Last quarter was another excellent for carriers primarily in the flatbed and specialized sector, confirmed on the recent quarterly earnings call with Daseke, Inc. (NASDAQ: DSKE), the largest flatbed and specialized transportation and logistics company in North America.

Daseke’s fleet consists of approximately 4,565 total tractors (down 6.3% y/y) and 11,051 flatbed and specialized trailers (down 3.7% y/y). The Texas-based carrier reported first-quarter revenue of $421 million, up 26.1% y/y. The adjusted operating ratio for the 1st quarter was 93%, improving on the 95.5% operating ratio recorded in the same quarter last year.

According to Jonathan Sepko, Chief Executive Officer of Daseke, “Strong end-market demand in each or our flatbed and specialized reporting segments continued to outweigh available capacity. These operating segments realized higher rates, contributing to the meaningful year-over-year revenue growth we experienced this quarter. Daseke’s Flatbed Solutions segment benefitted from continued strength and year-over-year improvement in the freight rate environment, with rates up 21% to $2.59/mile compared to $2.14/mile in 1Q21. In Daseke’s Specialized Solutions segment, sustained demand and improving freight rates primarily in the construction, high-security cargo, and commercial glass end markets pushed rates up 22% y/y to $3.40/mile from $2.78/mile this time last year. According to the earnings call report, this improved result is despite muted wind energy volumes.

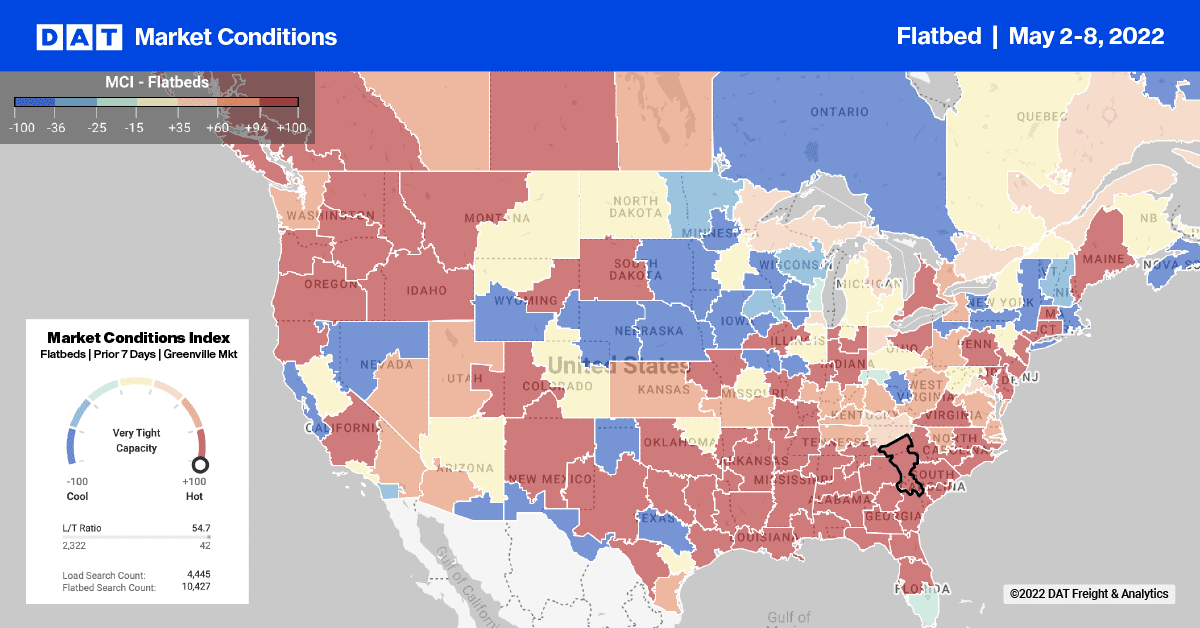

In Gary, IN, the largest steel-producing market for loads south to Pittsburgh, flatbed capacity eased considerably last week. Spot rates dropped to $3.28/mile excl. FSC, which is $0.82/mile lower m/m and $0.69/mile lower than the previous year. In Houston, DATs largest flatbed market, capacity also eased on the number one lane north to Ft. Worth weather spot rates dropped by around $0.50/mile below the April average to $3.37/mile excl. FSC this week. Capacity also eased for loads to the Permian Basin oilfield last week, with spot rates down by $0.40/mile below the April average to an average of $3.28/mile excl. FSC. That’s still $0.67/mile higher than the previous year.

Flatbed load post volumes surged last week, increasing by 18%, and are now 27% higher than this time in 2018 and just 1% higher than the previous year. Volumes have increased by 27% in the last month, while carrier equipment posts have steadily increased over the last five weeks. As a result, last week’s flatbed load-to-truck (LTR) ratio increased by 49% w/w from 70.02 to 72.66.

After being relatively flat for the first four months of this year, flatbed spot rates dropped for the third week in succession following last week’s $0.03/mile decrease. Flatbed rates ended the week at $2.64/mile excl. FSC, which is about the same as this time last year but $0.28/mile higher than the same week during the 2018 flatbed rate rally.