This Sunday, the Kansas City Chiefs and the Philadelphia Eagles square off in the Super Bowl in Glendale, Arizona. The big day also coincides with peak shipping of the delicious Hass avocado from Mexico. Michoacán, the only Mexican state with certification to export avocados to the U.S., exports 84% of the avocados grown to the U.S., with 80% of that volume entering the country via commercial crossing zones in Texas. Laredo and Pharr customs zones each account for around 40% of annual import volume.

Whenever the Super Bowl is held on the West Coast, there is a noticeable shift in truckload volumes of imported avocado further to the west via Nogales, AZ. Including Phoenix, the big event has been held out west on seven occasions since the avocado ban on Mexican avocados exports to the U.S. was lifted in 1997. On each occasion, the volume of avocados crossing via Nogales in January has doubled compared to the monthly volume for all other non-West Coast Super Bowls. It’s no surprise that the Nogales market is only one of 18 produce districts to report a slight shortage of reefer trucks in recent weeks, according to the USDA.

Michoacán is the central hub of Mexican avocado production, harvest, and exportation to the U.S. According to the Hass Avocado Board, it is the only location in the world where avocados can bloom 365 days out of the year. Located just 250 miles west of Mexico City and 650 miles to the closest U.S. border crossing in Pharr, TX, the state of Michoacán has all the ingredients to produce the world’s best avocados – rich volcanic soil, natural irrigation, and unique topography. The city of Uruapan, where most avocado orchards in Michoacán are located, receives around 64 inches of rainfall annually, which in turn feeds rivers and lakes that allow avocado farmers to irrigate their orchards naturally.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Each year, 1.45 billion chicken wings, 300 million gallons of beer, 14,500 tons of chips, 12 tons of nachos, 4,000 tons of popcorn, and 13.2 million pounds of avocado – or approximately 26 million individual avocados are consumed on Super Bowl Sunday, making it the second-largest food consumption day in the United States after Thanksgiving. In truckload equivalent terms, that’s almost 70,000 truckloads of freight. According to the USDA, over each year, 74% of avocado imports come from Mexico and 11% from California, but in January last year, Mexican imports jumped to 91% of the monthly total. 72% of Mexican avocados imported cross into the U.S. in Texas in the Laredo and McAllen freight markets or the equivalent of almost 5,000 monthly truckloads crossing the border.

Following the Texas freeze last week, outbound reefer rates increased by $0.02/mile to $2.24/mile, identical to 2018 and 2021 levels. The border markets of El Paso, Laredo, and McAllen reported load posts were up by 40% w/w, but with a surplus of trucks to meet demand, rates dropped by $0.05/mile to $2.21/mile last week. Volumes surged the most in McAllen, where load posts jumped by 47% w/w, while outbound rates cooled, dropping for the fourth week to an average of $2.24/mile.

Fresh-cut flowers for Valentine’s Day landing in Miami spiked truckload volumes last week, with load posts up by 77% w/w. Reefer linehaul rates for outbound Miami loads increased by $0.15/mile to $1.36/mile, while outbound state-level rates at $1.40/mile were almost $0.80/mile lower than the previous year. Loads from Miami to Philadelphia at $1.41/mile were $0.09/mile higher than the January average but over $1.00/mile lower than the previous year. Brooklyn. N.Y., reefer loads were paying slightly higher at $1.53/mile but still almost $1.30/mile lower y/y. In nearby Lakeland, improving produce volumes resulted in load posts increasing by 29% w/w and spot rates up by $0.08/mile to $1.30/mile.

Load to Truck Ratio (LTR)

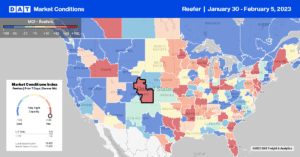

Although the winter produce market remains much cooler than the previous year, fruit and vegetable volumes did start to improve in Florida last week, increasing by 3% y/y. Arizona volumes are up 1% y/y ahead of this weekend’s Super Bowl in Phoenix, and surging volumes of roses and carnations ahead of Valentine’s Day spiked overall market volumes by 34% w/w. Reefer spot capacity tightened slightly with 13% fewer equipment posts last week, resulting in the reefer load-to-truck (LTR) increasing from 3.17 to 4.88.

Spot Rates

National average reefer linehaul rates continued to cool last week has dropped by 12% or almost $0.30/mile in the first five weeks of the year. Spot rates decreased by just a penny per mile last week to $2.09/mile. Following last week’s decrease, reefer spot rates are just over $1.00/mile lower than the previous year and around $0.11/mile lower than in 2018