December was arguably the strongest month for freight in 2016. So even though we’re now going through the typical seasonal slow-down for mid-January, rates are still higher than usual in some places for this time of year.

Spot market volumes still look strong, but contract freight has been a little slow. That means there are more trucks from big carriers available on the spot market, and the extra capacity pushed rates down on a lot of high-traffic lanes last week.

Load-to-truck ratios are highest for vans in the darker red areas on the Hot States Map, above.

HOT MARKETS

There’s more freight moving out of Houston this month. Texas van rates didn’t get quite as high as we saw in other markets, so the decline has been less steep for outbound rates there. Otherwise, prices in most major van markets started falling back down to more normal levels. A couple lanes rebounded after some large drops in the previous week. Chicago to Buffalo paid 12¢ better, with an average rate of $2.41/mile. Rates on the lane from Buffalo to Charlotte improved 9¢ to $1.75 per mile. Tornadoes in the Southeast could affect rates there this week, and our thoughts go out to the families that have suffered as a result of those storms.

Note: The Hot States Map above shows that Maine, Wyoming, and the Dakotas have high load-to-truck ratios, but load posts there are lower when compared to most other parts of the country

NOT SO HOT

The holiday retail season is in the rearview, so rates in the Midwest, Northeast and much of the West Coast are coming back down to earth. For instance, outbound rates are down 7% for the month in Los Angeles.

Load-to-truck ratios are highest for reefers in the darker blue areas on the Hot States Map, above.

Reefer rates also fell, despite more available loads. Just like with vans, it may be a case of less contract freight moving, which has led to more capacity on the spot market.

HOT MARKETS

There was a strong surge in reefer loads out of Dallas and McAllen, TX. California was also shipping more after a week of difficult weather, but there were enough trucks to accommodate the increase in demand. The exception was Sacramento, which was the only major reefer market with higher rates last week.

NOT SO HOT

Once again, the Midwest and Northeast had declining rates in general, but a lot of those prices were already pretty high. For example, the lane from Chicago to Philadelphia paid 25¢ less last week, but the rate still averaged $2.68/mile. The beer coolers for the Super Bowl in Houston must be stocked by now, too, because reefer rates on the lane from Denver to Houston fell back down to a more normal $1.65 per mile.

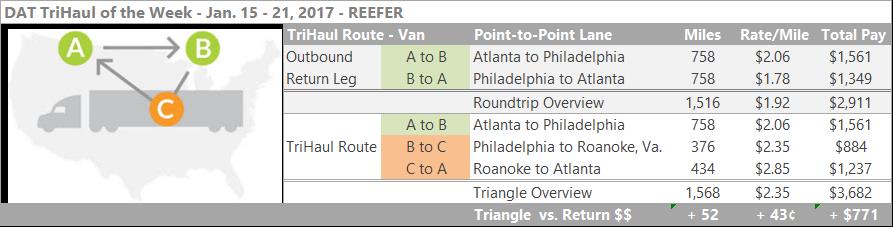

The headhaul lane from Atlanta to Philadelphia has been losing traction as of late. One way you can make up for the lost revenue is by boosting your earnings on the return trip with a TriHaul. You can take a reefer load from Philly to Roanoke, VA, which paid an average of $2.35/mile last week. Then you can pick up another load from Roanoke to Atlanta, which averaged $2.85/mile. If you can make the extra drops and picks work with your hours, you can turn what would’ve been a $2,900 roundtrip to something closer to $3,700. And if you’re able to avoid any extra deadhead, the TriHaul only adds a little over 50 miles.

Find loads, trucks and lane-by-lane rate information in the DAT Power load board, including rates from DAT RateView.