By Christina Ellington

Steel output in the U.S. in the week ending June 11 fell by 3% compared with the same time frame in 2021, according to the American Iron and Steel Institute (AISI). As a result, domestic raw steel production was 1,784,000 net tons, while the capability utilization rate was 81.7% compared to 1,834,000 net tons a year earlier.

In flatbed truckload equivalent terms, that’s roughly 1,667 fewer truckloads of steel per week. Adjusted year-to-date (YTD) production is 40,658,000 net tons, at a capability utilization rate of 80.7%, which is down 1.7% from the 41,361,000 net tons during the same period last year. In flatbed truckload equivalent terms, that’s roughly 23,433 fewer truckloads of steel this year.

Tonnage is 4.8% lower than 2018 in the Jan-May time frame. S&P Global Platts shows that the production volume of Northeast and Great Lakes regions has the most significant reductions. The Great Lakes region has decreased 15% or 1.9 million tons of volume compared to Jan- May of 2018. The Northeast region has decreased 23% or 995,0000 tons of volume compared to Jan- May of 2018. The Southern region is currently the largest production region and has increased by 7% or 938,000 tons of volume since 2018. S&P Global Platts also shows that total steel import volumes are up approximately 25% y/y for Jan- Apr.

All rates cited below exclude fuel surcharges unless otherwise noted.

The Decatur, AL, market was the top flatbed market last week, following a 23% w/w increase in load posts. Flatbed capacity loosened slightly, with linehaul rates dropping $0.03/mile to an outbound average of $3.80/mile. In contrast, on the 800-mile haul to Kansas City, MO, linehaul rates increased slightly last week to $2.90/mile or around $0.20/mile lower y/y. Next door in Memphis, capacity loosened rapidly following a $0.09/mile drop in linehaul rates to $3.43/mile. Even though the volume of loads moved between Memphis and Dallas increased by 4% last week, linehaul rates decreased to $3.50/mile, $0.30/mile lower than the May monthly average and $0.22/mile lower than the previous year.

Houston came in at number four this week in terms of load posts, which have been flat for the last three weeks, along with outbound linehaul rates holding steady at $2.94/mile. In Savannah, load post volumes increased for the fourth week following last week’s 14% w/w increase. Flatbed capacity has been relatively flat over the previous two weeks, with spot rates averaging around $3.32/mile. On the high-volume lane 250 miles west to Atlanta, at $1,007/load, flatbed linehaul rates are about $190 /load less than the same time last year and just over $100/lower than last month.

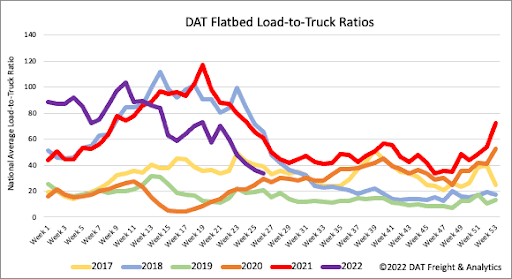

Flatbed load post volumes have dropped almost 40% in the last month and are now 26% lower than the previous year. Like dry van and reefer segments, flatbed equipment posts are at their highest level in six years and 15% higher than the last year. As a result, the flatbed load-to-truck (LTR) ratio decreased by 8% w/w to 33.68, 61% higher than in 2018 and almost the same as 2017.

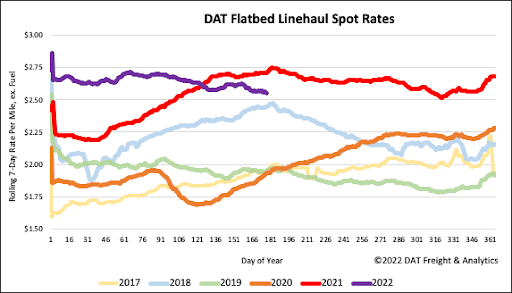

Flatbed linehaul rates were also flat last week at $2.58/mile, which is slightly below the 13-month average. Flatbed spot rates have only decreased by 3% YTD or $0.09/mile and are now $0.16/mile lower than last year but still 5% or $0.11/mile higher than in 2018. Compared to prior non-pandemic years, flatbed linehaul rates are $0.53/mile higher.