The current inverted market – where contract rates are well above spot rates – has presented plenty of opportunities for brokers. The historic gap between those rates has allowed for larger profit margins than were possible during the height of the pandemic.

That gap will not continue indefinitely, and the shifting markets put a greater emphasis on the need to balance rates, volume and margin. When rates are high, brokers can afford to move fewer shipments since they’re making more on a per-load basis. As rates fall, volume becomes more important – but that’s compounded by the fact that rates typically fall due to lower spot volume.

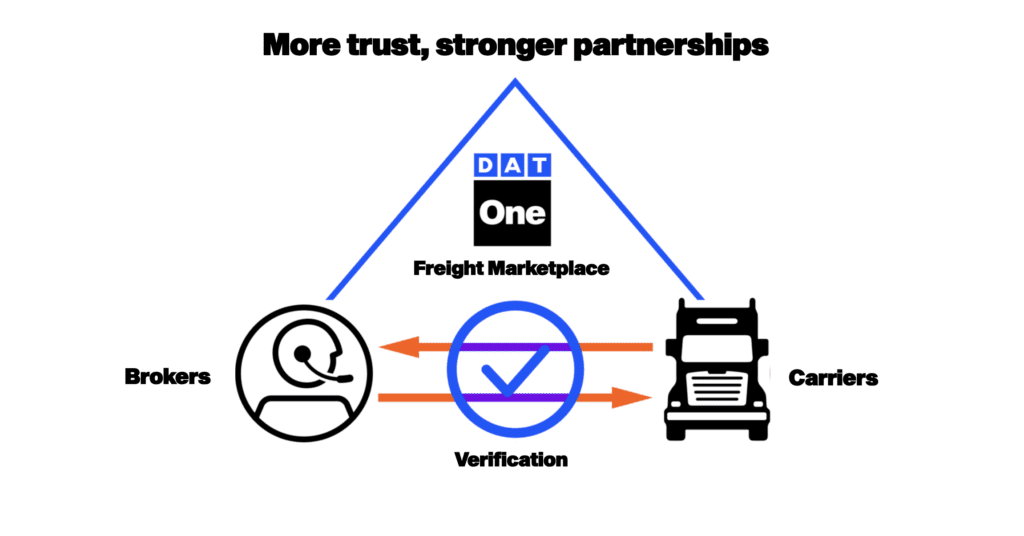

Luckily, brokers are also getting invited to bid on more and more contract freight, as the pandemic highlighted for shippers the benefits of having more flexibility in their routing guides. Brokers can utilize numerous partner carriers to provide consistent, cost effective capacity, making them uniquely qualified to service a shipper’s most problematic lanes. But one of the most difficult challenges for brokers is to provide forward-looking pricing at a time when you expect the market to flip.

Anticipating when the market will change is crucial to good pricing decisions. And of course, niche lanes on an RFP require a unique set of insights to price them accordingly. And just like with shippers, brokers have an opportunity to strengthen relationships with carriers. By providing loads on difficult lanes, brokers can win favor in the next market cycle. Brokers can also gain favorable rates by addressing the carrier’s need for efficiency, which can be achieved through automated booking or granting priority access to desirable loads and shipments.

The above is an excerpt from the Freight Focus, DAT’s annual year-in-review report. Get the full report and all our expert analysis of 2023 here.