Spring is starting early for flatbeds in the Southeast and much of the Midwest. Heavy equipment and related materials are already moving to construction sites at the end of a mild winter. Despite increasing volume, rates slipped lower in the last week of the month. Rates typically rise in March, however, so a rebound could be on the way.

Mild winter weather gave the flatbed freight season an early boost. Load-to-truck ratios rose throughout February, to end the month at 12.6 loads per truck. Demand has been especially strong in the Southeast, although declining steel shipments led to a reduction in flatbed freight volume in Birmingham. Outbound volume was also down in Cleveland, due to steel’s slump, but Pittsburgh was up for the month.

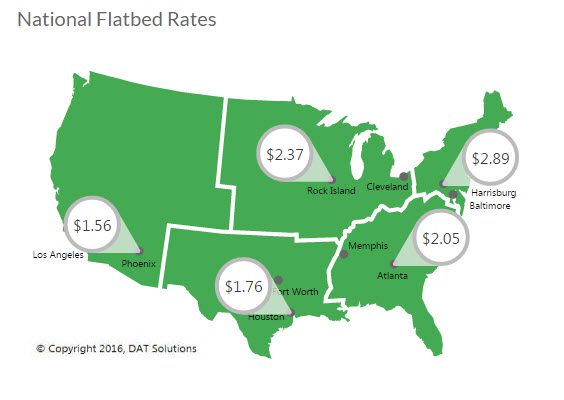

Flatbed rates declined 3¢ last week, to a national average of $1.80 per mile. Outbound rates rose in Memphis and Atlanta, but fell in Raleigh and Birmingham. Rates were also down in Cleveland and Harrisburg. In Houston, the largest flatbed market by volume, rates were mostly unchanged, but Dallas outbound rates rose 6¢ per mile.

Daily maps, along with detailed information on demand, capacity and rates for individual markets and lanes, can be found in the DAT Power load board. Rates are derived from actual rate agreements and contracts, as reported in DAT RateView.