Higher average temperatures in December across much of the U.S. gave way quickly to freezing cold, heavy snow and winter storms over the New Year’s break. Flatbed carriers who benefited from higher load volumes via a longer building and construction season in December are now seeing flatbed demand return to normal seasonal levels.

The colder weather is not only impacting major construction as both ambient and soil temperatures plummet, but it also typically slows down timber mill production as partially frozen saw logs require more time for processing. The building industry will face even stronger headwinds in 2022 following the Commerce Department’s recent decision to double tariffs on softwood lumber products from Canada (from 8.99% to 17.9%). According to Fastmarkets, around 25% of lumber consumed in the U.S. comes from Canada alone.

The volume of loads moved on flatbeds in the DAT freight network have only dropped by 3% during the month of December but have dropped by 7% since temperatures dropped and road condition deteriorated in the last 10 days.

Rates reported below do not include fuel surcharges

Flatbed capacity was very tight in the Laredo, TX, market last week, with spot rates jumping $0.20/mile to an average of $2.57/mile following a 34% w/w increase in load post volumes. Loads to the state capital in Austin hit a new 12-month high of $3.50/mile, while loads east to Houston ended the week up $0.15/mile to $2.61/mile. Flatbed capacity was also tight in the Lubbock oilfield market, where the average outbound spot rate jumped $0.30/mile to $2.69/mile last week.

On the West Coast in Los Angeles, flatbed capacity tightened, pushing up spot rates by $0.07/mile last week to $3.25/mile. Loads northeast to Las Vegas increased by $0.13/mile to $3.86/mile – the highest spot rates have been on this lane since October.

Not surprisingly, flatbed capacity was almost non-existent in Virginia as cold weather closed I-95 during last week’s deep freeze. As a result, the average outbound flatbed spot rate peaked at $5.40/mile. Farther south in Jacksonville, FL, loads to New Orleans were up $0.20/mile to $2.39/mile. In New Orleans, the average outbound rate was up $0.04/mile to $2.76/mile last week following a 52% m/m increase in import container volumes.

Load-to-Truck Ratio (LTR)

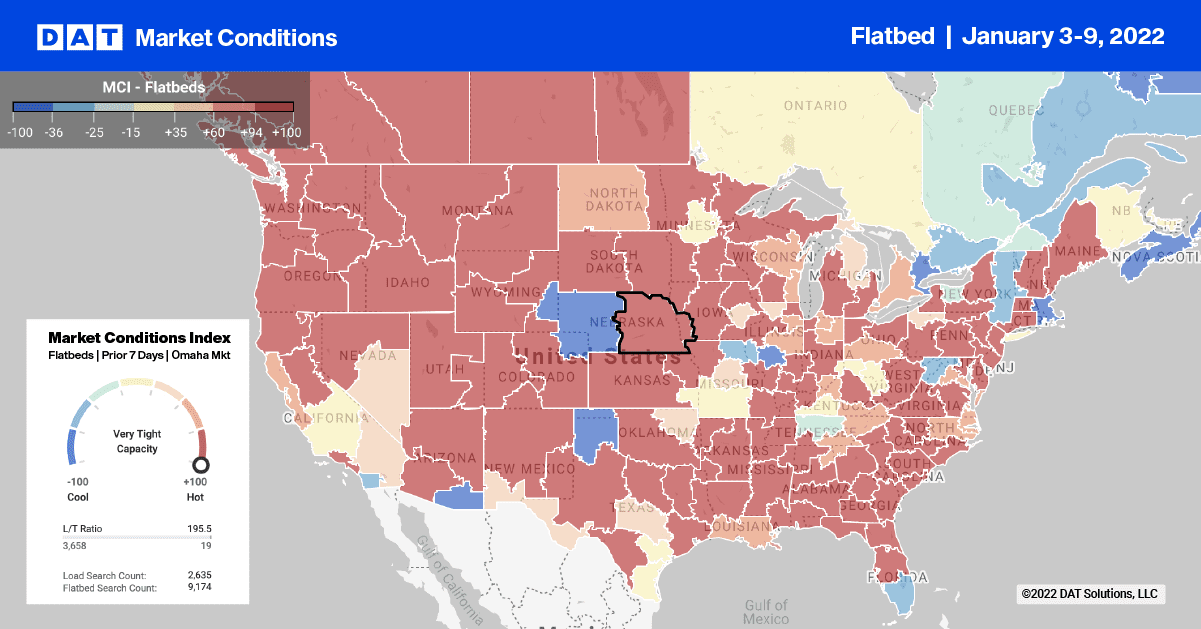

Flatbed load posts are currently running around 66% higher compared to the same time last year and even 3% higher than the week after the Polar Vortex extreme weather event last year. Carrier equipment posts are slightly lower than Week 2 in 2021, and as a result, the flatbed load-to-truck ratio decreased slightly from 88.60 to 86.95 last week.

Spot Rates

After remaining flat for the prior two weeks, last week’s flatbed spot rate decreased by $0.03/mile to $2.64/mile. The national average is currently $0.42/mile higher compared to the same period last year and an amazing $0.61/mile higher than the same week in 2018 when the flatbed spot rate rally was just getting started.