It’s time to park the notion that load boards are just for backhaul freight.

This year, about 43 percent of all spot market rates on North American lanes have been higher than contract rates because truck capacity has been so tight. We also found in September that, of the 17,172 lanes within our 65,000-lane U.S. database that had roundtrips of 500 miles or more, 53 percent of the van freight moves were headhaul, where headhaul is defined as the higher rate in a pair of moves—usually outbound and then back home.

At any given time there are literally more than 30 thousand available van, reefer, flatbed, and specialty equipment loads that are not under contract. A factory ramping up, a bumper crop, growth in commercial construction, a congested rail network—any of these things can generate freight that a shipper or broker will post to a load board.

The challenge is to quickly and confidently find the right load. By that I mean a load that will help you accomplish whatever it is you want to do, whether that’s maximizing revenue, getting home, or working with a particular shipper or broker. Here are four strategies you can use:

Call the Shots

Whether you need to go from Point A to Point B and back again or you’re simply looking for your next job, post your truck to the load board and answer your phone when the brokers call.

“I know people who don’t want to be bothered by the phone calls,” says Chad Boblett of Boblett Brothers in Lexington, KY, and one of the founders of the Rate Per Mile Masters group on Facebook, which has more than 1,400 members. “The way I see it, whoever receives the call is in the best position to negotiate the rate. If you’re a broker begging me for my service, then I get to name my terms. The only time I phone a broker is when I’m desperate, or I want to go home.”

Focus on Demand

“I always want to go from head-haul market to head-haul market,” says Bryan Spoon of Bryan Spoon Trucking. Based near St. Louis, he moves heavy machinery from Missouri to the East Coast and uses load boards to find flatbed loads on the return.

Spoon’s dispatcher, Anna Lowdermilk, stays a step ahead. If Spoon says he wants to haul to Chicago, “I want to make sure he can get a good rate on the outbound before I book a load to send him there,” she says.

Load-to-truck ratios for October show nation-wide demand for vans.

Balance is the key. For example, search the load board for freight coming out of a 100-mile radius of Chicago, then search for loads posted going to Chicago. If there’s an imbalance—say there are 509 loads inbound and 226 loads leaving—you know the broker will have an advantage on the rate. Looking for loads to Indianapolis or Peoria might be a better option.

Quote the ‘Ugly Load’

Boblett quotes every job that’s offered to him. He describes taking a call about a load of rain barrels to be picked up in Winchester, KY, on a Thursday and offloaded at three separate stops in Delaware, a tough place to find an outbound load on a Friday evening. Boblett could hear the desperation in the broker’s voice.

“I said, ‘If you give me $4,300, it’’d be worth doing,'” Boblett recalls. “This wasn’t a negotiation. He didn’t ask if I’d do it for $4,000 or $4,100. He just said, ‘Done.'”

Quoting the “ugly load” tells the broker that you’re available if the price is right—in Boblett’s case, being compensated for the miles he figured he’d have to deadhead out of Delaware.

Learn the Features

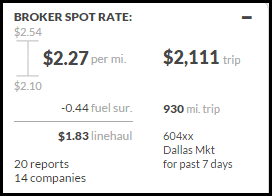

DAT Power subscribers get access to rate information

powered by RateView.

A reputable load board will have an array of tools you can use to find a load, review rate histories, and check the creditworthiness, stability, and reputation of a broker or shipper.

Dedicate time to learn how these features work. If you think a broker is low-balling you, it helps your cause when you can come back with a rate history on that lane and know how it was calculated. Are you looking at a 7-day average or a 90-day average rate? Are rate histories based on actual transactions or something else?

“Part of what you pay for today is all of this market intelligence and customer service,” Boblett says. “Take advantage of it.”