Diesel prices dropped 7¢, to $2.11 per gallon last week, the lowest since March 2009, and rates fell, too. Line haul rates are not exceptionally low, but the fuel surcharge was down to only 16¢ per mile, and it’s still falling. Freight brokers usually quote a one-time rate that includes both the line haul and the fuel surcharge, so the declining fuel price has an influence on rates.

The good news is that you’re getting paid today for the jobs you completed 30 days ago, when fuel surcharges were higher. You can put those extra pennies per gallon right in the bank.

The load-to-truck ratio fell from 2.7 to 1.7 loads per truck last week, a more typical result for the slow winter season. The DAT Hot States Map for last week still shows a lull on the West and East Coasts, with more intense demand in the Upper Midwest.

This week’s Hot Markets include a handful of cities where solid load volume combined with above-average load-to-truck ratios to make it easier to find a load out:

- Missoula, MT

- Rapid City, SD

- Eau Claire, WI

- Rock Island, IL

- Decatur, GA

- Erie, PA

- Syracuse, NY

Local conditions can change quickly. so be sure to check on outbound load availability before you go in.

Van rates fell 5¢ to a national average of $1.68 per mile last week, including a 1¢ declined in the fuel surcharge. Rates fell for hauls originating in Los Angeles, Dallas, Chicago, Atlanta, and Philadelphia, but strong freight volume may lead to a rebound on the most popular lanes this week or next.

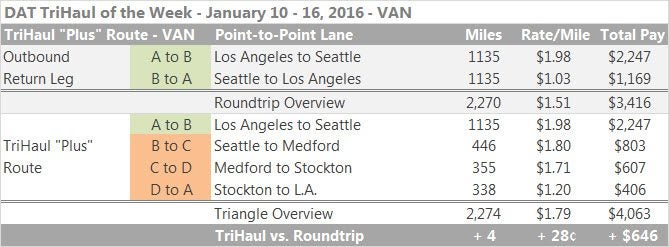

TriHaul: L.A. – Seattle – Medford – Stockton – L.A.

TriHaul: L.A. – Seattle – Medford – Stockton – L.A.

You can still get almost $2.00 per mile leaving L.A., but it’s more of a challenge to find decent rates for the return trip to L.A., especially from Seattle. If you can even find a load, it won’t pay much.

This isn’t really a triangular route. It’s a straight shot down I-5. But it can be a good solution when you’re leaving a dead-end market.

Heading out of Seattle, divide the southbound trip into shorter hauls. You’ll have more picks and drops, which can be time-consuming, but you’ll also make better money on your loaded miles. You will add about $650 in revenue, and boost your pay to $1.79 per loaded mile for the roundtrip, which could be a good week’s work in a slow season.

Demand and capacity information is based on load and truck posts from DAT Load Boards. Rates are derived from DAT RateView and are based on actual rate agreements between freight brokers and carriers. Reference rates include fuel surcharges but not accessorial or other fees.