According to Curt Blades, senior vice president of agriculture services at the Association of Equipment Manufacturers (AEM), farm machinery sales reflected farmers’ optimism last month:

“We are pleasantly surprised by the return to growth for small units in both the U.S. and Canada, and by a healthy rate. In addition to the continued growth of the big row-crop units, I think the interesting story is harvesters, up nearly 20 to 30% in their respective markets. Farmers investing in more of these big machines is another indicator of that farmer optimism we’ve been seeing.”

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

According to the AEM August United States Ag Tractor and Combine Report, total farm tractor sales:

- Climbed nearly 10% from August 2020

- Are up 13% year to date

- Are running 25% above the five-year average

Other categories also saw increased sales since last year:

- Sales of 2WD machines with less than 40 horsepower jumped 8.7%

- The 40 to 100 horsepower 2WD tractor category increased by 5.4%

- The 2WD 100+ horsepower tractor category increased by 37.8%

- The 4WD tractor category increased by 40.4%

- Self-propelled combines were up 19.8%

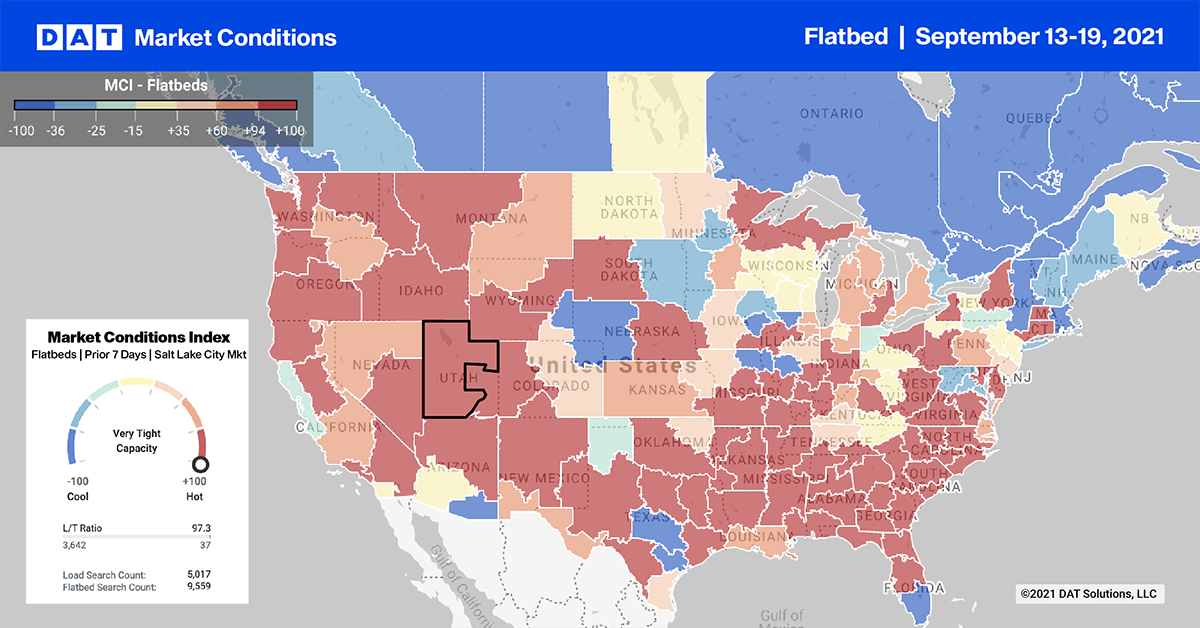

Inbound load volumes into the flood-ravaged Gulf Coast region eased slightly last week dropping by 2% following the week prior’s 31% inbound volume increase.

The New Orleans market appeared to get back to normal shipping volumes after two slow weeks. Load post volumes surged 78%. Fortunately, the available flatbed capacity allowed spot rates to stabilize and drop by $1.47/mile to $3.08/mile. (Spot rates peaked at $4.55/mile in the second week after Hurricane Ida made landfall).

Capacity is still tight out west in Reno, NV where spot rates jumped $0.20/mile last week to an average of $3.12/mile following a 15% increase in load post volume:

- Loads from Reno to Seattle increased by $0.08/mile to an average of $3.73/mile

- Loads on the 1,000-mile haul to Denver hit a new 12-month high of $3.32/mile

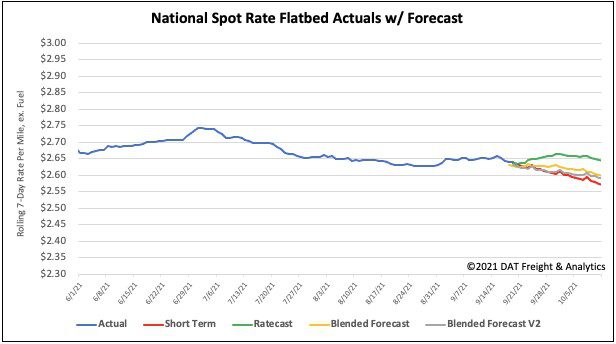

Spot rates

Rate movement in the flatbed sector has been fairly consistent over the last few months, moving a penny per mile one week and down by the same margin the next. Following the gain from the week prior, flatbed rates decreased by $0.01/mile last week to a national average of $2.64/mile.

Spot rates are now $0.46/mile higher than the same week last year. Compared to the same time in 2018, flatbed spot rates are $0.49/mile higher.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models