The growth in warehouse capacity in Phoenix is something to see, and one truckload carriers must keep an eye on. Current developments are hard to miss as you travel along I-10 west leading to Ontario and Los Angeles, as are the traffic snarls caused by never-ending highway construction. Current warehouse development extends 37 miles west of downtown Phoenix to Buckeye, AZ, just 100 miles from the California border and 300 miles to Ontario, CA. Greater Phoenix has been the beneficiary of a substantial volume of inbound freight from Los Angeles in the last few years due to surging imports from Asia. That’s slowed down somewhat, although the pace of development hasn’t. Brand new truckstops for long-haul carriers in the Buckeye area are proving truckload demand is rising.

One thousand two hundred miles east along I-10, another freight market is booming as importers continue to route containers and break-bulk cargo into Houston. Texas has always been a strong truckload market, but it’s grown into a powerhouse market in recent years. Texas flatbed carriers are enjoying some of the best outbound spot rates in the past seven years. At an average linehaul rate of $2.20/mile, only last year has been higher for the third week of the year when rates were $2.53/mile. Boosted by more substantial imports across the southern border and through the Port of Houston, 2023 is shaping up another good year for freight demand in the Lone Star state.

Tesla plans to start work in the next month on its 10 million square feet factory in Austin to manufacture the company’s Model Y and Cybertruck vehicles. The company has also leased another logistics facility west of Houston at the Empire West Business Park. According to the building owner, the new cross-dock facility is just over one million square feet with 1-10W frontage, has 196 dock-high doors, and has parking for 326 trailers.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Following last week’s disaster declaration in Texas following the winter ice storm, truckload capacity tightened slightly, with dry van outbound linehaul rates increasing by a penny per mile to $1.64/mile. That’s almost identical to 2018 levels but nearly $0.70/mile lower than the previous year. Last week, there was a surge in load posts in the largest commercial truck crossing zone for Mexican imports in Laredo. Volumes jumped by 47% w/w, although with ample capacity to meet demand, linehaul rates dropped by $0.04/mile to $1.79/mile.

Idaho state-level spot rates at $1.96/mile increased by $0.14/mile last week to $1.96/mile, which is identical to this time in 2018. Gains were boosted by a flurry of activity in Twin Falls, Idaho, which sent load posts up by 63% w/w resulting in spot rates increasing by $0.14/mile to $1.60/mile. Loads to Phoenix at $1.70/mile are around $0.14/mile higher than the January average but almost $1.50/mile lower than the previous year.

Dry van capacity also tightened slightly in the Southeast Region, where rates increased by $0.02/mile to $1.68/mile, almost $1.00/mile lower than the previous year. In Green Bay, dry van capacity was tight for outbound loads following last week’s $0.04/mile increase to $2.26/mile. Long-haul loads to Laredo, TX, at $1.49/mile, were at their highest level since last April, while 2,000-mile loads to Ontario, CA, were flat at $1.62/mile the previous week.

Load-to-Truck Ratio (LTR)

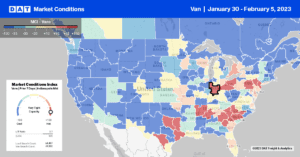

Load posts bounced back last week, increasing by 18% w/w to be within 9% of 2018 levels. The increase was in line with the typical end-of-month bump in shipping, although volumes are still around half what they were a year ago. Carrier equipment posts decreased 6% w/w, and even though they were 17% higher y/y, dry van spot capacity is within 3% of 2018, a helpful comparison considering the market at that time was still shedding capacity following the oversupplied 2019 market. As a result of higher load volumes and fewer equipment posts, the dry van load-to-truck ratio (LTR) improved last week, increasing from 2.20 to 2.79.

Linehaul Spot Rates

The rate of decline in dry van linehaul rates slowed following last week’s decrease of just under a penny per mile. The national average dry van rate of $1.78/mile was $0.90/mile lower than the previous year, $0.07/mile lower than in 2018, and $0.24/mile lower than the top 50 dry van lanes based on the volume of loads moved, which averaged $2.02/mile last week.