Trucks have been in short supply so far in June, and that’s been especially true in many of the major reefer markets. To get an idea of just how tight capacity has been, reefer truck posts on DAT load boards were down 9% last week compare to the previous week. Normally you’d expect an increase because that previous week included Memorial Day, so there were only four business days. So even with an extra business day, truck posts were down last week. By comparison, reefer load posts were up a whopping 42%, which is more than you’d expect from the extra business day.

The scarcity of trucks boosted outbound rates way up in many markets.

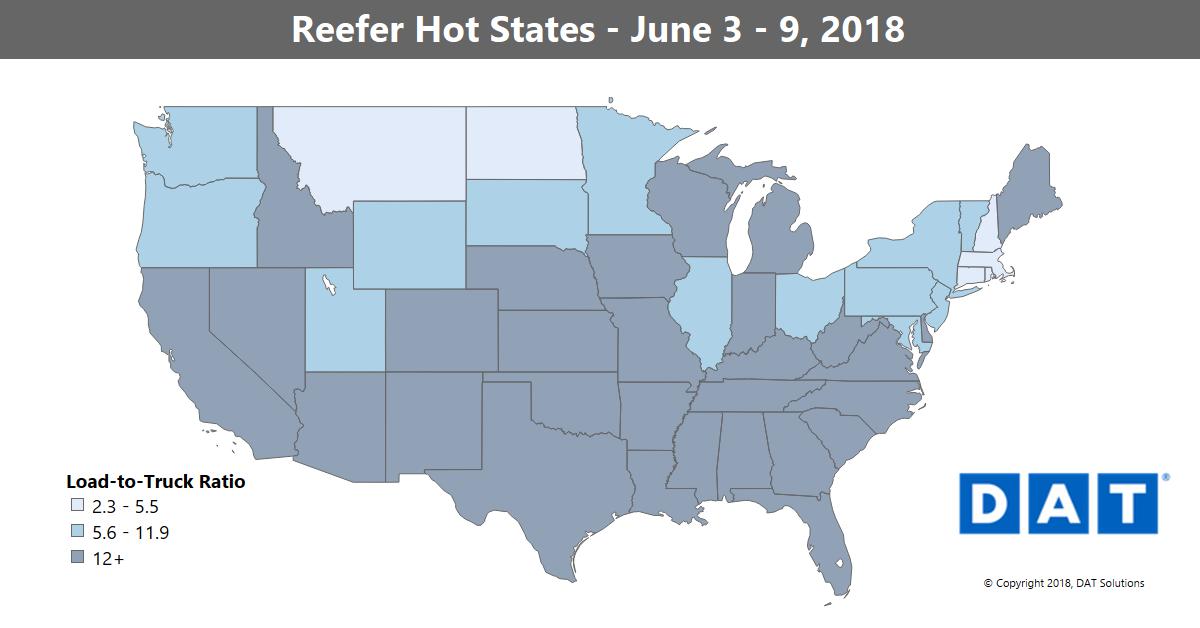

Florida shows up as dark blue in the Hot States Map above, signaling tight capacity, but that’s mostly confined to the middle and upper parts of the state. Down in Miami, rates on several lanes are settling into off-season pricing.

All rates below are averages, including fuel surcharges, based on real transactions between brokers and carriers.

RISING

Prices out of Dallas soared last week:

- Dallas to Atlanta rose to an average of $2.95/mile, 55¢ higher than a week ago – this might be temporary, as volumes were building up again in Atlanta by the weekend

- Dallas to Denver also rose 55¢ at $3.64/mile

Grand Rapids, MI, to Atlanta surged 64¢ to $3.04/mile, but on relatively light volumes. Atlanta to Philadelphia climbed 50¢ to a whopping $3.67/mile.

Out West, California pricing continues to improve, with rates up 25% in the past month out of Sacramento.

FALLING

- Miami to Atlanta fell 26¢ last week to $1.72/mile

- Miami to Baltimore rates tumbled 62¢ to $2.37/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.