According to the Association of Equipment Manufacturers (AEM), U.S. agriculture tractor sales finished January 2023 in the negative, while in contrast, all segments of agriculture equipment grew in Canada. The January AEM report notes total U.S. agriculture tractor unit sales fell for the month of January in all segments except one, with 100+hp 2WD tractors growing 22.8 percent. In contrast to farm tractor sales, self-propelled combine sales continued their growth streak, increasing by 133% y/y. Compared to January 2022, total U.S. farm tractor sales were down 14.1% y/y.

According to Curt Blades, senior vice president of industry sectors and product leadership at the AEM, “Most of the trends we’re seeing in this month’s report continue what we saw throughout most of 2022. However, the industry-wide growth we see in Canada this month is a pleasant sight, and we hope that trends continue and expand to the U.S. market”. In Canada, combine harvesters sales were up by 180% y/y, while total tractor sales finished the month up 7% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

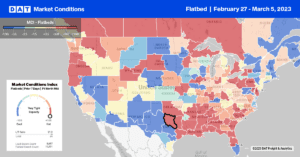

Flatbed capacity continues to tighten in the Southeast, with spot rates up $0.09/mile last week to a regional average outbound rate of $2.49/mile. Solid gains were reported in Georgia, where rates increased by $0.17/mile w/w to $2.54/mile, a penny-per-mile higher than in 2021. In Houston, DATs largest flatbed spot market, volumes increased by 26% w/w increasing spot rates by $0.02/mile to $2.32/mile last week. Loads west to Lubbock in the Permian Basin oilfield were flat at $2.69/mile, while loads north to Ft. Worth were at the same level but down to the lowest in 12 months. Loads east from Houston to New Orleans were also flat at around $2.40/mile, where they’ve been since November.

We’re heading into peak machinery shipping season out of Baltimore, and following a 30% increase in volume last week; capacity tightened, driving up outbound flatbed rates for the fourth week to an average of $2.85/mile, up almost $0.30/mile in the last month. Loads to London, ON, at $2.52/mile have been flat since the start of the year and around $1.50/mile lower than the previous year. Midwest loads to Bloomington, IL, at $2.71/mile, are the highest since last April, while loads to Decatur, IL, at $2.51/mile, are the highest since August and around $0.40/mile lower than the previous year.

Around Lake Michigan in the Chicago, Bloomington, and Gary markets, volumes were up 23% last week, with capacity continuing to tighten as rates increased for the fourth week to a regional average of $2.77/mile. In Memphis, the logistics capital of the country, volumes surged, growing by 47% w/w reversing the month-long decline in spot rates following last week’s $0.02/mile increase to $2.57/mile.

Load-to-Truck Ratio (LTR)

After being flat for the last few weeks, flatbed load posts surged last week, increasing by 30%. Volumes on the shipping calendar are still 76% lower than the previous year for week eight, typically when DAT begins to report increasing volumes heading into Spring, possibly making the last week’s increase an indication the flatbed market is pivoting. Carrier equipment posts are still at their highest level in seven years and were 38% higher than last year. As a result of the volume surge, last week’s flatbed load-to-truck (LTR) ratio jumped from 12.62 to 17.11.

Spot Rates

Flatbed spot rates have steadily increased for the last five weeks following last week’s $0.03/mile increase, the largest weekly increase this year. National average flatbed linehaul rates ended the week at just over $2.17/mile, representing an increase of $0.08/mile in the last month. Flatbed rates are still $0.56/mile lower than the previous year but are clearly influenced by strong seasonal patterns as we head into Spring.