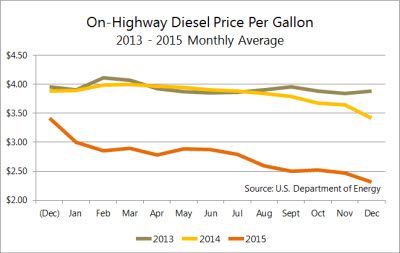

Diesel prices fell to $2.11 per gallon last week at the pump, as a national average. If your truck gets six miles to the gallon, your fuel cost is only 35¢ per mile. How could that possibly be bad?

Lower fuel prices lead to a lower fuel surcharge. Every shipper has a different formula to calculate the fuel surcharge, but typically you gain 1¢ of surcharge for every 5¢ or 6¢ increase in the price of diesel. Freight brokers typically quote one-time rates that combine the surcharge with the line haul into a total for the whole trip.

Learn how you can save on fuel costs with the DAT Fuel Card. To find out more, contact us online or call 800-621-2404.

Carriers benefit because costs are down, but also because 30-day terms mean you’re getting paid now for a haul in December, when the surcharge was closer to 19¢. Meanwhile, fuel prices dropped again, so next week’s surcharge will be closer to 14¢. If your company improves its mileage, or finds another way to cut costs, those few extra pennies per mile go straight to your bottom line.

Of course, revenue drops, too. Owner-operators are sensitive to this, but it hurts the big guys, too. For-hire truck tonnage increased 2.2% in 2015, but public trucking companies were pummeled by the stock market. With the savings on fuel, you’d expect them to do well, but the largest fleets spent that money on a record number of trucks in 2015 and an increase in driver pay. Now those big fleets have lots of capacity, and they can service their shipper customers better, but the earnings don’t look so great.

Weak players stay in business longer when fuel costs are low. Ordinarily, low rates would starve small and poorly managed carriers, but they survive somehow, filling their tanks at $2.11 or less per gallon. That means there’s even more capacity, and more competition, which drives rates still lower.

There’s a silver lining. Or maybe it’s a plastic lining. Due to low oil prices, the U.S. is able to manufacture some products, including chemicals and plastic resins that are derived from petroleum, and export them at favorable prices. Demand has been strong within the U.S. for autos and auto parts, which also contribute to freight volume. Unfortunately, other cargo types, including oil drilling equipment and fracking sand, are not in high demand compared to previous years. New construction is not exactly booming, either, the steel industry is suffering. Worse, consumers did not spend their gas savings on Christmas presents, which was a big disappointment to economists as well as retailers.

Rates are low now, but a rebound may be just a few months away. There are good reasons to expect spot market rates to rise in the second half of the year, or possibly as soon as the second quarter. Right now, carriers can take advantage of low fuel prices during the slow season, to get acquainted with new customers, new markets and new cargo types that require freight transportation. When freight picks up again in the spring, you’ll be ready.

Take advantage of DAT RateView to follow trends in truckload demand, capacity and rates, in the markets and lanes that are important to your business. RateView provides point-to-point rates, including fuel surcharges, for 65,000 lanes in the U.S., with separate databases for the contract and spot marketplaces