How big will your tax refund be this year? Thanks to the Tax Cuts and Jobs Act — which applies to the 2018 tax year — most taxpayers will see a reduction in their total tax bill for 2018.

There are 3 significant changes to the tax code that should let taxpayers keep more of their money this year, in most cases:

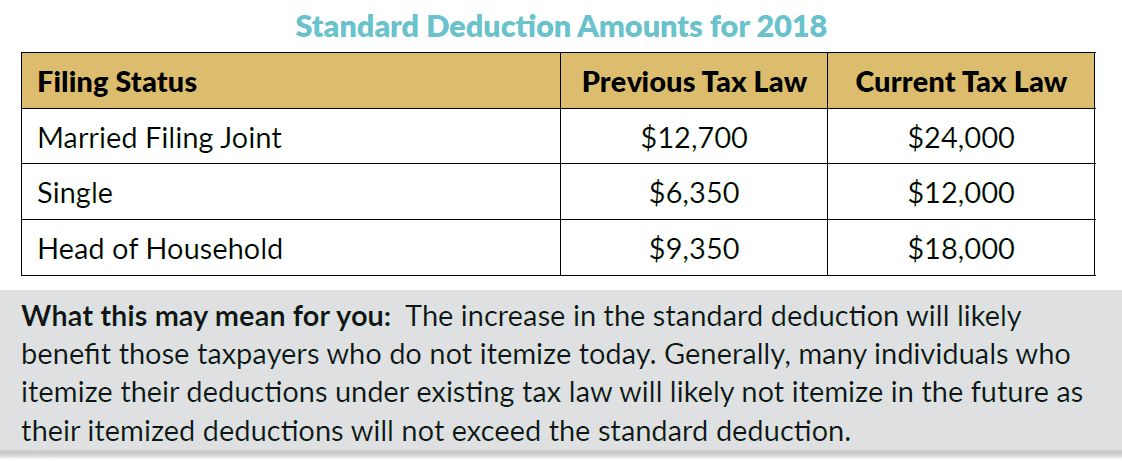

- Higher standard deduction

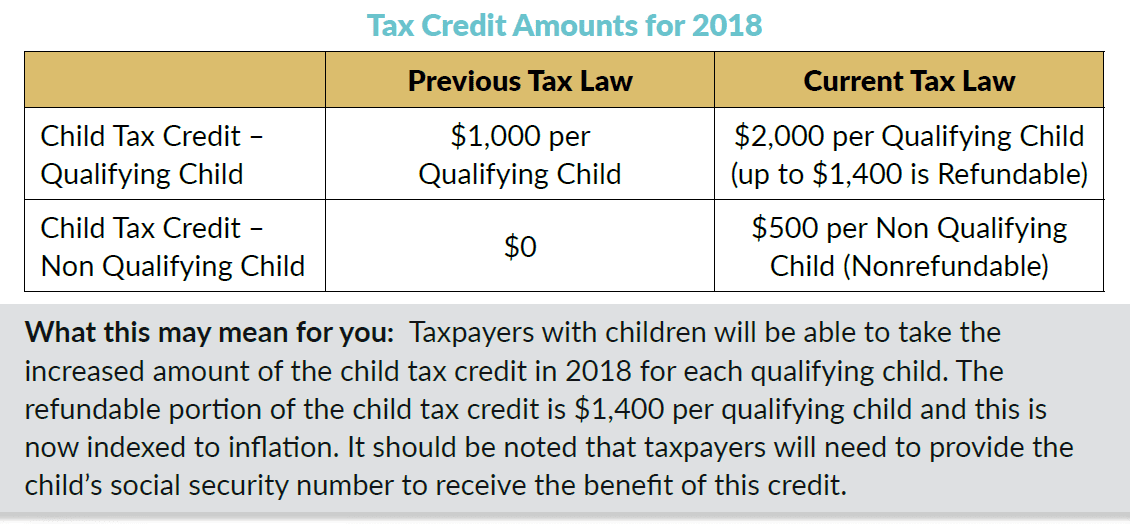

- Doubling of the Child Tax Credit

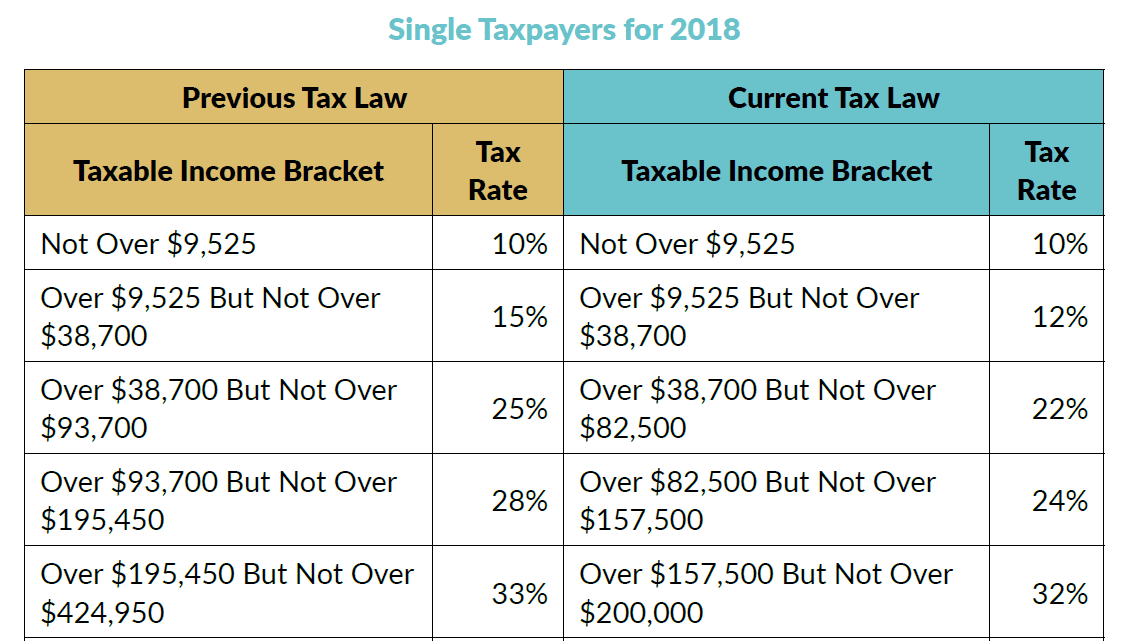

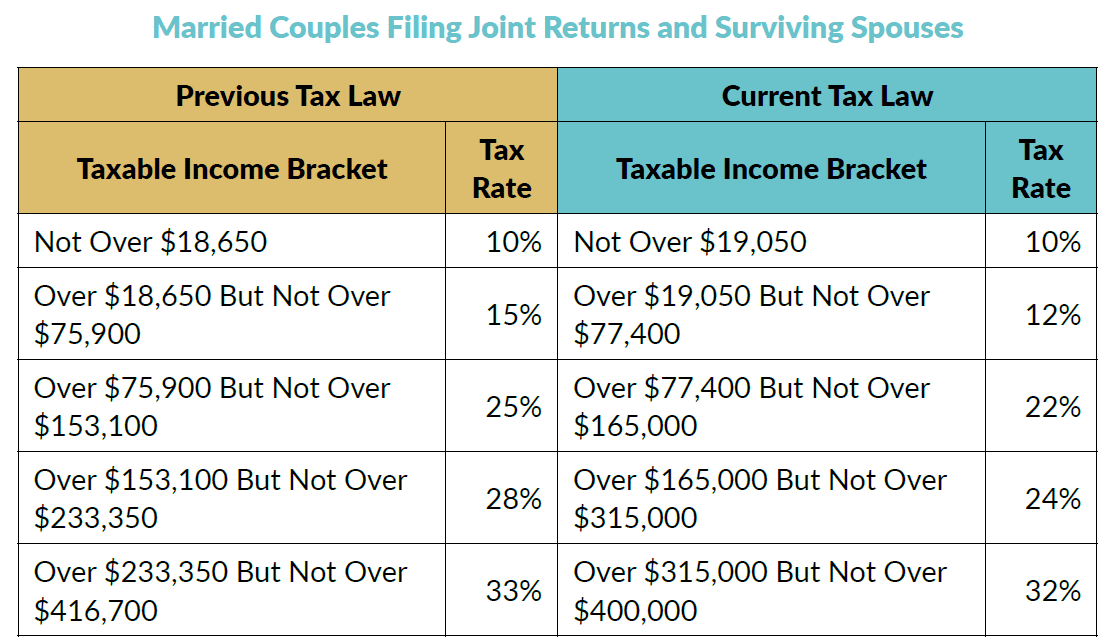

- Lower tax rates in most income brackets

A free tax guide from ATBS highlights changes to tax rules for the 2018 tax year. The guide is written for owner-operators, but it includes information that should be useful to other types of independent business owners, as well as company drivers, freight brokers, and salaried employees.

Keep in mind that while most taxpayers will pay less this year, some will pay more. If you happen to live or work in a high-tax state, for example, you could be at a disadvantage due to new caps on deducting state and local taxes from your Federal tax bill.

For tax assistance for your specific situation, contact ATBS via email or by calling 1-866-920-2827.

Related Content: 6 ways truckers can lower their 2018 tax bill