Texas is now the number-one state for refrigerated (“reefer”) freight transportation on the spot market, and by a wide margin. There are three reasons: First, agricultural markets in the Longhorn State are growing more fruit and vegetables, especially in the Rio Grande Valley, and the cattle and meat packing industries in the western part of the state add to that demand for refrigerated equipment.

Second, there has been a big increase in imports from Mexico, including agricultural products. New highways and bridges in Mexico make Texas border towns like El Paso and Laredo more accessible and more popular than Nogales, AZ, the previous volume leader.

After crossing the border into the U.S., the imported produce must be inspected, usually in a refrigerated warehouse in Texas. Following inspection, the route to Midwest and East Coast markets is shorter from Texas than from Arizona.

The third, and perhaps most important reason for Texan reefer leadership is the reduction of produce volume leaving California. The Golden State has dominated U.S. agricultural production ever since the first refrigerated rail cars rolled out of California in 1886. In recent years, however, persistent drought and changing water allocation has led to steady declines in produce volume. The drought is expected to incur direct costs of $1.8 billion in 2015, according to a report by the Center for Watershed Sciences at UC Davis. That’s about 4% of California’s $45 billion in annual revenue from agriculture, and spot market transportation is likely to bear the brunt of that reduction.

More reefer loads are available in Texas than any two states combined. On Friday, June 5, a Hot States Map from DAT Load Boards showed almost 9,800 reefer loads offered with an origin in Texas, where the load-to-truck ratio was 14.4. The second- and third-place states were California with 5,200 loads and a ratio of 5.1, and Georgia with 4,400 loads at a load-to-truck ratio of 8.6. In Florida, produce season has waned, but the Sunshine State still holds fourth place with 3,000 loads and a ratio of 4.6.

Within Texas, the Hot Market Map depicts sizzling demand, with trucks in short supply along the border with Mexico. The McAllen market is especially strong right now, with well over 2,000 load posts on Friday, June 5, and a load-to-truck ratio of 29.5. McAllen is a major transit point for produce harvests in the Rio Grande Valley, on both sides of the border. Laredo and El Paso are also border-crossing areas, with 800 to 1,200 load posts and a pronounced shortage of available trucks, driving load-to-truck ratios well above normal levels — above 131, in the case of El Paso.

Demand Heats Up for Vans in the Same Markets and Lanes

The heightened reefer activity contributes to a shortage of vans in the same markets. Any carrier with a reefer trailer is deploying it right now, diverting power units and drivers to the more lucrative, seasonal freight.

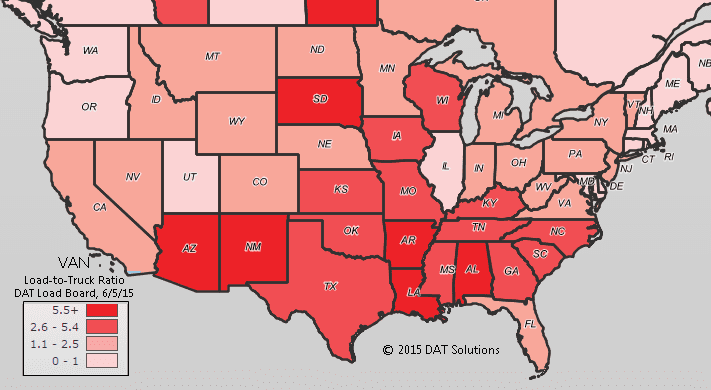

When a reefer market is as hot as these Texas markets are today, rates rise for vans as well. Van demand is well above average in Laredo, Lubbock, and Amarillo due to imports, cotton traffic and non-perishable produce such as melons going a short distance. A glance at the Hot States Map for vans, below, is nearly identical to the reefer map. The deepest red areas, denoting a higher number of loads and relative scarcity of trucks, are similar to the deep blue areas on the reefer map.

There is intense pressure on capacity across all the southern states, from East to West, except Florida and California. Expect rates to continue trending up in those high-pressure states and markets, for at least three or four more weeks. After that, the pressure will begin to drift northward with produce harvests, until the whole thing wraps up in the fall, and thousands of truckloads of apples roll out of states bordering on Canada.

Pressure on van capacity across the southern states is a secondary result of produce season. Reefer capacity is tied up with produce, so fewer power units and drivers are available to handle van traffic in the same markets and lanes.