The energy sector is a significant contributor to flatbed demand, and spot rates for many oil-producing lanes, such as Texas to South Dakota, have increased and remained elevated compared to 2021. According to Baker Hughes, the national weekly oil rig count shows a 52% y/y increase for the week ending August 26th of active drilling rigs as drilling companies react to recent supply and demand challenges. Weekly rig counts this August have averaged about 763 per week, while weekly rig counts in August 2021 averaged around 500 active rigs. However, current drilling activity is still below pre-pandemic levels, where the weekly average in August 2019 was 1157 active rigs, and August 2022 has declined 34% compared to 2019.

In Canada, the active rig count is also increasing y/y and is around 29% higher than in August 2021. CEO of Traffix, Chuck Snow, said in a recent interview, that flatbeds to Edmonton, AB are in demand due to the elevated oil prices, which allows for investing in the oil tar sands again. According to an article by the WSJ, investment in the Canadian tar sands has declined since 2014, primarily due to the high greenhouse gas emissions and poor returns to extracting the oil. Many international energy companies have moved out of the oil sands; however, smaller independents and private investors are increasing production.

All rates cited below exclude fuel surcharges unless otherwise noted.

Capacity continues to tighten in the Pacific Northwest markets of Medford and Portland following last week’s $0.05/mile increase to an outbound average of $2.96/mile. Load posts in Portland, the larger of the two markets, have increased by 11% m/m, and on the Phoenix lane, spot rates at $2.40/mile are now just over $0.20/mile higher than the previous year. Loads 1,200 miles to Denver have also been rising, increasing by $0.20/mile since June to an average of $2.29/mile.

In the significant steel-producing market in Gary, IN, flatbed spot rates increased by $0.13/mile last week to a market average of $3.04/mile. On the high-volume west to Minneapolis, spot rates reversed a 5-month slide, increasing to $3.40/mile last week or about $0.46/mile lower than the previous year. The opposite was the case on the run south to Pittsburgh, where spot rates are now $1.42/mile lower than the previous year at $2.31/mile last week.

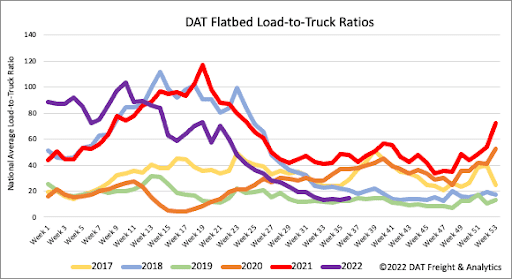

After dropping by 37% over the prior seven weeks, flatbed load posts reversed course last week, increasing by 12%. Volumes are still 55% lower than the previous year and tracking closely with 2017 levels, which took off in September of that year due to the impact of Hurricanes Irma and Maria. Equipment posts decreased by 2% w/w, but the market still sees almost 70% more flatbed equipment posts compared to 2018. As a result of a surge in load posts, the flatbed load-to-truck (LTR) ratio decreased from 13.02 to 14.84.

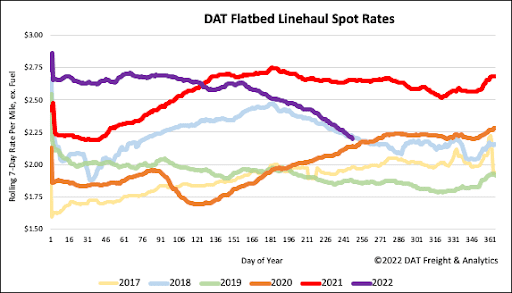

With flatbed equipment posts still at record high levels, the market is still oversupplied, and despite a late-month surge in load posts, flatbed linehaul rates dropped by almost $0.06/mile last week. At $2.24/mile spot rates have decreased by $0.41/mile since the start of June and are now just $0.02/mile lower than the end of August in 2018, considered an excellent year for flatbed carriers. Flatbed linehaul rates are $0.46/mile lower than the previous year.