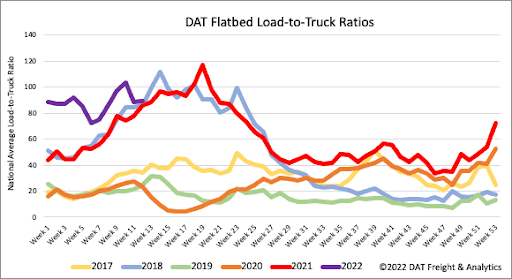

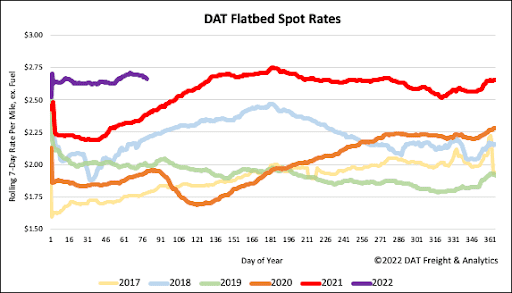

This year is shaping up as another strong one in the flatbed sector, and although the similarities to the last flatbed bull market in 2018 are striking, inflation has put a dent in carrier profit margins this year.

Now’s a great time to look at what makes a successful flatbed carrier, so DAT Freight & Analytics spoke to veteran owner-operator and flatbed carrier Bob McMillan for his top 10 tips. Bob has covered six million miles in his successful career and spent close to $14 million on fuel, tires, finance, and other operating costs. Here’s his best advice for aspiring owner-operator and small fleet owners:

- Choose carefully when buying a truck — you don’t need the biggest, flashiest truck to make a good living.

- Set realistic goals. Know what ambitions you have — to be an independent owner-operator and make a good living or grow your business and become a fleet owner—either way, you need to build a solid base financially to start with.

- Choose your partners (shippers, other carriers, and brokers) and lanes you want to run carefully.

- Always be clean and tidy, and present yourself as a professional truck driver.

- Know your operating costs and live within your means

- Know when to say “No.”

- If your fuel costs exceed 25% of load revenue, the load is probably not profitable.

- Always run good tires, check pressures regularly and rotate tires.

- Keep your truck and trailer maintenance up to date and shop for the best deals and suppliers (and then stick with them).

- Take good care of yourself on the road and make an effort to make healthy, home-cooked meals with you whenever possible.

In California last week, flatbed capacity was tight, pushing up spot rates by $0.11/mile to an average of $2.80/mile excl. FSC. There was a similar story in Portland, OR, where rates jumped by $0.18/mile to $3.08/mile excl. FSC following last week’s 24% w/w increase in load post volumes. Loads south to Stockton, CA, were up by $0.22/mile to an average of $2.99/mile excl. FSC with loads to Salt Lake City up by the same amount to $3.12/mile excl. FSC.

Capacity eased slightly in DAT’s largest flatbed market in Houston, where rates decreased by $0.02/mile to $2.83/mile excl. FSC last week. On the high-volume lane north to Ft. Worth, rates decreased by $0.07 to $3.17/mile excl. FSC.

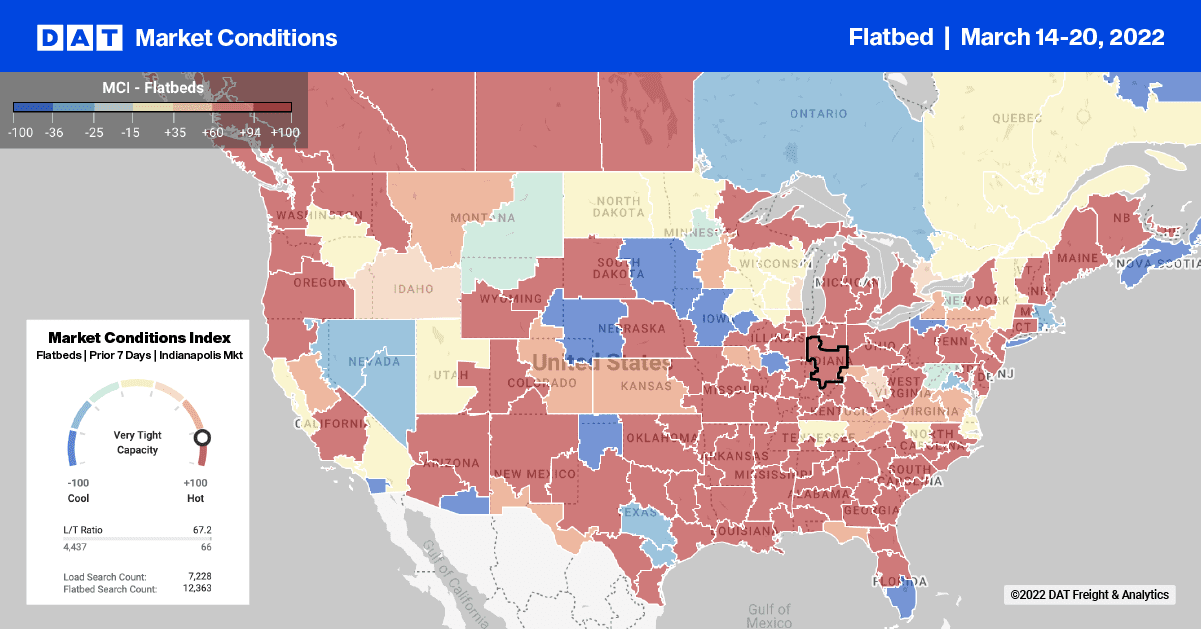

The flatbed sector is the only equipment type following seasonal patterns following last week’s 2% w/w increase in load post volumes. Last week, flatbed capacity was relatively flat, leaving the load-to-truck (LTR) mostly unchanged at 89.26.

After increasing for the prior three weeks, flatbed spot rates decreased by $0.04/mile last week, erasing all of the gains over the previous month. Last week’s national average flatbed spot rate of $2.68/mile excl. FSC was $0.28/mile higher than the previous period last year and $0.46/mile higher than the same week in 2018.