Gulf of Mexico hurricanes Ida and Larry have far-reaching effects, dumping tons of rain on Prince Edwards Island’s potato crop, located 2,000 miles away. Prince Edward Island is the largest potato-producing province in Canada and grows one-quarter of the potatoes in the country.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Recent rain has waterlogged the fields, making it difficult for farmers to begin this season’s harvest. Prince Edward Island’s shipping season typically begins in late July, with early or “new” potatoes hitting the market in Atlantic Canada. The main crop follows, which is harvested starting in September.

Prince Edward Island potatoes are grown for three specific markets:

- Table potatoes, sold to retail and food service sectors (30% of potatoes)

- Processing potatoes, manufactured into French fries, potato chips, and many other products (60%)

- Seed potatoes, grown with high-quality and health standards to yield future commercial potato crops (10%)

Combined with lobster season, which has also just begun in the Canadian Maritimes, we’re now seeing a constant flow of reefers up and down the I-95 freight corridor. They’re loaded with seafood, potatoes and french fries and deliver loads within 24-hours of harvest and/or processing to major markets including Boston, Chicago and New York.

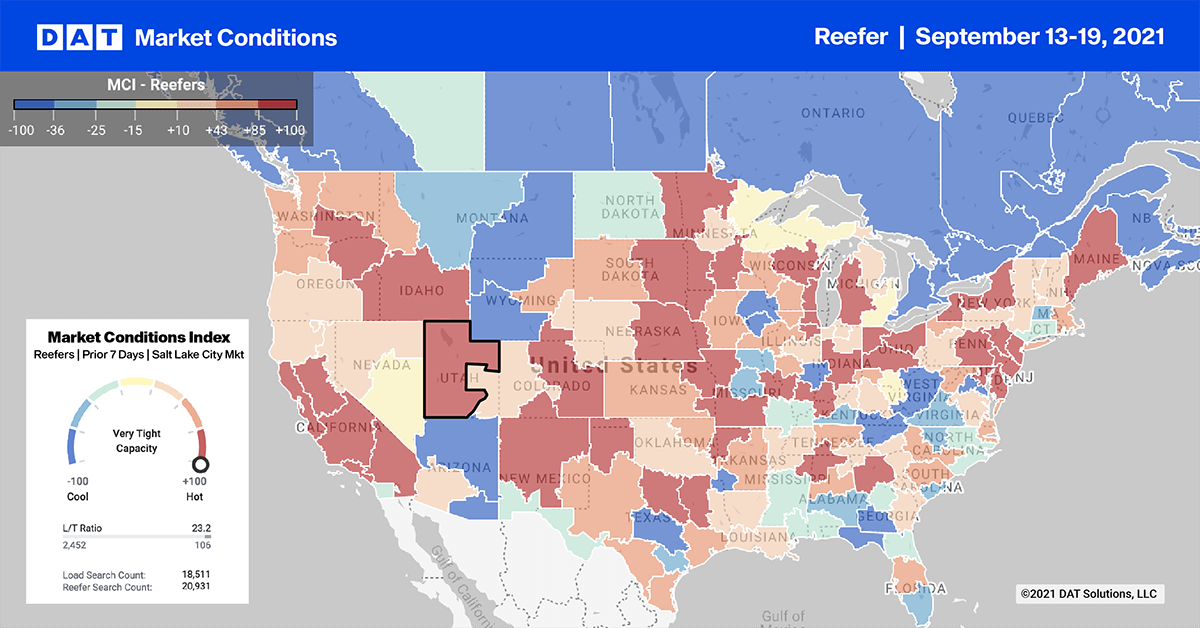

Higher import volumes across the southern border and the beginning of fall season produce helped keep reefer spot rates elevated last week as capacity remains very tight nationally. We’re starting to see significant shipping volumes in fall produce this week, including:

- Broccoli from northern Maine

- Apples from Washington State (where truckloads are now averaging 1,775 loads per week)

- Potatoes from Idaho and Minnesota

In Minneapolis, spot volumes are up 27%, and the reefer rates market increased by $0.28/mile to an average of $3.42/mile.

The major growing region in Rock Island, IL saw upticks in the freight industry:

- Shipping volumes are up 13%

- Spot rates increased by $0.42/mile last week to an average of $3.86/mile

- Reefer loads from Rock Island to Hunts Point, NY hit a new 12-month high at $4.27/mile

- Loads west to Denver increased by $0.23/mile last week to an average of $4.03/mile

In California the best loading opportunities are in the Salinas Valley where iceberg and romaine lettuce are producing around 1,875 truckloads weekly.

Year round strawberry production accounts for about 785 truckloads per week, followed by cantaloupe and grapes in the San Joaquin Valley at approximately 2,650 combined truckloads per week.

Reefer rates out of Fresno were higher than usual:

- Seattle remained high at $4.40/mile

- Hunts Point, NY increased $0.19/mile to an average of $3.30/mile

- Atlanta increased $0.05/mile to an average of $3.30/mile

Spot rates

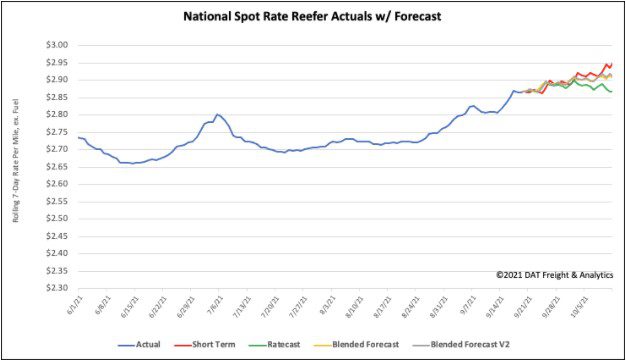

As temperatures cool, the reefer spot market continues to heat up as spot rates increase by another $0.02/mile last week. Reefer spot rates averaged $2.87/mile last week also, which is $0.52/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 20 lanes (compared to 37 the week prior)

- Remained neutral on 31 lanes (compared to 22)

- Decreased on 19 lanes (compared to 11)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models