According to IHS Markit PIERS, the Port of Baltimore held onto the number one position for RoRo (roll-on/roll-off) total import cargo tons in November (with 39% of total volume). This category includes automobiles, cranes, trucks, agricultural and construction machinery.

The Port of New York and New Jersey accounted for almost as much at 38% of total tons imported last month. Both port volumes have been steadily declining since the seasonal peak in import tons in March this year and are down 42% and 33% since the start of the year respectively.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Overall retail sales of agricultural tractors in the U.S. were doing well in October, which were up 4.8% compared to this time last year and 11.4% since the start of the year. Most of the gains this year have been in the 40 to 100 HP farm tractor category (most suited to flatbed and drop decks). However, compared to last year, retail sales of the heavier four-wheel drive farm tractor were down 6.3% in October.

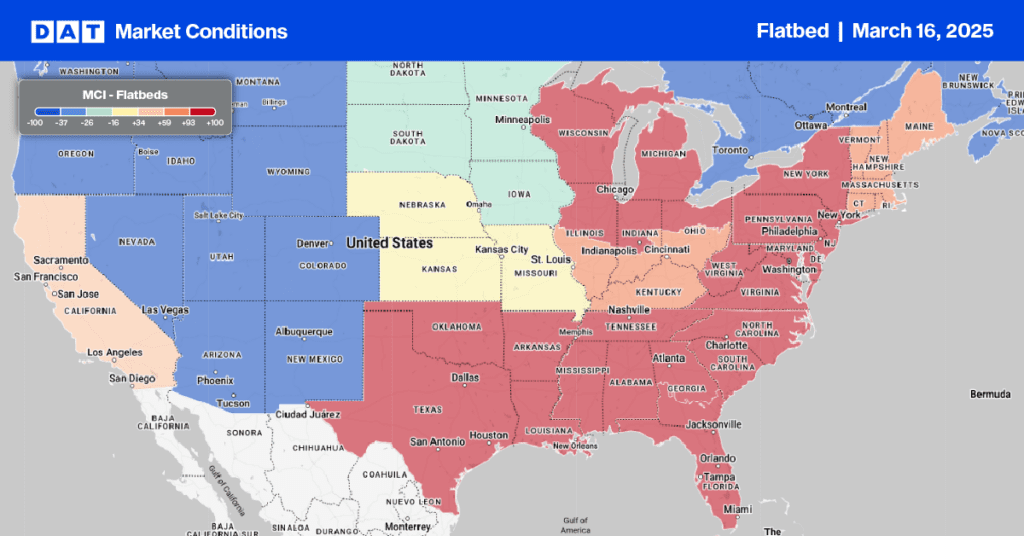

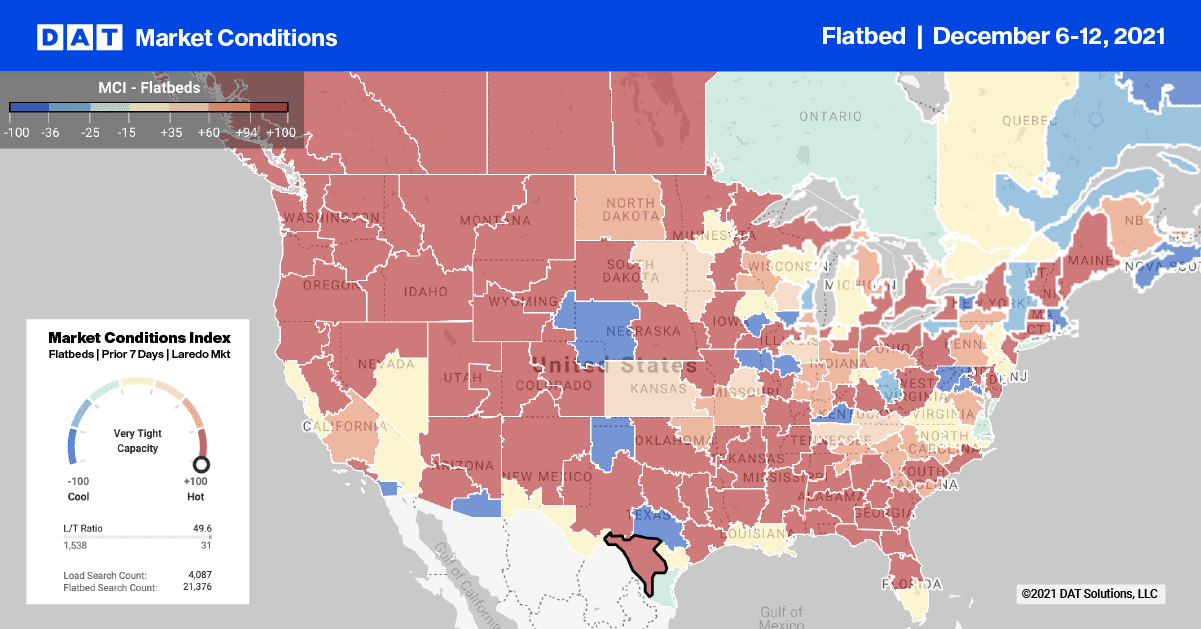

Flatbed loads are now down 13% in the last four weeks despite the late season surge in flatbed activity due to unseasonably warm weather.

While flatbed spot rates normally dip this time of the year, Medford, OR saw a surge. Demand for Christmas trees has driven spot rates up by $0.32/mile in the last week to an average outbound rate of $3.48/mile. Loads on the 700-mile haul from Medford to Los Angeles averaged $3.46/mile last week, up almost $1.00/mile since the start of October. Loads to Stockton are paying higher at $3.72/mile. Just north of Medford in Portland, average spot rates were up $0.06/mile last week to an average of $2.95/mile.

Spot rates

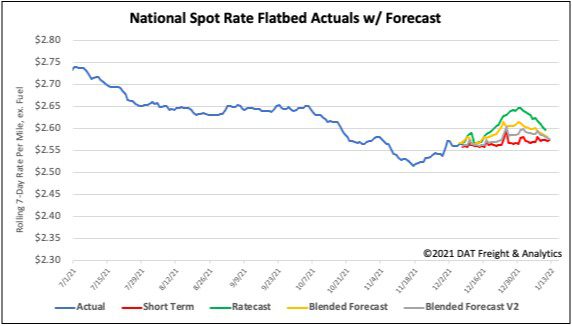

Even though there are higher volumes of freight in the flatbed spot market at the moment, available capacity eased slightly. Spot rates dropped by $0.01/mile to a national average of $2.56/mile last week. Compared to this time last year flatbed spot rates are still $0.36/mile higher and $0.52/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models