Last week, Church Brothers Farms in Salinas, CA, made the annual migration south to Yuma, AZ, where they will produce salad vegetables over the winter. From November to March each year, Yuma, AZ, becomes the Winter Salad Bowl, where 90% of leafy greens are produced for domestic consumption. Church Brothers uproot their farm team and entire salad plant twice a year, enabling them to produce salads at the source. The move last week involved over 200 people and 60 trucks, and from the time the Salinas plant was broken down, loaded onto flatbeds, and shipped 500 miles, the salad plant was operational in just 58 hours.

Accordion the Tom Karst at The Packer, lettuce prices soared to record levels at $110/carton in the Salinas Valley as the season closed. High prices and lower yields were driven mainly by crop damage associated with an aggressive pest and disease complex of Impatiens Necrotic Spot Virus (INSV) and soil-borne diseases, according to The Grower Shipper Association of Central California. According to Salinas, Calif-based Markon’s Fresh Crop Report for Nov. 20, “many suppliers of lettuce and tender leaf crops are done harvesting in the Salinas Valley and have started fall–winter production in the Arizona desert region where crops are healthy, and there is no presence of the types of soil disease and virus pressure that ended the Salinas Valley season early.”

According to the USDA, weekly truckload volumes of lettuce in California were down 29% y/y at the start of November. In Arizona, weekly truckload volumes are running 16% ahead of this time last year, with peak shipping volumes expected in the first and second weeks of December.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the USDA, there was a shortage of trucks in Eastern North Carolina last week, home to the nation’s largest region for sweet potato production. North Carolina is also the second-largest producer of turkeys and Christmas Trees. Last week state-level linehaul rates increased by $0.13/mile to $2.68/mile, identical to 2017 and 2018 levels and $1.14/mile lower y/y. Short haul loads from Raleigh, NC, to Richmond, VA, increased to $949/load last week, reversing a three-month slide.

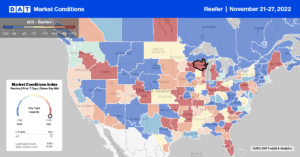

On the West Coast in the San Franciso market, which includes the lettuce-producing Salinas Valley, linehaul rates increased by $0.14/mile last week to $2.05/mile. Loads 1,400 miles north to Calgary, AB, increased to $2.17/mile last week, reversing a four-month slide on that lanes. In nearby Fresno, linehaul rates increased by $0.04/mile the previous week to $1.86/mile for outbound loads. In Atlanta, the Southeast Regions; largest distribution market, outbound linehaul rates increased by $0.08/mile to $1.94/mile while loads south to Lakeland dropped to $3.03/mile, the second lowest weekly average in the last 12 months. In the Midwest in Wisconsin, average reefer spot rates increased by $0.07/mile to $2.97/mile last week, which is identical to 2018 levels.

Load to Truck Ratio (LTR)

Reefer load posts were somewhat muted last week and were around half compared to last Thanksgiving. That’s consistent with lower demand in some sectors, including produce, where weekly truckload volumes are trending 13% lower y/y or close to 4,000 fewer weekly loads of fruit and vegetables. Last week’s volume was 57% lower than the previous year, while carrier equipment posts were 15% higher over the same timeframe and at the highest level in the last six years. As a result of a decrease in volume and an increase in equipment posts, last week’s reefer load-to-truck (LTR) dropped by 33% from 5.26 to 3.51.

Spot Rates

As they always do in the lead-up to Thanksgiving, reefer linehaul rates increased to $2.12/mile following last week’s $0.04/mile gain. Compared to the peak reefer rate on Thanksgiving in prior non-pandemic going back to 2016, last week’s national average was still $0.11/mile higher. The numbers look a little worse compared to the previous two years. At $2.12/mile, last week’s reefer linehaul rate is precisely $1.00/mile lower y/y, $0.37/mile lower than the prior two-year average, and just $0.11/mile higher than the oversupplied 2019 reefer market.