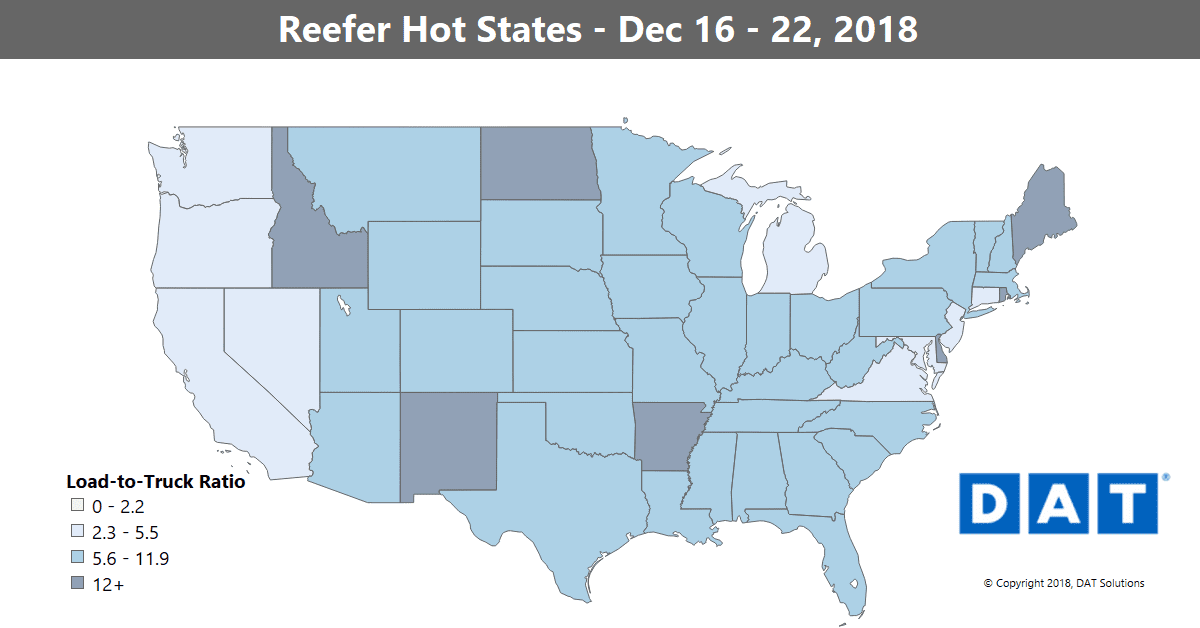

Shippers had plenty of last-minute freight to deliver before Christmas, and that stopped the slow slide we had been seeing in reefer freight. The demand for fresh food before the holiday pushed volumes up 7% last week, which boosted rates on most of the high-traffic reefer lanes.

Those increases could be short-lived, though. Now that the urgency surrounding the holiday is gone, capacity will likely loosen as major produce-growing regions brace for winter. In places like the Upper Midwest, reefers will be used to keep commodities like electronics and some chemicals from freezing in the cold weather. But for now, look south for reefer loads.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

Hot Markets

McAllen, TX, continued to be the the focal point last week for winter harvests from both sides of the border.

- McAllen to Elizabeth, NJ, surged 51¢ to $2.75/mile

- McAllen to Atlanta also jumped up 25¢ at $2.51/mile

A couple off-season spikes out of Florida:

- Lakeland, FL, to Charlotte jumped up 65¢ to $2.03/mile

- Miami to Boston added 37¢ at $2.05/mile

Falling Lanes

Midwest volumes lagged behind other regions…

- …and the biggest decline was on the lane from Grand Rapids to Cleveland, down 43¢ to $3.06

- Twin Falls, ID, to Phoenix dropped 29¢ to $2.85/mile

- Philadelphia to Miami was down 20¢ to $2.24/mile, likely due to higher demand out of Florida

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.