The West Coast continued to drive spot market demand last week. Load-to-truck ratios in Los Angeles hit 12.2 on Friday, even stronger than the prior Friday when it was just over 10. Los Angeles outbound rates rose last week, which is in contrast to declining rates in most of the remainder of the country. Stockton volumes were also up sharply, but Seattle volumes rose most, 34%, and are expected to rise for the next several weeks as they work through the bottleneck of vessels in Puget Sound.

On the other end of the supply chain, Atlanta volumes also rose 13% and rates are stabilizing in that market.

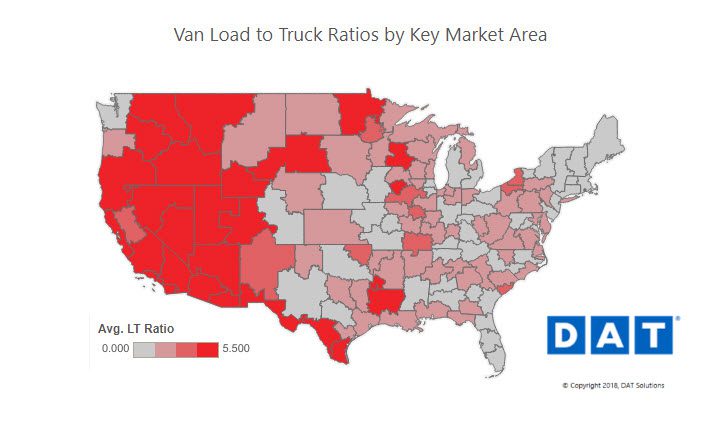

The load-to-truck ratio for vans increased 10% last week, to 5.2 loads per truck. Shown is the load-to-truck ratio for vans month-to-date by key market area. The load-to-truck ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates.

Pressure is Building

On the top 100 van lanes, rates were up on 39, while 56 lanes were down and 5 were unchanged, compared to the previous week. The national average van rate moved down a penny, to $2.09 per mile, mainly because of a 1¢ drop in the fuel surcharge. Pressure is building, however. The threatened strike by UPS Freight (LTL) may already be causing shippers to divert their cargo to other channels. Last week cargo van loads climbed more than 10%, which suggests rates may head up again soon.

Hot Markets

Both the Seattle and Los Angeles markets saw some double digit rate increases:

- Seattle to Eugene, OR moved up 26¢ to $2.88/mile

- Los Angeles to Dallas increased 14¢ to $2.51/mile

- Los Angeles to Denver also increased 14¢ to $3.21/mile

- Out East, Buffalo to Columbus recovered 21¢ to hit $2.21/mile

Not So Hot

The Dallas and Houston markets continue to be extremely slow, with weak load-to-truck ratios. Overall, the state has a load-to-truck ratio of 3.1 – it’s basically stuck in neutral. Falling lane included:

- Philadelphia to Boston slipped 16¢ to $3.72/mile

- Buffalo to Allentown was down 14¢ to $3.25/mile

- Columbus to Memphis rates declined 13¢ to $1.85/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.