Demand in the flatbed sector continues to track the 2018 freight market, driven by a growing industrial economy. This year, new housing starts to trend upward following the 5.65% sequential increase in February in the single-family housing market and an increasing machinery market.

According to economic data from the Federal Reserve, seasonally adjusted machinery production in February 2022 increased by close to 1% m/m, but it was up 8.3% compared to the same time in 2021. The February reading for machinery production is also 8.3% higher than the previous peak in November 2018. According to the Association of Equipment Manufacturers (AEM), agricultural machinery sales are currently 9.2% higher y/y as we head into the seasonal peak at the end of April. Year-to-date volumes are also up 5.0%, with most growth coming from the 2-wheel drive 100+ horsepower segment (up 27.9% y/y).

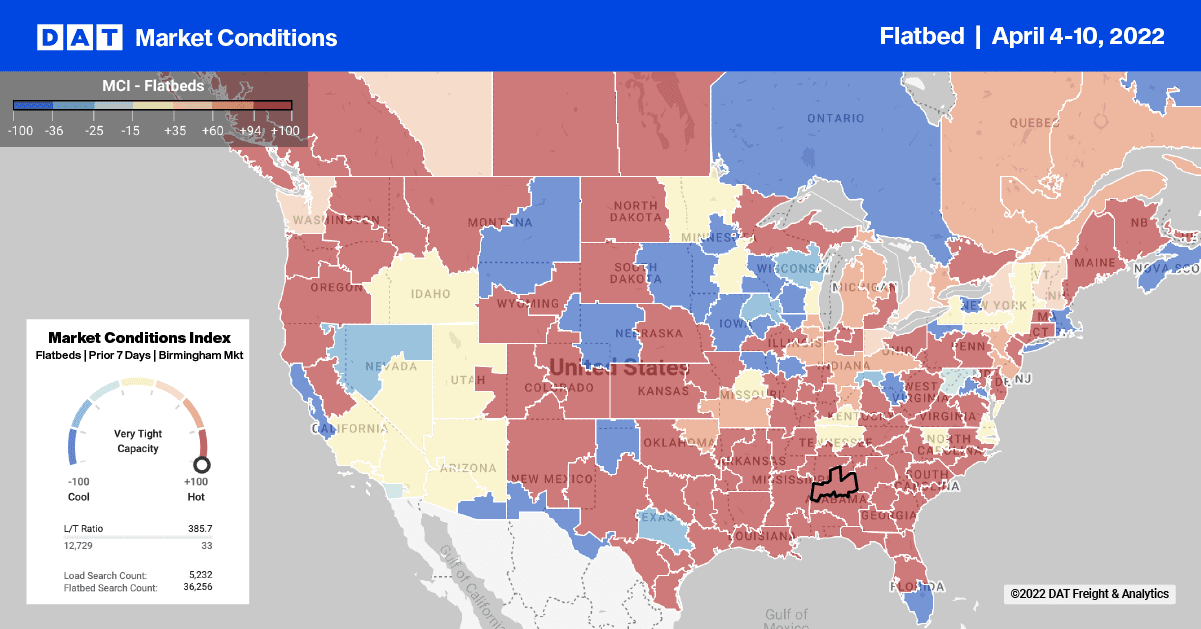

Available capacity in Nebraska remained tight last week after state average rates increased by 7% w/w to an average of $2.23/mile excl. FSC. Loads from Omaha to Reno have increased by $0.41/mile in the last week to an average of $3.42/mile excl. FSC or around $0.65/mile higher y/y. Flatbed spot rates in the Southeast Region are currently running around $0.10/mile higher y/y at $3.07/mile excl. FSC. Leading the way is Mississippi, where state average outbound spot rates are up 38% y/y, averaging $3.29/mile excl. FSC, while in the Jackson freight market, rates are slightly higher at $3.32/mile excl. FSC after increasing $0.21/mile in the last week.

In DAT’s largest flatbed market in Houston, available flatbed capacity remained flat last week while loads moved north to Ft. Worth increased 4% w/w. Higher truckload volumes on the busiest outbound lane in Houston had the opposite effect on spot rates dropping by $0.08/mile in the last week to $3.40/mile excl. FSC for the 270-mile haul. On the number two outbound lane from Houston to El Paso, loads moved decreased by 10% w/w with available capacity much tighter, pushing up spot rates by $0.10/mile to an average of $3.18/mile excl. FSC last week.

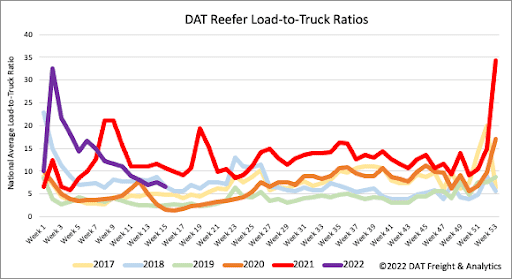

Flatbed load post volumes dropped 15% last week and are now down 20% in the previous four weeks. Volumes are 12% lower y/y but 9% higher than in the same period in 2018. After being flat for the prior four weeks, carrier equipment posts increased by 13% last week, resulting in the last week’s flatbed load-to-truck ratio plunging by 25% w/w from 83.64 to 62.98.

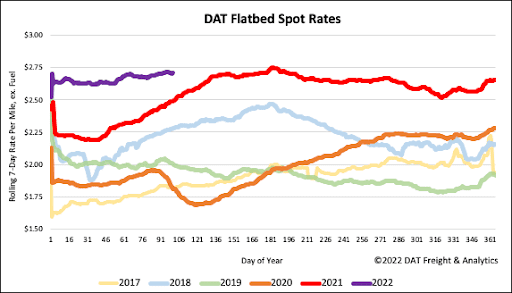

Flatbed spot rates hit a record-high of $2.75/mile excl. FSC on Independence Day last year and following last week’s $0.05/mile increase are now just $0.03/mile below the 2021 all-time high. Spot rates ended the week at $2.72/mile excl. FSC and are now up by $0.05/mile YTD. Compared to the 2018 bull market, flatbed spot rates are now 19% or $0.43/mile higher than the same week that year.