US raw steel mill capability edged down in the week ended March 26, decreasing from 80.2% to 79.4% from the prior week, the American Iron and Steel Institute (AISI) reported on March 28. Domestic raw steel production was 1,726,000 net tons (69,040 equivalent truckloads) compared to 1,768,000 net tons (70,720 equivalent truckloads) in the week ending March 26, 2021 – this represents a 2.4% y/y decrease. For the week ending March 26, 2022, production was down 0.9% w/w or the equivalent of 1,680 fewer equivalent truckloads.

Adjusted year-to-date production through March 26, 2022, was 21,225,000 net tons (849,000 equivalent truckloads), at a capability utilization rate of 80.4%. That is unchanged from the 21,218,000 net tons during the same period last year when the capability utilization rate was 77.1 percent. The Southern Region was not only the largest producer at 43% of the domestic weekly tonnage but was the only region to post a gain in weekly production (up 1.1% w/w). Regional production for the week ending March 26, 2022 in thousands of net tons: North East: 170,000 (-2.3%); Great Lakes: 578,000 (-2.7%); Midwest 166,000 (-0.6%); Southern: 746,000 (+1.1%), and Western: 66,000 (-4.3%).

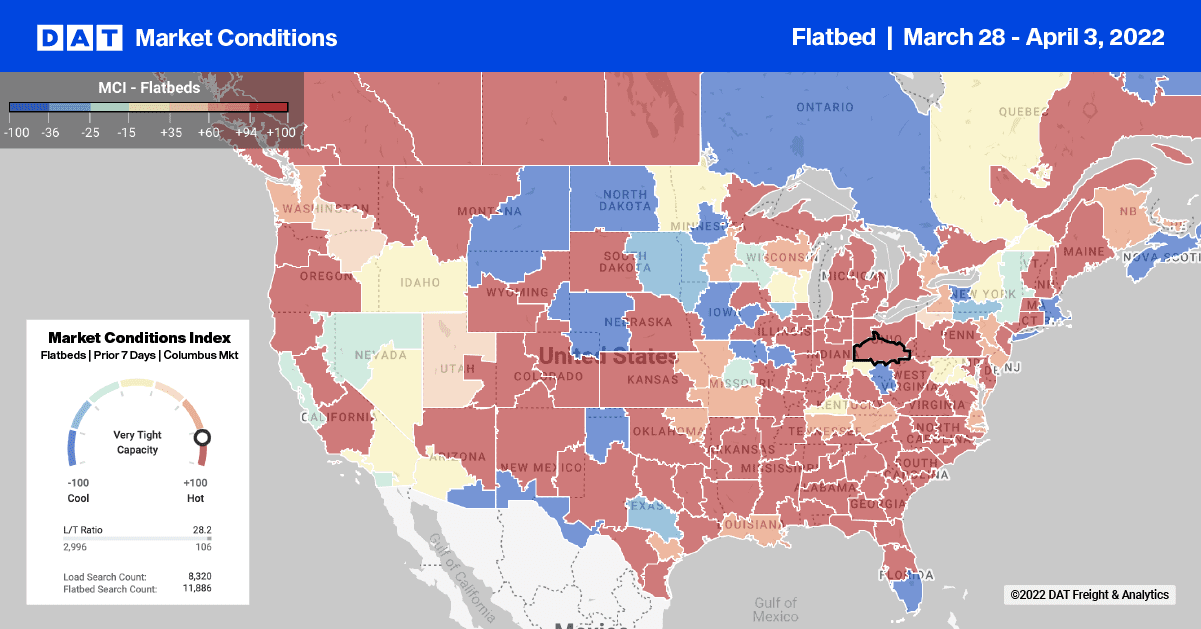

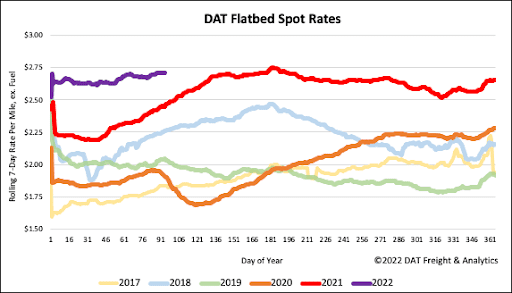

After dropping for the three prior weeks, flatbed spot rates in the largest steel-producing market in the U.S. increased by $0.10/mile to an average rate of $2.70/mile excl. FSC in Gary, IN, last week. Loads to Omaha were down by $0.15/mile to $4.47/mile excl. FSC last week while loads to St Louis, MO, dropped by $0.40/mile to $4.04/mile excl. FSC. In DAT’s number one flatbed market in Houston, capacity tightened last week as rates increased by $0.12/mile to $2.93/mile excl. FSC.

Flatbed capacity remains very tight in the Pacific Northwest markets of Portland and Medford, where outbound spot rates jumped by $0.20/mile last week to an average of $3.11/mile excl. FSC. Loads from Portland to Stockton were up by $0.15/mile the previous week to $3.11/mile excl. FSC is $0.24/mile higher y/y. Los Angeles loads also increased by almost $0.30/mile last week to an average of $2.79/mile excl. FSC or about $0.35/mile higher than the same week the previous year.

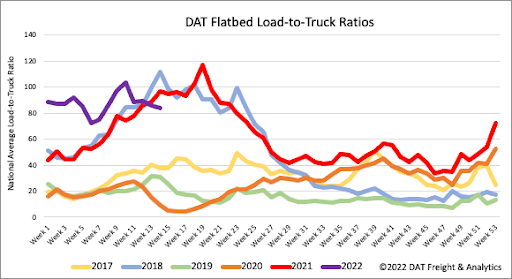

Flatbed load post volumes are now down 10% in the last four weeks following last week’s 3% w/w decrease. Volumes are still 9% higher y/y and 25% higher than in the same period in 2018. Carrier equipment posts remained flat for the fourth week in succession resulting in the previous week’s flatbed load-to-truck ratio decreasing by 2% w/w from 85.64 to 83.64.

Flatbed spot rates mainly were flat last week, ending the week where they started at a national average of $2.71/mile excl. FSC. Spot rates have increased by $0.04/mile since the start of the year and are now $0.27/mile higher than the previous period last year and $0.45/mile higher than the same week in 2018.