According to the OEMs manufacturing autonomous trucks (AT), trucks without drivers can’t arrive soon enough, with the recent trucker vaccine mandate protests simply throwing more fuel on the fire. Removing drivers from trucks is a contentious subject in the trucking community, especially when drivers are losing their jobs and/or careers.

Proponents claim autonomous trucks will operate 24/7 without prescriptive hours-of-service regulations limiting utilization levels can move freight from clogged ports to store shelves reducing delivery costs and carbon emissions along the way. OEMs have touted fuel savings of 10-13% and in one study, AT trucks were 10% more fuel-efficient than the same model of truck driven by a human driver, according to the OEM TuSimple. Another study by Georgia Tech found that Ryder Systems’ new autonomous transfer hub networks, which combine ATs on highways with conventional trucking operations for the first and last miles, can reduce costs by 29% to 40% for an extensive freight network.

Recently the world’s first fully autonomous semi-truck trip was completed in Arizona by TuSimple on open public roads without a driver in the vehicle and human intervention. Since then, they have conducted six additional “Driver Out” trips, according to the OOIDA Foundation. While impressive, the technology appears to be far from ready. TuSimple claims their ATs will be commercially available by the end of next year despite all the hype around the recent road trips, which had lots of added safety measures protecting the vehicle and outcome in what can be best described as a controlled environment.

According to TuSimple, they had traversed the route thousands of times to collect enough data before they were ready for the first autonomous run. A survey vehicle was utilized “to look for anomalies” 5 miles ahead of the driverless truck on the big day. In addition, “An oversight vehicle capable of putting the autonomous truck in a minimal risk condition” was close behind along with law enforcement about half a mile behind the truck for extra safety measures.

On the regulatory front NHTSA (National Highway Traffic Safety Administration) estimates that on average, 3,400 crashes involving Level 2 autonomous vehicles will occur each year, in addition to 200 crashes involving Level 3-5 autonomous vehicles. NHTSA is currently seeking approval from the Office of Management and Budget (OMB) for a 3-year extension to the information collection period, which requires certain manufacturers of motor vehicles and equipment and operators of motor vehicles to submit incident reports for certain crashes involving ATs. Despite all the hype, it’s clear AT technology is progressing rapidly, but we’re still quite a few years away from mainstream adoption and a meaningful impact on long-haul dry van capacity.

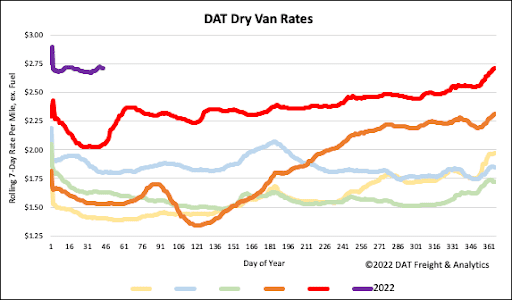

Congestion or lack thereof in port markets is something we’ve been tracking for 18-months, and for carriers and brokers, there’s been a direct correlation between import container volumes, load post volumes, and spot rates. In Los Angeles, where vessel congestion appears to be easing and import volumes dropping, spot rates have also dropped by around $0.30/mile in the last month – now averaging just over $3.00/mile excl. FSC. On the high-volume lane from Los Angeles to Chicago, spot rates have cooled considerably – after reaching a high of $3.29/mile in December, they’ve dropped by $0.42/mile to $2.87/mile excl. FSC this week.

On the 372-mile lane from Los Angeles east to Phoenix, an enormous warehouse market ideally suited for imports from Asia, spot rates dropped back to an average of $4.36/mile excl FSC this week. That’s a decrease of $0.45/mile since the high of $4.81/mile excl. FSC was recorded in December last year. On the East Coast, capacity continues to tighten in Elizabeth, NJ, the second largest port market in the country. Spot rates for loads to Atlanta hit a new 12-month high last week at $2.86/mile excl. FSC – that’s $0.92/mile higher than this time last year.

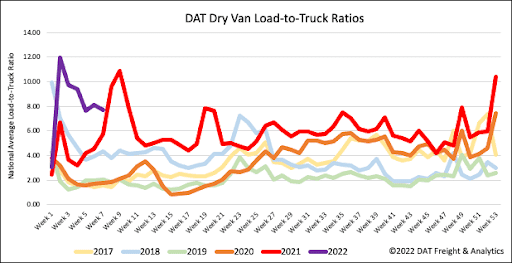

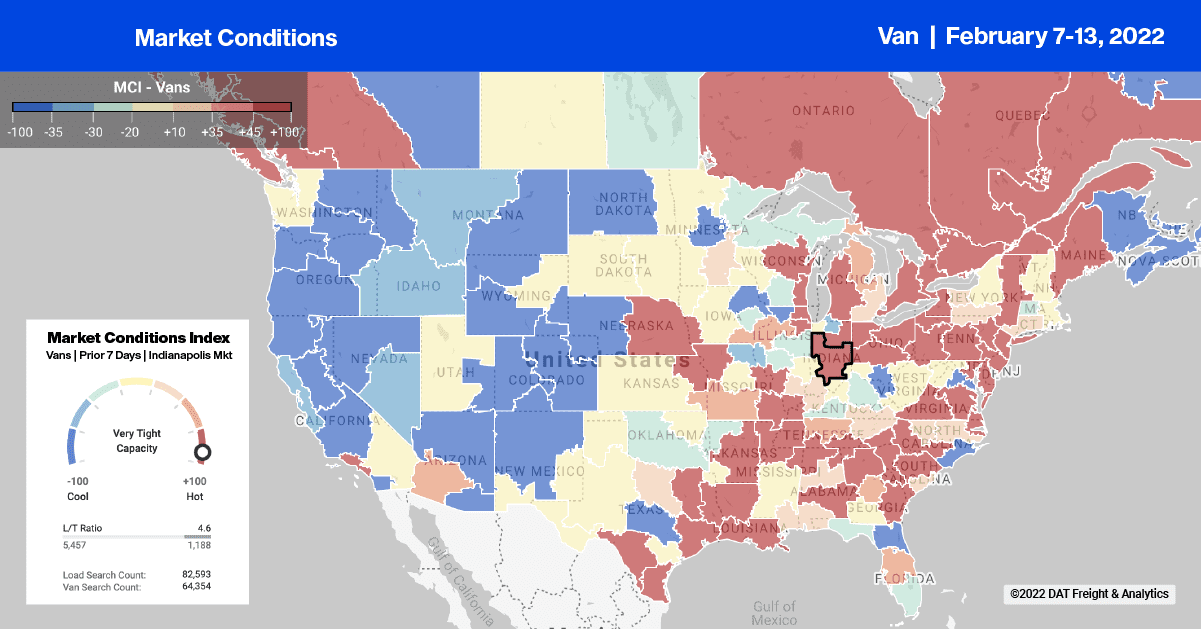

Dry van load post volumes increased by 2% w/w making it three weeks of successive gains. Volumes are still down 14% m/m, and along with a 7% w/w increase in carrier equipment posts, last week’s dry van load-to-truck ratio decreased by 4% w/w 8.08 to 7.77.

Spot rates in the dry van sector have only decreased by $0.06/mile in the last month – last year, they dropped by $0.33/mile in the first six weeks of 2021. Last week’s spot rates decreased another penny per mile to a national average of $2.71/mile excl. FSC. To put these extraordinary numbers into perspective, last week’s average spot rate was 32% higher than this time last year and around $1.00/mile higher than 2018 as that year’s rate rally was just getting started.