Peak season for Florida seems to have come to a close, and reefer rates responded accordingly. Prices out of Miami and Lakeland plummeted, but the ripple effects also led to higher outbound rates in Atlanta, as prices adjust and demand shifts northward to Georgia produce.

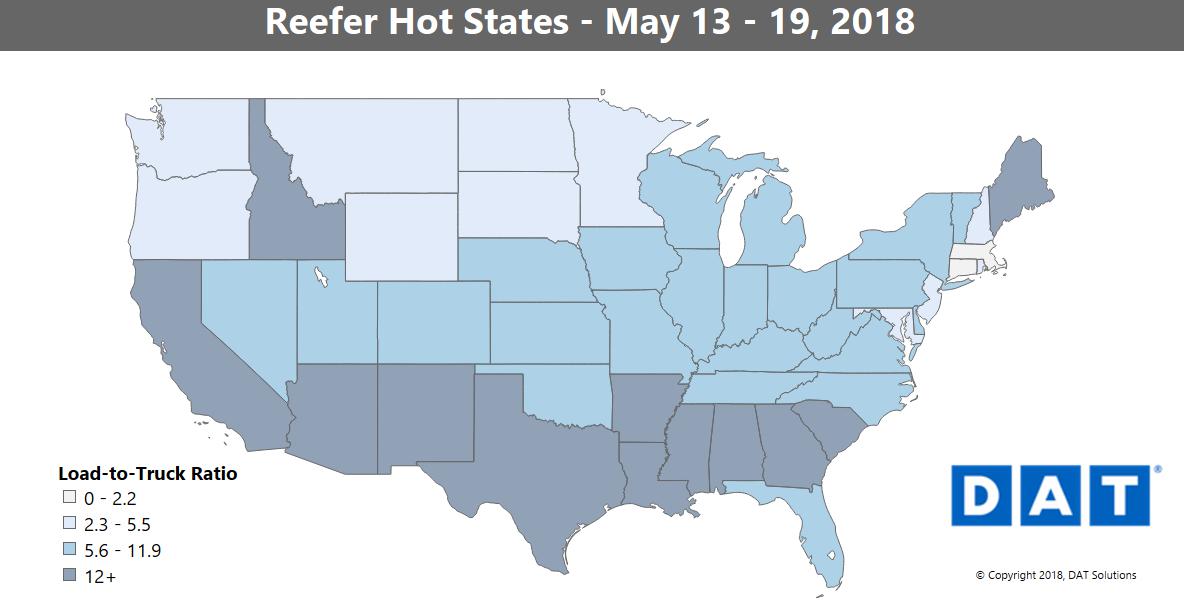

Aside from Florida, the southern band of states from California eastward experienced high demand for reefers last week. On the national level, the national average reefer rate held steady at $2.49 per mile, while the reefer load-to-truck ratio got a 9% boost, from 8.5 to 9.2 loads per truck.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

HOT MARKETS

In California, volume and rates revved up for reefers in Los Angeles, and prices rose for outbound reefer loads in nearby Ontario, as well as the Fresno and Sacramento markets. Border crossing points at Nogales, AZ and McAllen, TX also got a boost from imported produce last week. Other hot lanes included:

- Atlanta to Philadelphia jumped 55¢, to $3.16/mile.

- McAllen, TX to Atlanta climbed 38¢ to $2.95/mile

- Ontario, CA to Seattle increased 35¢ to $3.41/mile

- Nogales, AZ to Dallas bumped up 31¢ to $2.91/mile

FALLING

Major lanes out of Miami and Lakeland were down, with rates and volumes dropping steeply:

- Miami to Atlanta plunged 74¢ to an average of $2.38/mile

- Miami to Baltimore dove 59¢ to $2.91/mile

- Lakeland to Atlanta dropped 57¢ to $2.40/mile

- Lakeland to Baltimore fell 46¢ to $2.93/mile

Other lanes, further north, also saw rate declines. Grand Rapids, MI to Madison, WI fell 19¢ to $2.97/mile, and the lane from Chicago to Minneapolis moved down 12¢ to $2.63/mile.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.