For carriers, brokers and shippers looking down the road to gauge consumer demand, the latest consumer confidence data from the Conference Board indicates consumers are feeling more optimistic about the economic recovery.

The Conference Board Consumer Confidence Index surged in March to its highest reading in 12 months. Consumers’ assessment of current business and labor market conditions in the Present Situation Index also increased. Consumers’ short-term outlook for income, business and labor market conditions also improved, with the Expectations Index climbing.

“Consumer Confidence increased to its highest level since the onset of the pandemic in March 2020,” according to Lynn Franco, Senior Director of Economic Indicators at the Conference Board. “Consumers’ assessment of current conditions and their short-term outlook improved significantly, an indication that economic growth is likely to strengthen further in the coming months. Consumers’ renewed optimism boosted their purchasing intentions for homes, autos and several big-ticket items. However, concerns of inflation in the short-term rose, most likely due to rising prices at the pump, and may temper spending intentions in the months ahead.”

Find loads and trucks on the largest load board network in North America.

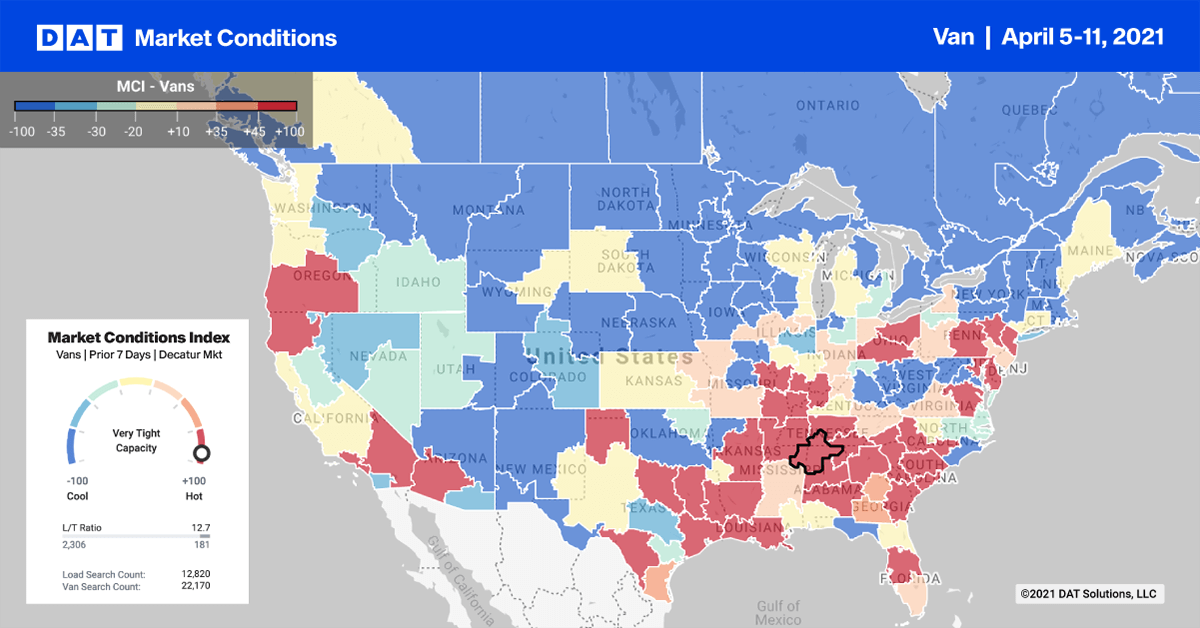

Load posts in the top dry van markets dropped last week in all but one. Harrisburg, PA, posted at 2% gain, although capacity loosened with spot rates dropping $0.05/mile to an average of $2.50/mile, excluding fuel.

Overall, load posts in the top 10 markets decreased by close to 7% last week, with spot rates staying flat at an average of $2.51/mile.

Like the last few weeks, capacity tightened again on the West Coast in Los Angeles and Ontario, CA, where load volumes dropped by an average of 12%. Rates increased by $0.04/mile to an average of $2.90/mile and $3.00/mile respectively.

There was a similar story in Texas where volumes in Houston and Dallas dropped by 3% while rates increased by $0.03/mile to $2.15/mile and $2.05/mile respectively (excluding fuel).

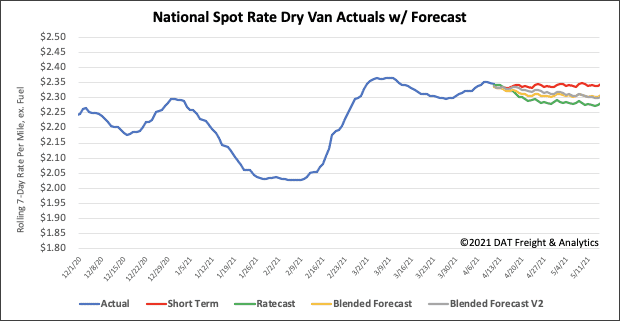

Spot rates forecast

Dry van spot rates reversed course last week, decreasing by $0.04/mile to end the week at $2.35/mile, (excluding fuel). However, spot rates are $0.82/mile higher than this time last year when the pandemic lockdown started. During the last capacity crunch in 2018, last week’s dry van spot rate was $0.48/mile higher.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.