The global supply chain crisis seems to be impacting the food industry more than most, judging by what carriers are experiencing recently.

Just before Christmas, McDonald’s reported a shortage of French fries in Japan due to delays in getting product from the Pacific Northwest. Recent flooding in British Columbia and port congestion due to surging imports from Asia are impacting import volumes of potatoes, forcing the fast-food chain to resort to three 747 jumbo air cargo freighters to deliver much-needed inventory.

Supply chain disruptions in the temperature-controlled market extend across the country, including the current USDA ban on imports of potatoes from Prince Edward Island and labor shortages at food processing plants. Just last week a long-haul carrier in Maine waited 13-hours to unload his inbound load at a potato processing plant before the shipper could start loading the outbound load of frozen French Fries.

The shipper told the driver that the load was urgent. He couldn’t cancel and just had to wait. Twenty-seven hours later, the driver pulled off the dock.

Another trucker reported 27-hours at a grocery chain loading dock in Pennsylvania just before Christmas and although both drivers and carriers were paid detention, removing truck capacity from the roads due to lengthy delays is contributing to the tight capacity phase of the current freight market.

A driver in a recent OOIDA Detention Survey summed up the food shipping industry best: “I drive freight for a respectable commodity sector that always adheres to their appointment times. Occasionally, I will look for filler loads, but when I do, I never consider hauling anything grocery-related because the wait time could be 8 hours or more…and when detention time is paid, it isn’t up to par with other types of loads.”

Another detention survey conducted by ATRI found drivers who operate reefer trailers experience delays of four or more hours 37% of the time compared to just 19% for dry van drivers.

Rates reported below do not include fuel surcharges

In addition to tight dry van capacity in Twin Falls, ID, last week, reefer capacity was also very tight for outbound loads – reefer rates jumped $0.18/mile to $3.85/mile. Spot rates for loads from Twin Falls to Stockton, CA, increased by almost $0.80/mile over the December average to $4.44/mile last week. Loads heading east to Chicago also hit a 12-month high of $3.68/mile.

In the Southeast, reefer capacity tightened last week following a $0.40/mile increase in outbound spot rates with the Tifton, GA< short-haul market reporting a $0.90/mile w/w increase to $3.43/mile. Loads to nearby Atlanta were up just over $0.60/mile last week to an average of $5.80/mile, while export loads to Savannah, GA, 180-miles to the east hit a new 12-month high of $7.36/mile – more than double the spot rate just 12-months earlier.

Load to Truck Ratio (LTR)

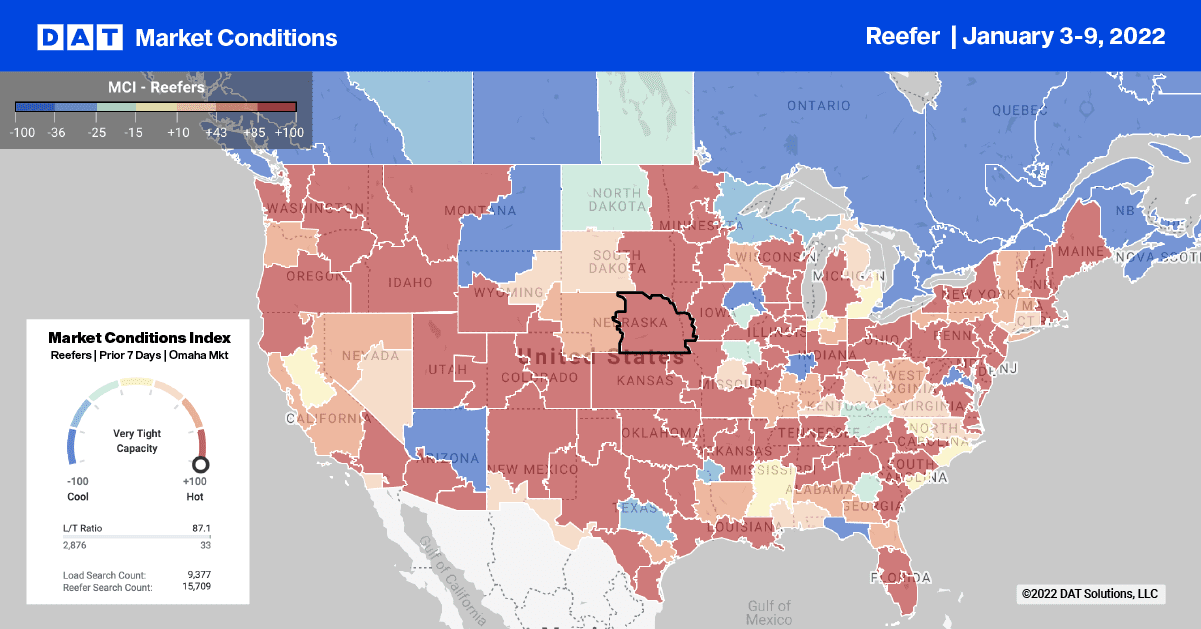

Load posts surged to end last week more than double the same time last year and even 23% higher than the week after the 2021 Polar Vortex extreme weather event. Carrier equipment posts ended last week 18% lower y/y but were also 3% lower than the week of the Polar Vortex last year when carriers were shut down across the Midwest. As a result, the reefer load-to-truck ratio more than tripled last week, increasing from 10.16 to 32.58.

Spot Rates

The $0.07/mile drop in reefer spot rates last week erased the gains of the prior week, with the national average reefer rate sitting just over $3.15/mile. The national average reefer spot rate is $0.70/mile higher than the same period last year.