Fastmarkets report a record-setting surge in Southern Pine exports to Mexico propelled total U.S. softwood lumber shipments to a 30-year high in 2022. Shipments of all species to Mexico climbed to 385 million board feet last year, up 8% from 2021 and the third-highest annual total on record. For the first time since 2016, Mexico overtook Canada’s previous year as the largest foreign market for U.S. softwood lumber. Shipments to Canada declined by 11% in 2022.

Southern Pine shipments from the Southeast Region increased by 60% y/y, surpassing 2016 as the highest volume on record. The Fastmarket report noted Southern Pine producers have indicated that Mexican demand for Southern Pine timbers has been robust. According to Dustin Jalbert from Fastmarkets, Southern Yellow Pine (SYP) export volumes to Mexico mainly come from the U.S. Southeast, which includes Eastern Texas to the Atlantic Coast and as high as Virginia in terms of where most SYP sawmill capacity is located in North America.

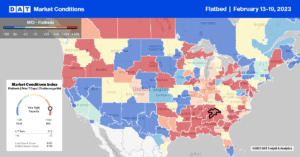

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Flatbed Capacity on the West Coast in Los Angeles continues to tighten following last week’s $0.15/mile increase to $1.96/mile, up almost $0.20/mile in the previous month. Solid rate gains on the short-haul lane to Fresno drove the Los Angeles market last week. Spot rates on the 200-mile lane at almost $800/load were the highest since last October. In contrast, spot rates for loads northeast to Las Vegas softened last week and, at $2.84/mile, are the lowest in 12 months and $1.20/mile lower than the previous year. At $2.09/mile, the Californian state average is right around 2019 levels and trending directionally with the hot 2018 flatbed market.

In the Dallas/Ft. Worth area, volumes increased by 33% last week, pushing up outbound spot rates by $0.03/mile to $2.03/mile the previous week. On the 650-mile haul to El Paso, spot rates at $1.78/mile were the highest since last October. Spot rates were up slightly on the short-haul lane to Austin and, at $517/load, are the highest since September but $170/load lower than the previous year. Volumes were up 8% w/w in Mobile, Al, last week, along with spot rates, which increased by $0.08/mile to $2.59/mile. Loads east to Lakeland were up slightly to $2.77/mile last week, while Miami loads were paying higher at $2.89/mile.

Load-to-Truck Ratio (LTR)

After increasing for the prior three weeks, flatbed load posts plateaued last week but remained 75% lower than the previous year and a half what they were in 2018. Carrier equipment posts remained at their highest level in seven years and are around 5% higher than in 2020 following last week’s 6% w/w increase. As a result, last week’s flatbed load-to-truck (LTR) ratio increased slightly from 13.20 to 13.93.

Spot Rates

Flatbed linehaul spot rates increased for the fourth week following last week’s $0.03/mile increase to a national average of $2.13/mile. Flatbed rates are $0.07/mile higher than in 2018 and 2019 but just over $0.50/mile lower than the previous year.