Like most produce growers in California, grape growers also faced various challenges in 2022. Katie Driver, Technical Services Manager for UPL North America, described the year as a “wild ride for agriculture starting with a frost that came through in the spring wiping out some grape crops and forced some tough decisions for growers. It’s not a secret that we’re dealing with a years-long drought, so managing water has been an issue for everyone. As the season progressed, we also had higher heat that came through the summer, followed by late rains causing disease flare-ups.

The vast majority of U.S.-grown table grapes come from central California. According to The California Table Grape Commission, Californians have cultivated grapes for over two centuries, with 99% of U.S. table grapes produced in California’s warm, dry climate. California table grape growers harvested more than 97 million boxes of grapes over the 6-month season. When we factor in seasonality and year-round domestic demand, the California grape season that runs from May through December delivers around 45% of volume to the U.S. market, followed by 42% from Peru and Chile, and Mexico (10%).

For truckload carriers, their load points shift from farms to ports as imported grapes meet consumers’ demand over winter. Peru’s volume picks up in the December/January timeframe and runs through April when Chilean grapes arrive in volumes equivalent to California’s peak production in the third quarter. South American countries will ship to ports including Philadelphia, where 87% of last November’s grape imports landed, making it a good market for east coast reefer carriers. Grape volumes towards the end of California are down 5% y/y, whereas November ’22 imports from Peru are up 145% y/y. Alejandro Cabrera Cigaran, general manager of the Association of Table Grape Producers of Peru, says, “Peru is expected to export no less than 70 million boxes of table grapes in the 2022/2023 campaign.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

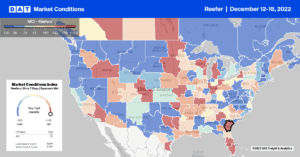

After loosening for the prior three weeks, Fresno reefer capacity tightened slightly last week following the $0.03/mile gain to an outbound market average of $1.81/mile. Short-haul regional lanes recorded gains, with most out-of-state long-haul loads to the east lower than the prior week. Loads north to Seattle at $2.39/mile were the weakest in 12 months and around half this time the previous year. Denver and Phoenix loads at $2.27/mile and $2.63/mile, following a similar y/y trend to the Seattle lane.

In El Paso, reefer capacity was very tight following last week’s $0.28/mile increase to $1.60/mile. Loads west to Ontario were at their second-highest in 12 months at $1.68/mile and $0.30/mile higher compared to December last year. 2,100-mile loads east to Philadelphia were at their lowest in a year at $1.62/mile. While in Philly, reefer capacity eased following the previous week’s $0.02/mile decrease to an outbound average of $2.22/mile, where rates have been for the last few weeks. Loads south to Atlanta were flat at $2.20/mile, while loads further south to Lakeland were $1.00/mile lower than the previous year at $2.32/mile last week.

Load to Truck Ratio (LTR)

Reefer load posts were at their lowest level in five years last week, even though volumes increased by 6% w/w. Volumes were around 60% lower than the previous year, while carrier equipment posts remained at their highest level in six years, 33% higher than the oversupplied 2019 market. As a result of higher volumes and a decrease in equipment posts, last week’s reefer load-to-truck (LTR) increased from 3.52 to 3.93.

Spot Rates

Last week’s national average reefer linehaul rate, at $2.10/mile, continues to track closely with 2017 and 2018 levels following last week’s $0.01/mile increase. Reefer linehaul rates are $0.89/mile lower y/y but still $0.13/mile higher than in 2019.