The National Retail Federation, the world’s largest retail trade association, released their first Economic Review of 2022. This follows their recent prediction that retail sales in the last two months of 2021 were on track to grow as much as 11.5% over the same period in 2020.

The NRF expects the COVID-19 omicron variant will bring uncertainty to the economy in 2022 and could contribute to inflation, but is unlikely to cause widespread shutdowns or slowdowns according to NRF Chief Economist Jack Kleinhenz.

“Even with the experience of the past two years, there is no model that can predict how the economy responds to a pandemic, but what we have learned is that each successive variant has slowed down the economy but that the degree of slowdown has been less,” he said.

What follows the end-of-year retail shopping sales season is “return season.” Unlike in other years, it’s expected to increase to a total of $120 billion in goods returned between Thanksgiving and the end of January 2022.

To put that into perspective, returned goods could be as much as 9% of the total value of goods purchased during the recent holiday season, or the equivalent of approximately 400,000 truckloads of freight looking for a new home. Assuming $12,000 per ton of retail sales and 25 tons per load, truckload carriers could have hauled an additional 620,000 truckloads of retail freight in the last two months compared to the same period in 2020.

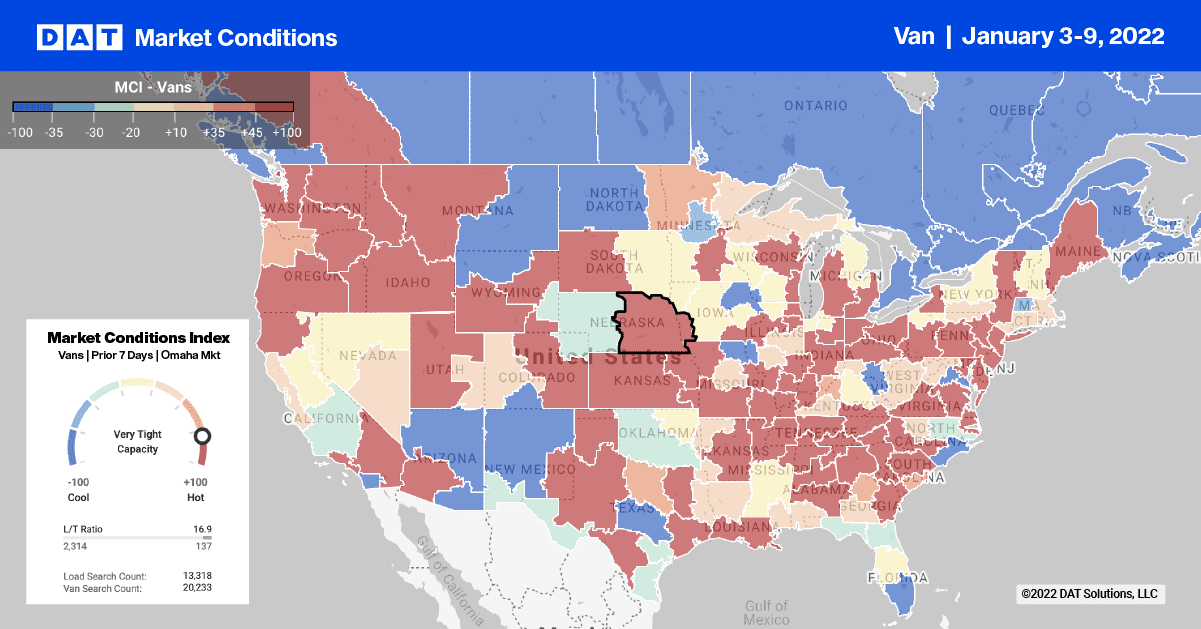

That might not sound like a lot in an industry that moves around 250 million truckloads annually, but in a market where capacity is as tight as it’s been in decades, it’s significant and has contributed to the record-high spot market volumes the DAT freight network is currently recording.

Rates reported below do not include fuel surcharges

The first full shipping week of 2022 coincided with some extreme weather events including heavy snow and ice in Virginia, Washington state and New England. Road closures ground traffic to a halt, with many travelers and truckers totally unprepared for winter driving.

In Virginia, the I-95 was closed for around 24-hours over a 50-mile stretch from Fredericksburg to Richmond. In the Pacific Northwest, I-90 over the Snoqualmie Pass was closed for 3-days. Despite what many expected in the Northeast, Winter Storm Garrett dumped a foot of snow along the I-95 corridor, but due to the light and fluffy snow composition, roads remained open with minimal delays reported.

Weather’s impact on freight markets was most evident in Virginia. Although it’s a smaller freight market, the state is part of the entire I-95 freight corridor, which is made up of 17 contiguous states, accounts for 21% of the nation’s road miles and contains around 40% of the U.S. population. Last week’s closure resulted in dry van spot rates surging by $0.30/mile to an average outbound rate of $3.31/mile after being relatively flat since mid-December.

With very few highways in and out of Washington State, the extended I-90 closure resulted in capacity tightening in surrounding markets, including Twin Falls, ID; Spokane, WA; and Salt Lake City. Dry van rates in these three states jumped by $0.10/mile to an average of $2.77/mile, with the same result in the reefer sector.

Truckload capacity for dry vans was particularly tight last week for outbound loads in Twin Falls – dry van rates increased by $0.36/mile to $3.14/mile. Spot rates for dry van loads from Twin Falls to Stockton, CA, increased by almost $2.00/mile over the December average to $4.60/mile last week. Loads from Seattle to Stockton were paying $2.58/mile, which is not only the highest rate in the last 12-months but is just over $1.00/mile higher than the same time last year.

Load-to-Truck Ratio

The volume of freight moving in the spot market surged last week, as shippers got back to business for the first full shipping week of 2022. Load posts on the DAT Load Board are currently 80% higher compared to the same time last year and even 3% higher than the week after the 2021 Polar Vortex weather event.

In contrast, the number of carriers posting their equipment last week was 4% lower y/y and on par with the week of the Polar Vortex, as freezing cold temperatures shut down freight networks. As a result, the dry van load-to-truck ratio almost quadrupled last week, increasing from 3.03 to 11.97.

Spot Rates

Overall dry van capacity eased last week despite a 19% w/w increase in loads moved on the DAT freight network. Dry van spot rates decreased by $0.04/mile last week to a national average of $2.74/mile. The national average spot rate is currently $0.50/mile higher than the same week last year.