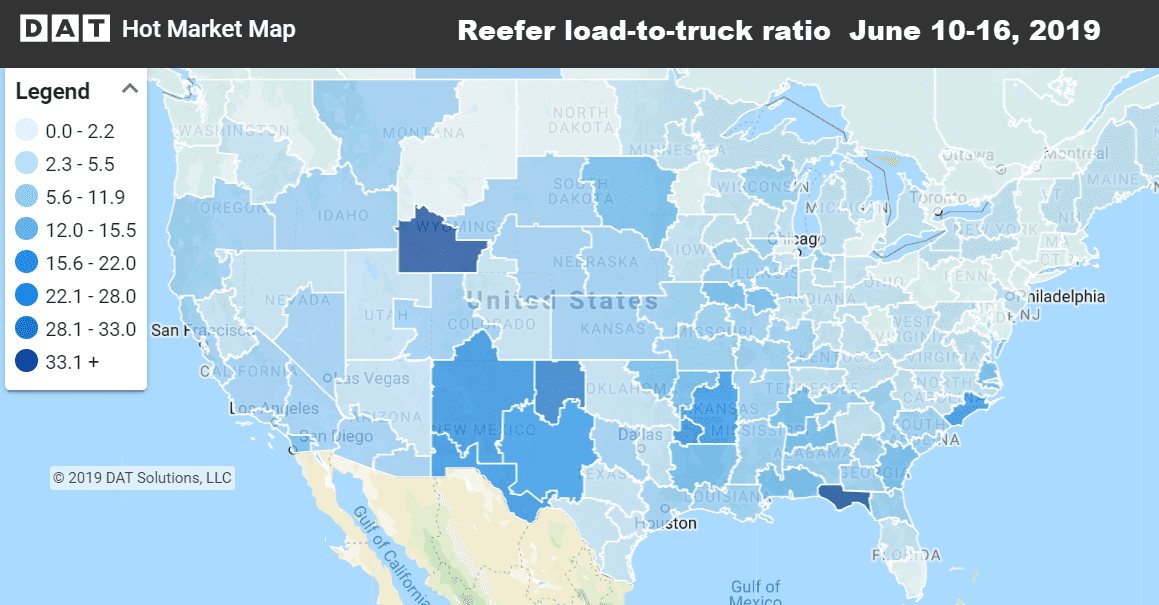

Although the national reefer load-to-truck ratio was down 30% last week (after rising 67% the previous week), there were areas of the county where demand exceeded supply. As seen in the Hot Market Map below, markets with ratios above 20 to 1 included Tallahassee, FL, Albuquerque, NM, and Amarillo, El Paso and Lubbock, TX. Green River, WY had a high load-to-truck ratio, but only because there were just a few loads and no trucks.

Hot Market Maps are available in DAT Power and DAT RateView.

Rising rates

Rates increased in 3 of the top 4 California markets: Sacramento, Ontario and Fresno, with L.A. rates showing a slight decline. Freight volumes were up more than 40% coming out of Nogales, AZ — possibly because the threat of tariffs on Mexican imports has passed — and the biggest rate jump was on lane from Nogales to Dallas. Volumes were also up coming out of the border town of McAllen, TX, but rates were lower there.

- Nogales, AZ to Dallas jumped 49¢ to $3.36/mi.

- Fresno to Seattle increased 27¢ to $3.21/mi.

- Sacramento to Salt Lake City also increased 27¢ to $2.86/mi.

- Out east, Atlanta to Philadelphia added 19¢ to $2.74/mi.

Falling rates

Many of the lanes with large price drops were ones that had spiked during the previous week. That was not true for Florida, however, as prices there fell last week and the week before.

- Twin Falls, ID to Phoenix plunged 62¢ to $1.50/mi.

- McAllen, TX to Atlanta dropped 33¢ to $2.33/mi.

- Green Bay to Minneapolis fell 29¢ to $2.34/mi.

- Miami to Elizabeth, NJ declined 28¢ to $1.97/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.