In addition to being a short work week, it was also the busiest week on the Christmas tree shipping calendar. Retailers looked to position inventory as shoppers began the holiday buying process.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Reefer spot rates in the Pacific Northwest, where the most softwood pines are harvested, peaked at $3.37/mile last week, which is up $0.35/mile over the last four weeks. Loads from Seattle to San Francisco averaged $2.64/mile last week, which is more than $1.00/mile higher than the same week last year.

Ahead of last weekend’s festivities in Las Vegas, reefer spot rates from Los Angeles hit a new 12-month high of $6.11/mile. That’s $1.00/mile higher than the same time last year.

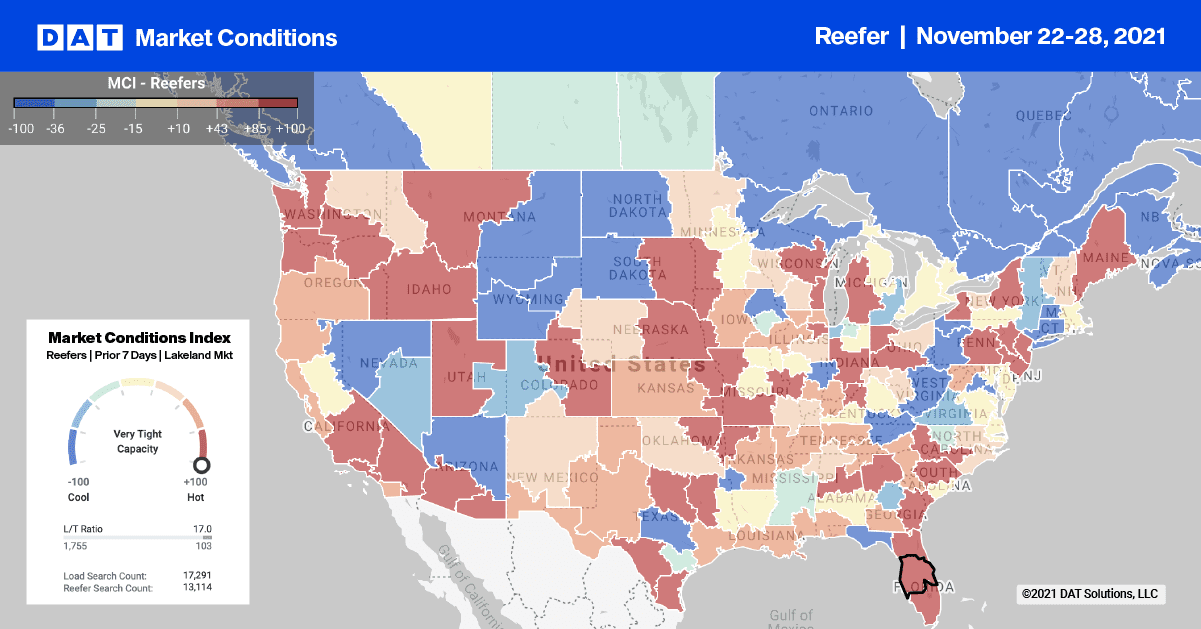

In the other main holiday destination in Orlando, FL, spot rates from Atlanta to Orlando held steady at $4.18/mile last week. That’s up $0.74/mile compared to the same week last year. Reefer capacity was also tight in Florida as winter vegetables continue to ship in increasing volumes. Spot rates were up $0.14/mile last week to an average outbound rate of $1.72/mile.

Spot rates

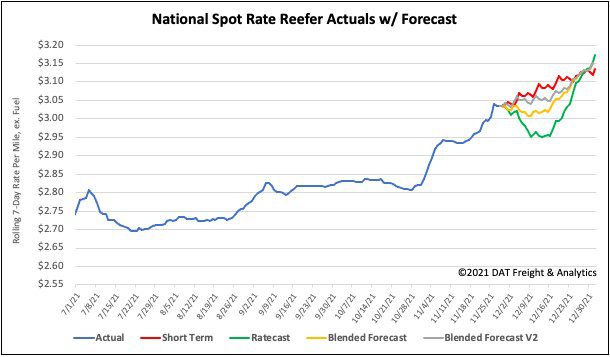

Reefer equipment posts dropped by 30% last week compared to just 19% in Thanksgiving week in 2020. This resulted in tighter capacity during an unprecedented shipping season characterized by very high demand. The reefer spot rate ended last week up $0.04/mile to a national average of $3.04/mile, which is 16% or $0.47/mile higher than this time last year.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models