I am usually an optimistic, “glass half-full” kind of guy, but it’s hard to ignore recent indicators that point to a contraction in Q4 freight and a slow economy overall.

There are always bright spots, of course. Individual markets are unusually robust, including Idaho, Maine and New Mexico. Not coincidentally, these three states are harvesting potatoes right now, so this increase in volume could be a short-term, seasonal phenomenon. Even if it is sustained, those markets don’t compensate for weak numbers from Atlanta, Chicago, Columbus, Dallas and other major freight hubs, including traditional manufacturing cities.

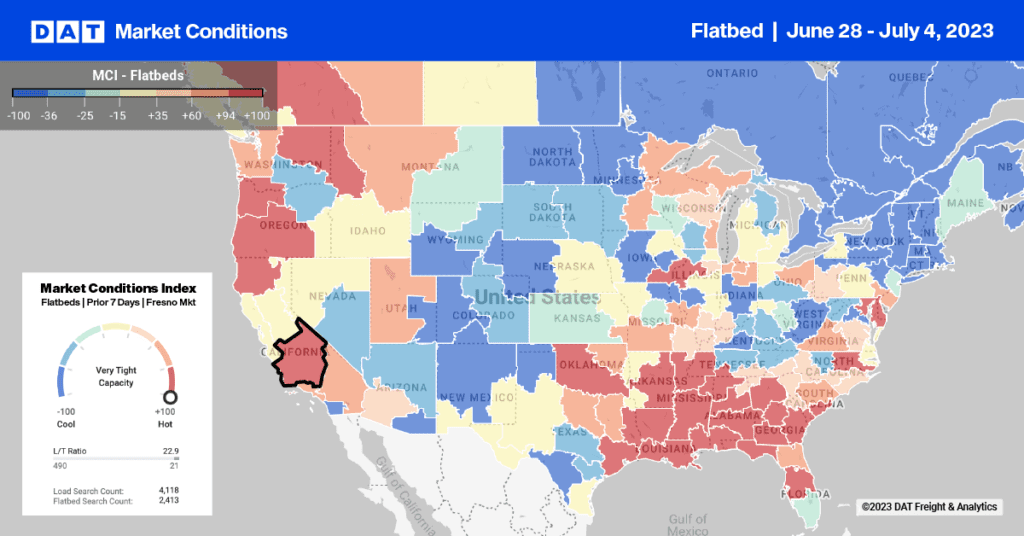

Two weeks ago, van freight was plentiful and load-to-truck ratios favored carriers in markets across the country, including (circled, from left to right) Central and Southern California, New Mexico, the upper Midwest and Western New York State. (Hot Market Maps are a feature of DAT Load Boards and DAT Truckload Rate Index.)

This week, the map shows reduced pressure in California, including the high-volume L.A. market. Albuquerque NM is still a hot market, but additional freight availability there does not compensate for the decline in California. The Upper Midwest still shows a relative capacity shortfall, but the freight volume does not meet seasonal expectations. Western New York is quiet, as the late September surge in the Buffalo market is not sustained two weeks into the new quarter.

A few more drops for the half-full glass: Freight brokers and shippers will enjoy available capacity in most markets. Spot market capacity increased 17% in September compared to the same month in 2011, and not only because of the reduced freight volume. For a long time, we have heard reports that trucks will soon be idled due to driver turnover and shortages, and soaring diesel prices added to pressure on small carriers. If and when the economy improves and freight comes roaring back, these factors are likely to force rates up, but that demand spike is not materializing just yet. Carriers are actively looking for freight right now, and their pricing is likely to be competitive.

The current trends can also benefit carriers who specialize in an equipment category, cargo type or geographic area where demand is high. Flatbed rates are sustained at last year’s level in October to-date, and reefer rates are up 3 cents. However, van rates are 5 cents lower now than they were in October 2011, as a national average.

Note: Reference rates are national averages for line haul in DAT Truckload Rate Index, and do not include fuel surcharges. Fuel is higher in 2012 than it was in 2011, for all equipment types.