For many motor carriers, June couldn’t get here fast enough. This is typically the busiest time of the year for spot freight, and it brings in some of the highest rates of the year for trucking companies. Last week, prices increased on 90 of the top 100 van lanes, and on DAT load boards, there were more load posts than any other single week since last September.

Of course, much of last week’s jump in rates and load-to-truck ratios was due to International Roadcheck, the 3-day inspection blitz that ran Tuesday through Thursday across the U.S., Canada and Mexico. In past years, rates have increased during Roadcheck week as many drivers take the week off to avoid inspection hassles. Not only are there fewer trucks in operation during Roadcheck week, but all those inspections take time, which reduces the productivity of the trucks that remain on the road.

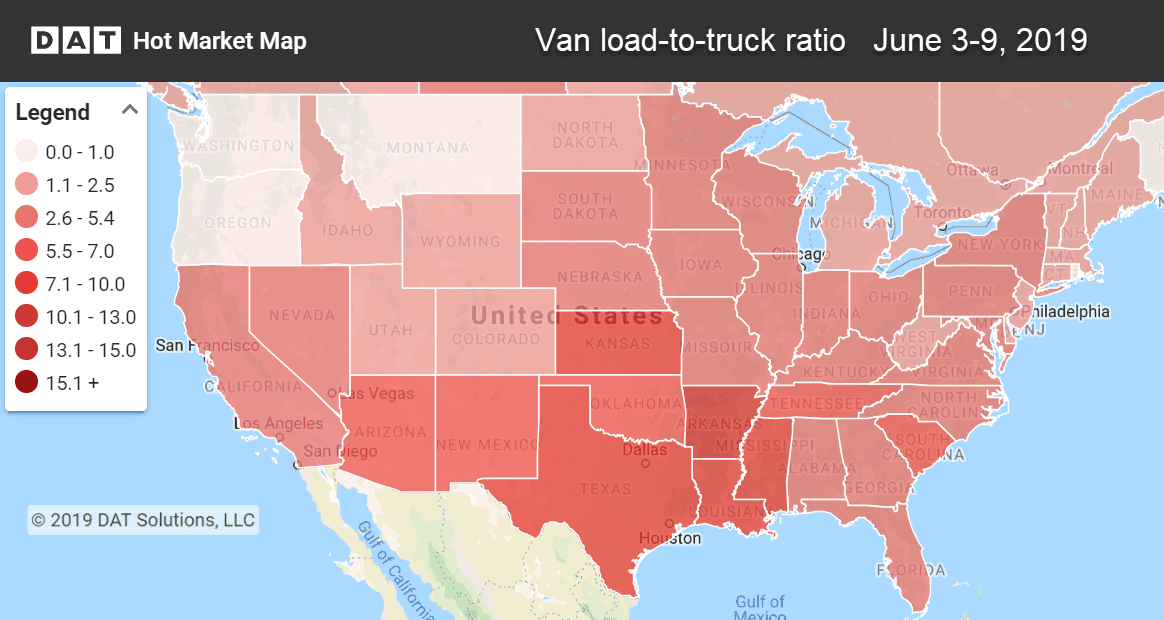

The national average load-to-truck ratio rose to 3.9 van loads per truck last week. Trucks were hardest to find in the southern band of states.

Rising Rates

Most of the big rate increases occurred east of the Mississippi River, especially out of the Midwest.

- Columbus to Buffalo surged 41¢ to $3.12/mi.

- Chicago to Allentown jumped 31¢ to $2.66/mi.

- Atlanta to Philadelphia increased 29¢ to $2.64/mi

- Memphis to Indianapolis added 21¢ to $2.38/mi

- Los Angeles to Dallas gained 17¢ to $1.84/mi

Falling Rates

There were only 8 lanes in the top 100 where rates declined, and of those, the biggest drop was only 6¢ per mile.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.