It’s not peak season for tractor sales until April, coinciding with planting season, and although volumes typically decrease in February, last month’s 19.4% decrease was higher than last year. Total farm tractor sales are also down 17.2%year-to-date. Two smaller categories, 100+ HP 2WD and 4WD tractors, were up 2.7% y/y and 55% y/y, respectively. Compared to the 5-year average spanning 2018 to 2022, volumes are slightly above trend.

According to IHS Markit/PIERS, February imports of Tractors, Agricultural Machinery, and Lawn and Garden Equipment were down 12% YTD compared to the same time last year. Most imports come through the Baltimore port, where volume is up 25% y/y. Savannah is a close second in volume but is down 39% y/y. Norfolk and New York both receive a similar volume of Tractor/Machinery imports, and combined, they are up 1.9% y/y. National volumes of tractor imports are down 13% y/y. In Baltimore, the primary port for Tractor volume is up 0.4% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

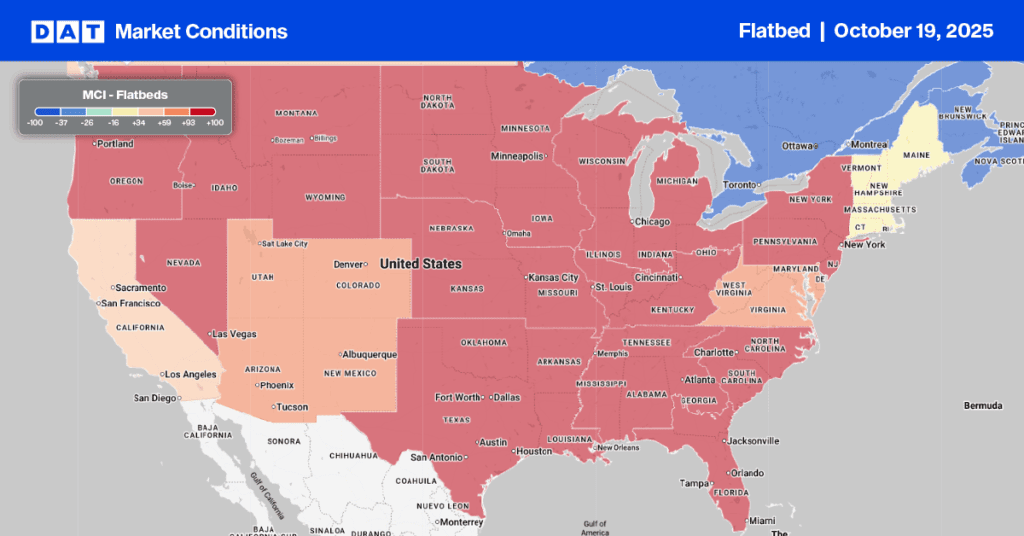

Flatbed capacity was tighter last week around the southern tip of Lake Michigan in the Chicago, Joliet, and Gary markets. Combined, volumes were up 14% w/w, and spot rates were up by $0.07/mile for outbound loads. In Chicago, the larger of the three markets, rates increased by $0.05/mile to $2.77/mile on 20% higher w/w volumes. At $2.69/mile, Illinois state average flatbed rates were up $0.09/mile w/w and by the same amount compared to 2019.

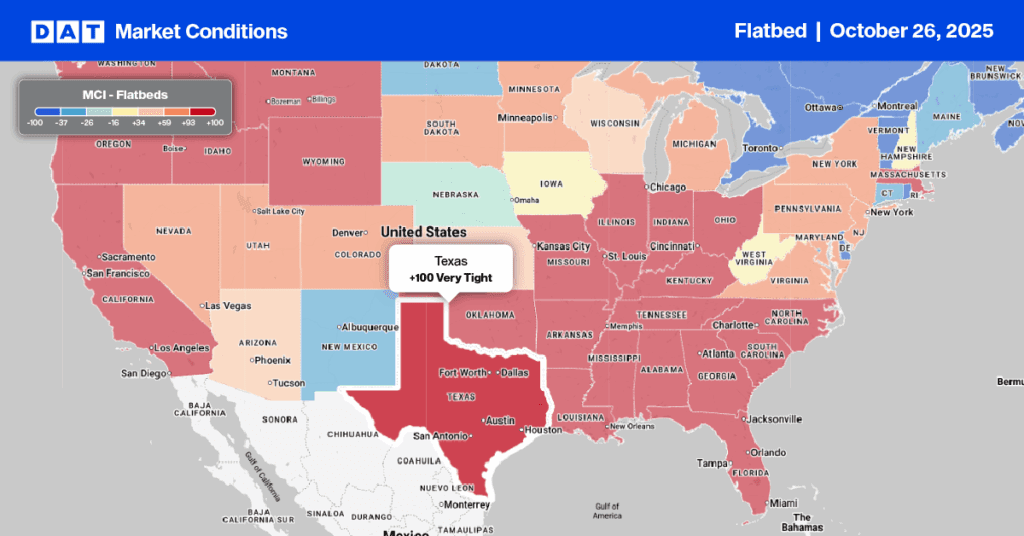

In Savannah, volumes surged and increased by 39% w/w, but with adequate available capacity, spot rates dropped by $0.03/mile to $2.47/mile last week. State-level rates in Georgia averaged $2.61/mile last week,l identical to 2018. Flatbed spot rates in Texas have been steadily climbing over the previous eight weeks, and at $2.32/mile, they are the second-highest in seven years and $0.04/mile higher than in 2018. In Alabama and Mississippi, spot rates increased by $0.07/mile last week to $2.72/mile, around $0.15/mile higher than in 2018.

Load-to-Truck Ratio (LTR)

Flatbed volumes have steadily fallen for the last three weeks following last week’s 1% decrease. Load posts are also around a quarter of what they were over the prior two years. Carrier equipment posts were just over 2% lower last week, resulting in the flatbed load-to-truck (LTR) ratio increasing by 1% to 14.46.

Spot Rates

Flatbed spot rates have increased by $0.05/mile since the start of the year, with most of the gains coming in the last month following last week’s $0.01/mile increase. At $2.20/mile, the national average is $0.50/mile lower than the previous year and within $0.08/mile of 2018.