It’s unusual for rates to rise in both directions on a point-to-point lane, but an exception to that are the lanes connecting the Memphis and Columbus markets. Sometimes rates can rise going in both directions, from Memphis to Columbus AND Columbus to Memphis. The same thing happened on the round trip between Atlanta and Charlotte.

Both those lanes offer great opportunities for truckers, so if you have a van in the area, start looking on your load board for those two round trips. Here are a few pointers, to help you make more money in these hot markets.

When Rates Rise in Both Directions, You Want to Be There

When there is an increase in the head haul rate — from Memphis to Columbus, for example — it usually means that there is a lot of freight moving in that direction. Load providers are competing for trucks, and they raise rates to attract carriers. Meanwhile, empty trucks start to congregate at the destination — in this case, it’s Columbus.

Rates offered for the “back haul” direction — from Columbus to Memphis — tend to decline when lots of truckers are stuck in Columbus, looking for freight. Nobody can afford to drive empty or to sit in one place and wait for rates to go up, so carriers will tend to accept a low rate just to get back to the point of origin. Those low back haul rates don’t always cover the carrier’s cost, so the original head haul (Memphis to Columbus) has to be pretty attractive to make up for low pay on the return trip.

No Matter Where You Park Your Truck, the Lower-Priced Direction is the “Back Haul”

Truckers complain about low back haul rates, and they’re right to be upset. If they are located (domiciled) in Columbus, for example, some of their outbound trips will be paid at back-haul rates. If you operate a truck out of a back haul market, look for higher-paying freight in a nearby city — in this case, you might try Toledo — then do the math to see whether the extra money will cover the deadhead.

If you’re in a market with high outbound rates, like Memphis, you want to be choosy about your destination. The outbound rate may be high, but you won’t be happy if your truck is going to get stuck at a destination with no freight for the return trip.

Choose Destinations Using the Load-to-Truck Ratio

One way to find freight: look at the load-to-truck ratio. That simple ratio, based on the number of loads posted on DAT Load Boards, divided by the number of truck posts, is a handy indicator of market pressure. To figure out where trucks are in high demand, take a look at a Hot Market Map (available in DAT Power Load Boards and DAT RateView.) Memphis has a load-to-truck ratio of 9.9 for vans, which is off the charts.

Hot Market Maps can point you to high-demand markets. Start with areas that are the darkest red color, where load-to-truck ratios are well above average. Then click on those areas of the map (in DAT RateView or DAT Power Load Boards) to view the number of load and truck posts for the most recent business day. If there are hundreds or thousands of loads and the ratio is high, rates will be high, too.

Context is Worth Money

The outbound ratio of 3.0 from Columbus is good, compared to other markets. The Hot Market Map gives you some helpful context. The ratio is also good when you look at the history on that lane. The 13-month history that appears in DAT RateView (below) shows a load-to-truck ratio of 2.3 at this time last year. (Note that the ratios were atypically high in Columbus this past winter because of extreme weather that immobilized entire fleets, as well as railroads, for days and weeks at a time.)

Strong seasonal opportunity on the lane from Columbus to Memphis is confirmed by comparing current load-to-truck ratios and rates against a 13-month history in DAT Rate View.

Prices Change Fast: Don’t Miss Out

When there is a lot of freight available at the destination city, load providers compete for trucks. That puts pressure on outbound rates. Savvy truckers catch on quickly — usually within hours or days — and demand the higher rate. Pretty soon, they’re getting $2.25 or $2.30 per mile for a round trip between Memphis and Columbus, instead of the annual average rate of $2.02.

We often hear carriers say: “Don’t tell me the rates. I know my rates.” If those guys were looking at RateView right now, however, they might see that the round-trip rate they know so well is costing them, big time.

Someone who “knows” the rates would be pretty happy averaging $2.10 per mile between Memphis and Columbus, but another trucker with RateView just negotiated for $2.25 or more. On a 1,200-mile round-trip, those missing pennies start to add up. Get the high rates while they are available, because the busy season doesn’t last forever.

Round-Trip Example: Memphis – Columbus – Memphis

We published this information in DAT Trendlines, for the week of June 8-14:

Memphis to Columbus, $2.54 per mile, 18¢ (compared to the week of June 1-7)

Columbus to Memphis, $2.05 per mile, 37¢

Round trip average: $2.30 per mile, 55¢ (Wow.)

In one week, the average round-trip rate soared to $2.30 from a middling $1.75 per mile, which barely covers the carrier’s costs.

If you’re a carrier with trucks in the Columbus or Memphis areas, you are either checking the load board right now, or you’re already punching a freight broker’s number into your phone. Hold on a sec. I just checked the rates again in DAT RateView, and here’s some new information:

Memphis to Columbus, $2.70 per mile, 16¢ more

Columbus to Memphis, $1.80 per mile, -25¢ (Ouch.)

Round trip average: $2.25 per mile, -5¢ compared to last week.

This is still a pretty darn good rate for a 1,200-mile round trip, but that excess freight in Columbus is already taken. It may come again, it may not.

Another Way to Make Money: Triangular Routes

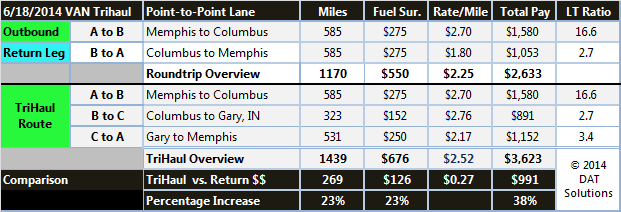

If you want to make a little more money, look for a back haul from Columbus a third location. This week, you might try Gary, IN. Then look for another load from Gary to Memphis. At DAT, we call this triangular route a TriHaul, and we offer suggestions and rate information in RateView so you can identify the best combinations to boost revenues, profits and equipment utilization.

If you are running the round-trip between Memphis and Columbus in two days, you won’t have time for any stops. However, if you are running this round-trip in three days, and you can make it work with the driver’s hours and your other business, give this a try.

Here is how you can make $931 more this week, by adding about 270 miles and an extra stop in Gary to a round trip between Memphis and Columbus:

TriHaul Example: Memphis – Columbus – Gary – Memphis

Triangular routes, or TriHauls, can boost revenues and profits. If you are able to position a truck and driver to take advantage of these opportunities, look in DAT RateView for suggestions on routes and rates.

Conclusion: 4 Ways to Make More Money With Better Information

1. When rates rise in both directions, you want to be there. Look for loads in those lanes.

2. Choose destinations using the load-to-truck ratio. Consult DATproducts for maps and charts that help you predict rate trends.

3. Prices change fast. Don’t miss out. Validate your pricing regularly, so you can negotiate the best rates when the market is hot.

4. Another way to make money: Triangular routes. It might even pay to deadhead a short distance.