Van spot rates fell to $2.00 per mile for the month to-date, in a typical seasonal slump. Spot freight volume hasn’t changed a lot since January 2018, but there’s a lot more capacity available, so it’s easier for brokers and 3PLs to find a truck at their target price. There are still pockets of high rates, but pricing has dropped on most high-traffic lanes.

Then the weekend ushered in Winter Storm Harper, which brought snow, ice, and plunging temperatures to the Northeast and Midwest. Icy roads contributed to hundreds of traffic accidents on major highways, and made cleanup more difficult. Ice accumulated on power lines, cutting off electricity for thousands of homes and businesses. More than 1,500 flights were canceled, as well.

Big storms like Harper typically disrupt scheduled freight moves and drive more demand to the spot market. If the cold and ice persist through this week, or if major roads are flooded, look for rates to rise on lanes that pass through the 15 affected states in the Northeastern and Midwestern regions. The increase should be temporary, weather permitting.

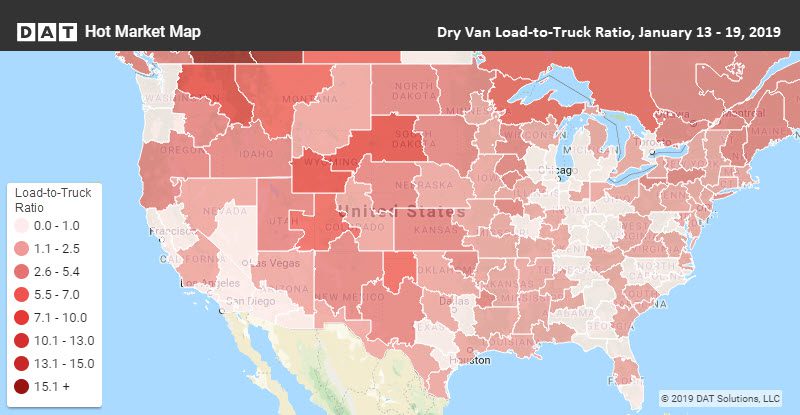

There were more trucks than loads available in a whole swath of key market areas last week, from Minnesota down to South Florida, and along much of the West Coast. All those truck posts drove load-to-truck ratios down to a national average of 3.7 loads per truck, the lowest mark since May 2017.