The 2021 produce shipping season is underway, with both domestic and imported truckloads of produce posting 4% week-over-week gains. Still, the latest USDA data has truckloads of domestic produce down 42% year over year. Imported produce is up 8%.

“February had two holidays, Super Bowl and Valentine’s Day, where we typically see a significant part of the dollars go to foodservice,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “While restaurants are starting to reopen in many states, retail still saw an above-average boost, with many grocers offering meal solutions for Super Bowl entertaining and Valentine’s Day at home. Additionally, everyday demand continues to be elevated as the majority of the nation’s school-aged children remain in virtual or hybrid education and many people are still working from home.”

Fresh fruit and vegetables demand continues to improve and are now up 7.4% and 12.8% y/y respectively.

Looking down the road, reefer carriers can expect produce volumes to continue climbing based on a few factors. COVID-19 cases are coming down, with vaccinations increasing. We’re almost in Spring and produce growers are harvesting in the south. Pent-up demand for eating out is likely going to increase foodservice spending, with a relaxation of social gathering restrictions likely to accelerate.

Find reefer loads and trucks with the largest load board network in North America.

Most markets in this week’s top 10 reported gains last week. Los Angeles and Ontario, CA, volumes were up 6% and 7% respectively, although reefer capacity eased slightly. Spot rates dropped $0.07/mile to $2.96/mile (excluding fuel) on average out of Los Angeles and $0.01/mile to $3.06/mile from Ontario.

In Atlanta, outbound volumes dropped 4% with very little change in capacity. Rates stayed around the $2.71/mile mark.

In Dallas, capacity was much tighter last week, increasing rates by $0.06/mile to $2.44/mile for all outbound loads. In McAllen, TX where import volumes of produce from Mexico are up 8%, spot rates increased $0.11/mile to an average of $2.59/mile last week.

After increasing for the last few weeks, outbound capacity eased slightly in Chicago, where spot rates dropped $0.02/mile to $3.33/mile.

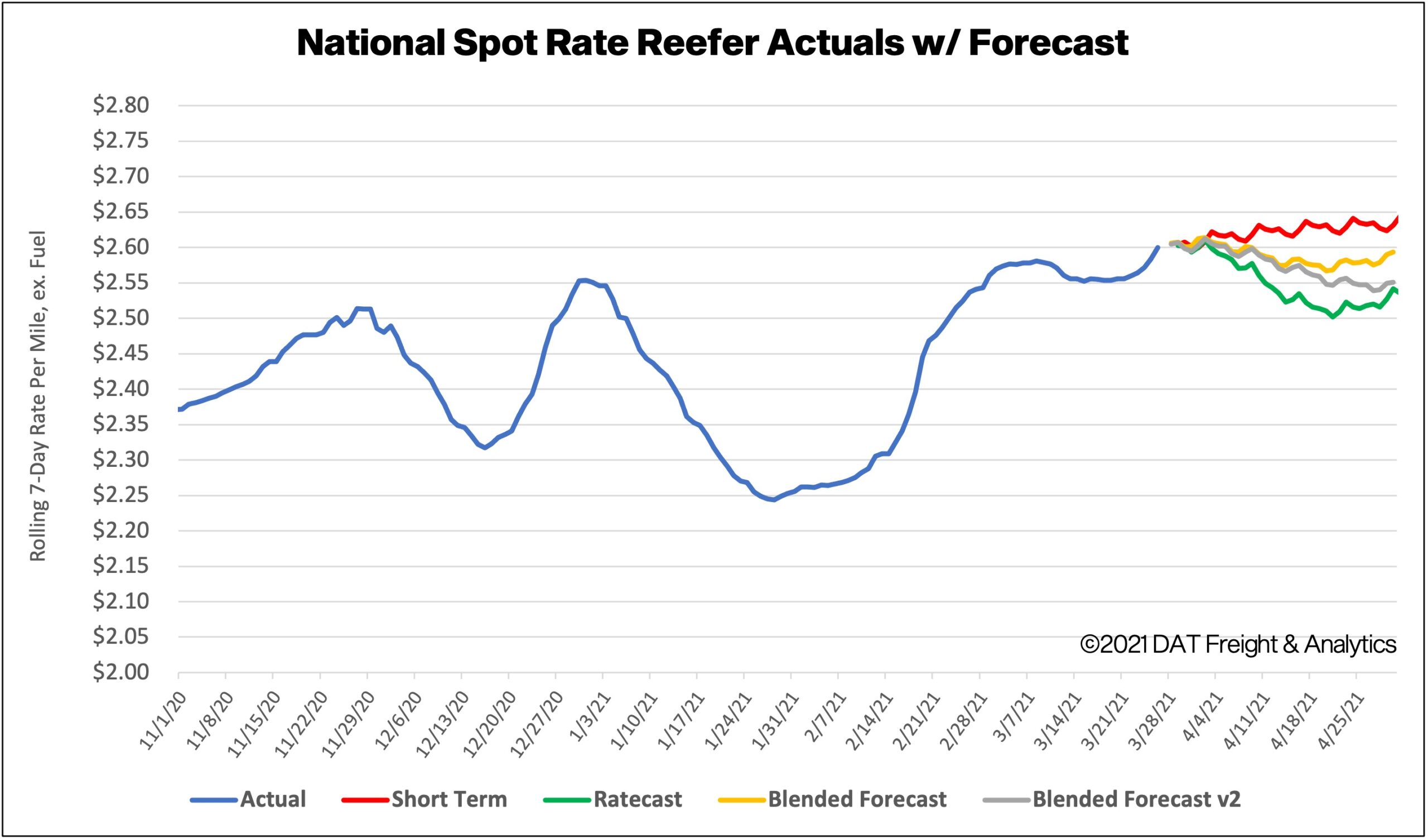

Spot rates forecast

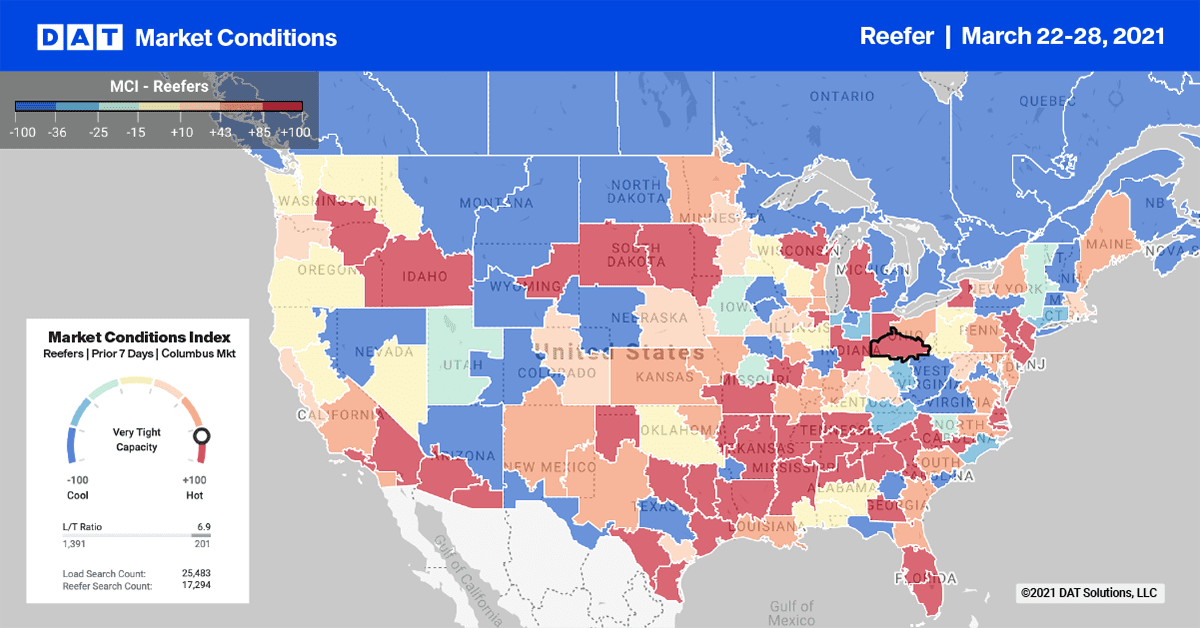

Despite being the end of month and quarter, there was only a slight increase in load and truck post volumes last week. Capacity remains generally tight, though, and as a result, spot rates inched higher, increasing $0.01/mile to end the week at $2.63/mile, excluding FSC.

Compared to the same week in 2020, reefer spot rates were $0.61/mile higher and remain at record high levels.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.