The Technomic 2022 Top 500 Chain Restaurant Report, which includes expert findings and insights into the sales performance of U.S. chain restaurants in 2021, points to a continued recovery in the food services sector. This is great news for reefers, shippers, carriers, and brokers.

“2021 was a year like no other for the Top 500 chain restaurants,” said Kevin Schimpf, director of industry research and insights. “Drastic shifts in market conditions led to unprecedented volatility in results for the industry’s largest chains. While overall Top 500 sales surpassed pre-pandemic benchmarks, more than half of all ranked chains fell short of returning to 2019 performance levels.” Top 500 chain sales increased 18% on an annual basis.

According to The Evolution of Dining report by Placer.ai they report, “So despite Omicron, cold weather, and rising inflation and gas prices, dining visits are still on a recovery path. As the weather warms and customers can dine outdoors again, there is hope that the sector’s impressive recovery will continue its upward climb.” Placer.ai tracks the foot traffic of numerous industries through anonymous location data from tens of millions of mobile devices. For the week of April 17 Placer.ai’s latest data shows a 13% y/y increase for the dining category and a 7% y/y increase for the 5 weeks in the month of March. Grocery foot traffic was relatively flat for the week of April 17 with a 1% increase y/y and a 1% y/y decrease for the 5 weeks in the month of March.

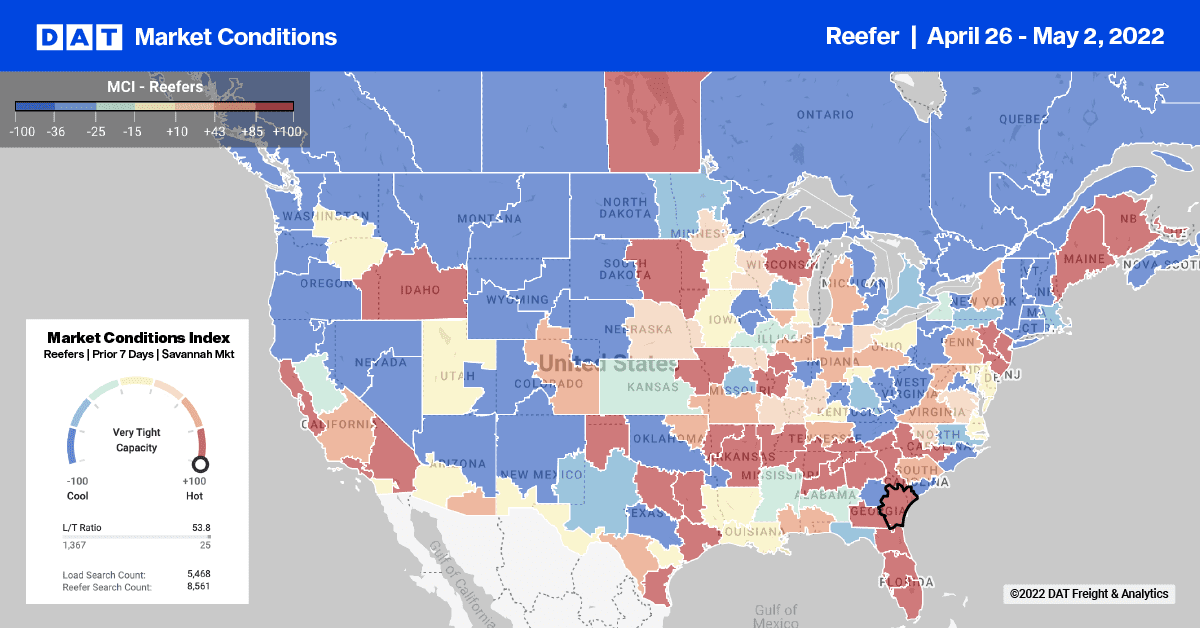

Loads moved on the top 70 reefer lanes dropped on 50 lanes last week and increased on just 17, with spot rates down on 39 lanes and up on just 10. The loads moved across all markets were down 4% last week and down by the same amount in the previous four weeks.

Last week, Florida was in the spotlight with higher volumes ahead of Mother’s Day, providing a 15% w/w load post volume boost in the Miami market. Outbound average reefer spot rates jumped by $0.17/mile to $1.95/mile last week, with capacity very tight on the 664-mile haul to Atlanta – spot rates have increased to $2.48/mile this week, which is $0.58/mile above the April average. Rates are around the same as the previous year on this high-volume lane, with more upward rate pressure expected this week. Last year, reefer spot rates between Miami and Atlanta jumped $0.30/mile in the lead-up to Mother’s Day.

The same is occurring on longer haul lanes, including Chicago, where rates are sitting at $2.14/mile excl. FSC this week. That’s up $0.60/mile above the April average and $0.04/mile higher than the previous year. Loads to Boston from Miami are currently averaging $2.65/mile excl. FSC or about $0.30/mile higher than the April average but $0.10/mile lower than the previous year when spot rates surged to $3.24/mile excl. FSC right before Mother’s Day. Capacity also tightened in the produce-heavy Lakeland market, with rates increasing by $0.05/mile to an average of $1.78/mile excl. FSC. Detroit is a popular destination for reefer loads out of Miami, where spot rates increased by $0.20/mile above the April average to $1.76/mile excl. FSC, but that’s still $0.36/mile lower than the previous year.

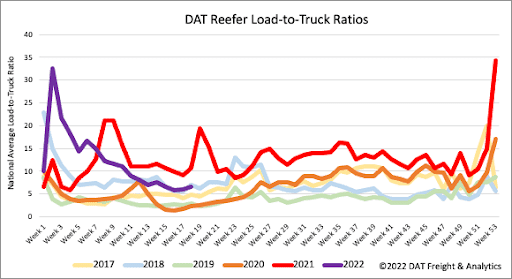

Reefer load post volumes increased 6% last week, helped by the upcoming Cinco de Mayo and Mother’s Day celebrations. Equipment posts were down slightly, which increased the reefer load-to-truck ratio (LTR) by 9% w/w from 5.99 to 6.55. Reefer LTRs are slightly below 2018 levels, while the two components of the load-to-truck ratio tell a more complete story of the reefer market. Load post volumes are slightly above 2018 levels, while equipment posts are almost the same as 2019 levels.

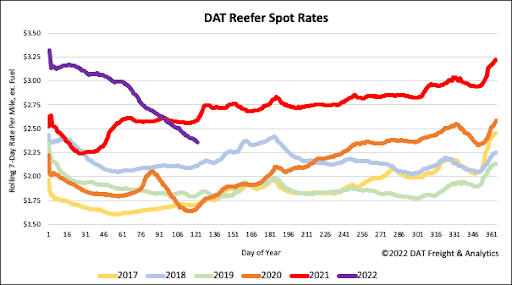

Even though last week’s $0.04/mile decrease was the lowest weekly decrease in the previous five weeks, at $2.39/mile excl. FSC, reefer spot rates were now $0.02/mile lower than the Independence Day peak in 2018. Reefer spot rates have dropped by $0.23/mile in the last month and 24% or $0.77/mile since the start of this year. Even though previous week’s national average is now $0.23/mile lower than last year, it’s still $0.53/mile higher than the same time in the previous four non-pandemic years from 2016 to 2019.