As the price of lumber futures drops back below $1,000 per thousand board feet (down 42% since May), the building industry commenced construction of 1,098,000 new single-family homes in May. That’s another 44,000 more compared to April and 365,000 more than May of last year.

According to the Census Bureau, new home starts were up 4.17% in May and are now up 34% since last year despite building permits being down 1.57%. This could indicate a slow-down is on the way based on current supply chain disruptions and labor shortages in the building sector. Building permits lead new home starts by one to two months so they’re a useful indicator to gauge future flatbed demand for lumber and building materials.

The Southeast Region recorded a 2.78% increase in new single-family starts and accounted for 54% of total starts in May. Volumes increased 5.36% in the West Region (25% of volume) and by 16.55% in the Midwest Region although it only accounts for 15% of monthly production.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

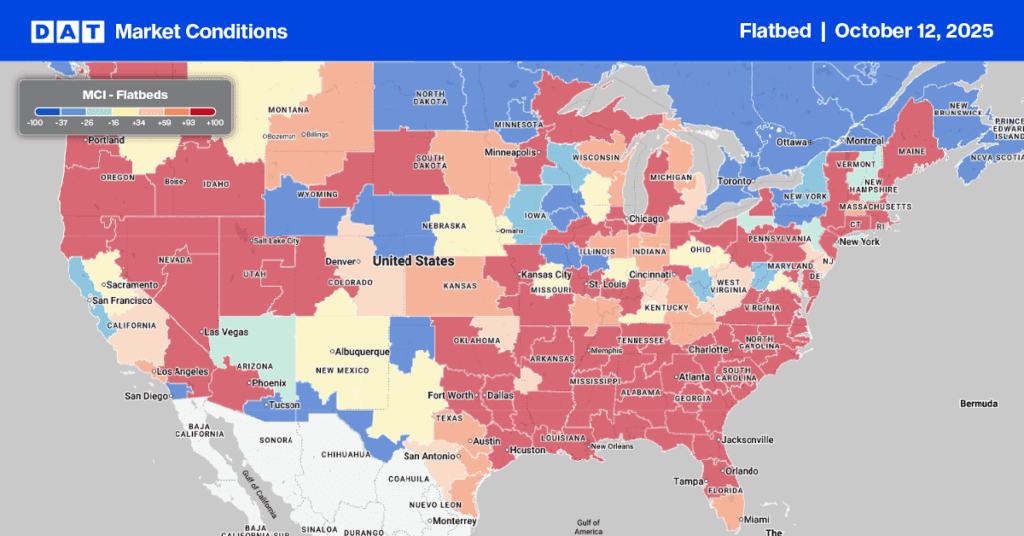

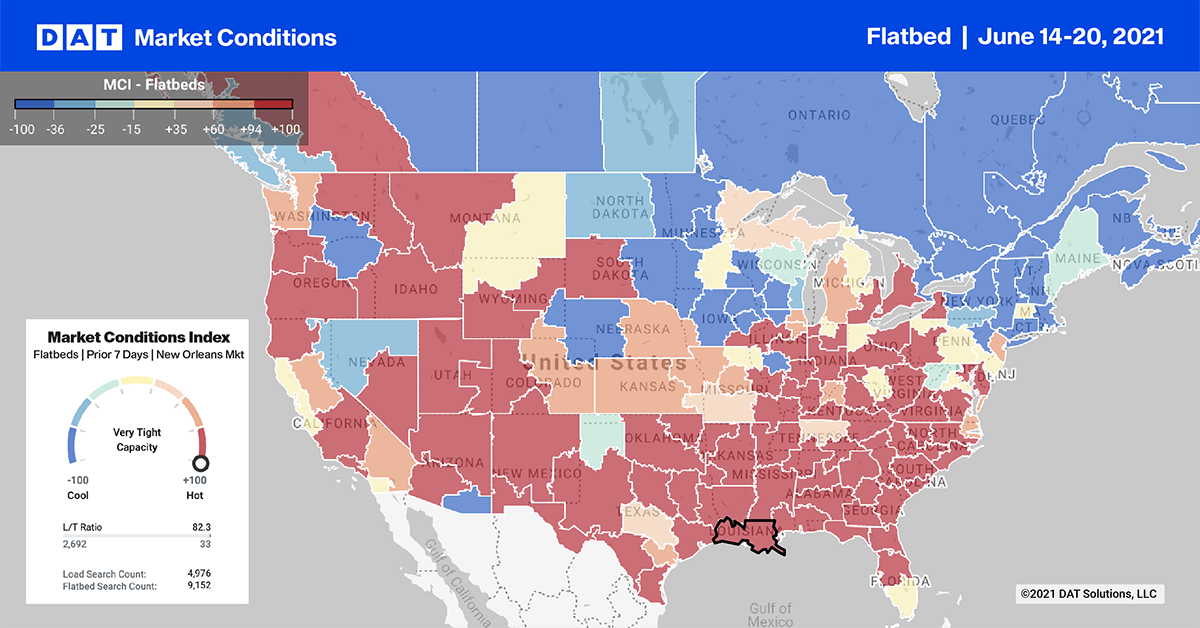

Flatbed volumes in the Top 10 markets eased again last week dropping by 13%. Clearly, a cooling market trend is emerging in this sector. Rates dropped on average by just $0.01/mile in the Top 10 markets but remain high at an average of $3.64/mile. Capacity was tight in Memphis, TN. Even though Memphis volumes were unchanged last week, spot rates increased by $0.06/mile to an average of $3.63/mile to all destinations.

Capacity was particularly tight in Savannah, GA and despite volumes decreasing by 22% last week, spot rates jumped $0.15/mile to an average of $3.67/mile.

Spot rates

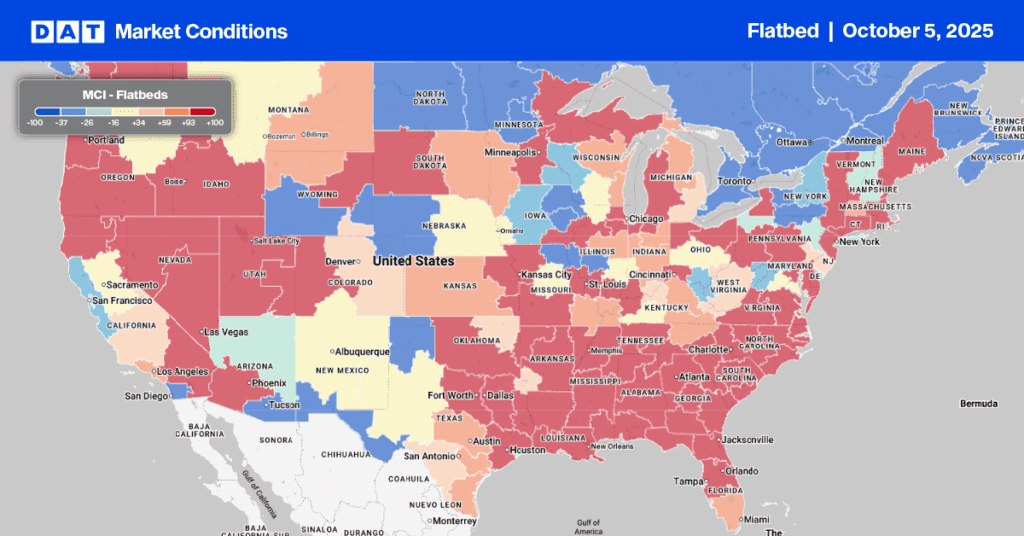

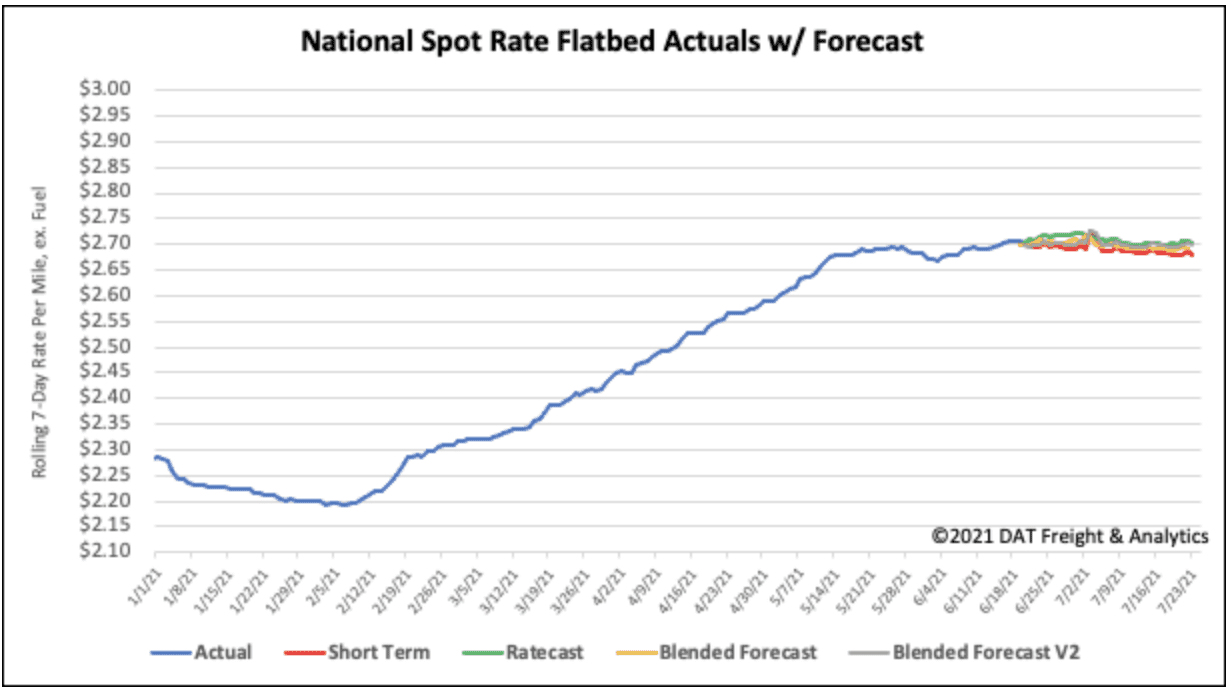

Flatbed spot rates continue to plateau staying around $2.70/mile. This is the fifth consecutive week where spot rates have been working in a tight $0.01/mile to $0.02/mile range. Volumes are clearly declining though and there’s a real sense this sector is cooling off after an amazing run over the last 12-months driven by demand in the residential building and construction industries.

Flatbed rates are still $0.81/mile higher than the same week last year and $0.24/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models