Although the coastal towns in the path of Hurricane Florence are generally at the receiving end of the distribution chain, there are 4 port cities in the hurricane’s path that will certainly affect freight movements — and likely result in rate increases in those markets.

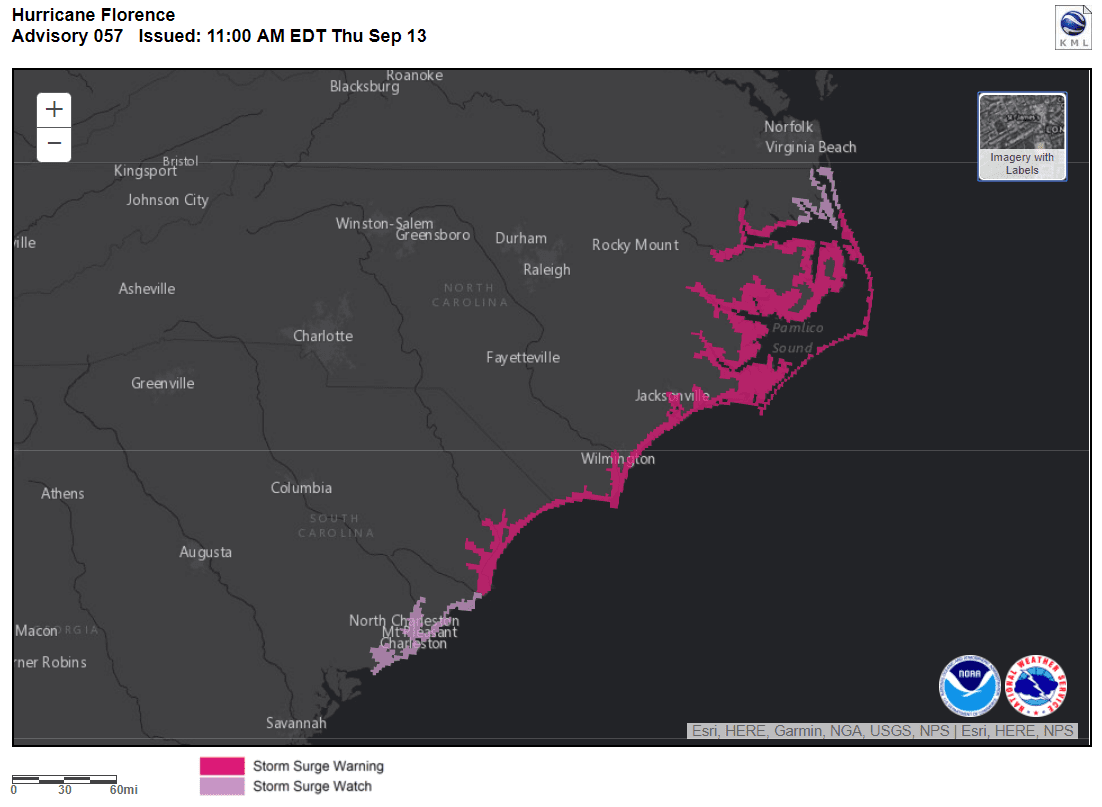

This graphic from the National Oceanic and Atmospheric Administration (NOAA) shows locations most at risk for life-threatening storm surges from Hurricane Florence.

Click on the port name below for the latest closure information:

Port of Wilmington, North Carolina – This port is right in the center of the hurricane path and is expected to be the hardest hit. The ports of Wilmington and Morehead City will be CLOSED on Thursday, Sept 13 and Friday, Sept. 14. The port is 26 miles from the open sea on the Cape Fear River.

Port of Charleston, South Carolina – This port will be CLOSED at least Thursday, Friday and Saturday, and possibly longer depending on conditions. More than 200,000 twenty-foot equivalent container units (TEUs) passed through South Carolina Ports in August.

Port of Norfolk, Virginia – There’s currently a tropical storm warning for southeastern Virginia, and the port of Norfolk is expecting heavy rain and tropical storm force winds Thursday evening through Saturday. The Coast Guard has closed the main shipping channel and no ships can enter or exit the port. The port’s truck gates will also be closed on Friday and Saturday, at least intermittently. See the port’s website for more closure information.

Port of Savannah, Georgia – The port of Savannah website has not announced any closure information, but it too could be affected by heavy rains. Savannah is the second-busiest U.S. container exporter (behind Los Angeles) and in July the port handled more than 370,000 TEUs.

Sign up for one our newsletters to stay up to date on supply chain disruptions and the latest freight trends.